by Helen Sanders, Editor

In this month’s Treasurer’s Voice, conducted jointly by TMI and Treasury Strategies, Inc. we asked treasurers about their opinions and experiences of eBAM (electronic Bank Account Management). The response to the survey was overwhelming, with 260 responses in just two weeks. What became very clear, however, was that although eBAM appears to have become a familiar concept, there are some common misunderstandings about what eBAM really is.

Awareness and use of eBAM

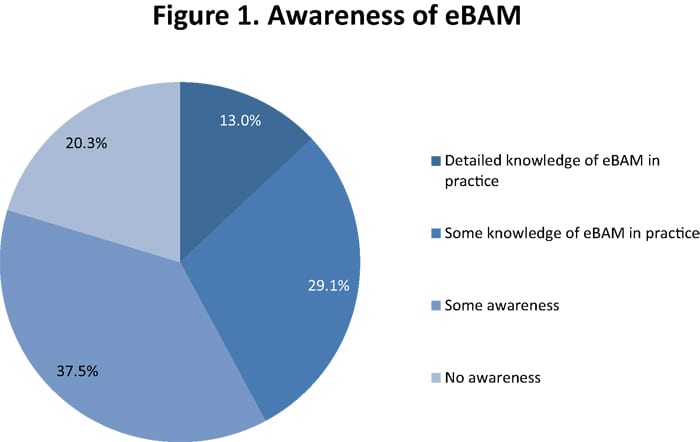

We first asked treasurers how much they knew about eBAM (figure 1). The results demonstrated that the majority (57.8%) have no or little awareness as yet, but as a relatively new initiative this was not surprising. Tom Durkin, Global Head of Integrated Channels at Bank of America Merrill Lynch explained that this was consistent with his experience,

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version