by Ferdinand G. Jahnel, V.P., Treasurer, Henry Schein, Inc.

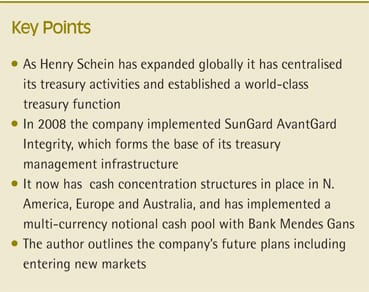

Henry Schein has experienced phenomenal growth since listing on NASDAQ in 1995, with revenues growing from $616m in 1995 to $8.5bn in 2011, the result of increased market share through internal growth and strategic acquisitions, greater product and service diversification, and major international expansion. To support this growth, our treasury function has evolved enormously over this period. Having now put in place a sophisticated cash, treasury and risk management infrastructure, our aim has been to leverage it further to maximise possible operational and financial efficiencies, and to deliver value to the organisation. As we expand internationally global cash management and FX risk have become more significant priorities. In this article, we outline how leveraging a global, multi-currency notional cash pool has enabled us not simply to optimise liquidity, but also to hedge our FX risk more effectively.

Treasury journey

Five years ago, with a far smaller business, and less exposure to international markets, our treasury decision-making and execution was not yet fully centralised, with treasury’s operational activities relating mainly to North America. At that time we did not have a treasury management system (TMS) in place. We relied on an external consulting resource to manage our European cash and the resulting FX exposures.

Since then, we have centralised our treasury activities, and recruited the skills and experience that we required to create a world-class treasury function. We now have 15 team members located primarily at our headquarters in Melville, N.Y. The team takes responsibility for cash management, financing, investments, capital structure, bank relationships, insurance and risk management, including foreign exchange (FX).

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version