by Helen Sanders, Editor

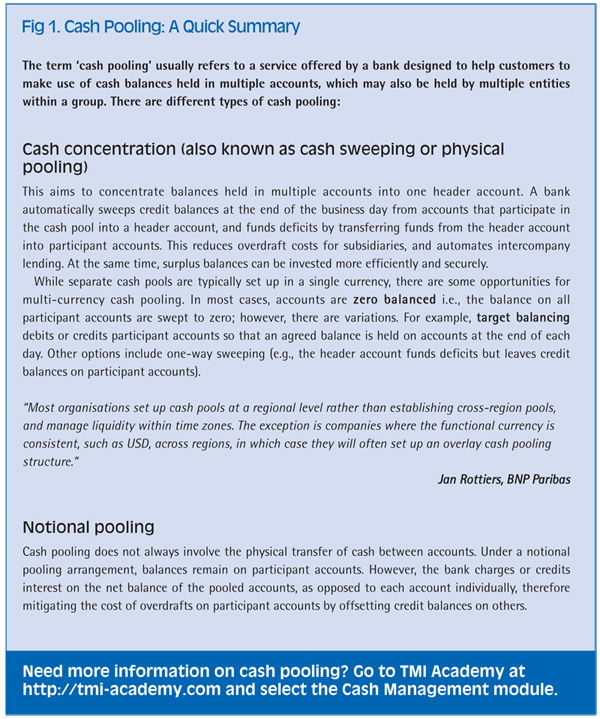

Cash pooling, particularly cash concentration (physical pooling) is well-established as a fundamental technique for treasurers to manage corporate liquidity, both domestically and cross-border (figure 1). However, given some of the recent regulatory and technology changes that have emerged in recent years, to what extent do treasurers really need cash pooling any more, particularly in regions such as Europe? As Chris Paton, Bank of America Merrill Lynch says,

“The basics of liquidity management have not changed: corporations still need to balance security, liquidity and yield, irrespective of the interest rate environment and degree of FX volatility at a particular time. What is changing, however, is the regulatory environment in which treasurers manage their cash, with Basel III and the liquidity coverage ratio (LCR), SEPA, liberalisation in China and changes to regulations in local markets all impacting on the opportunities to centralise liquidity.”

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version