by Helen Sanders, Editor

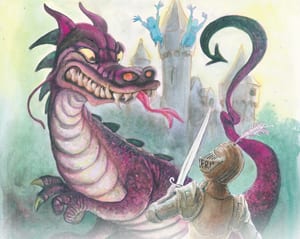

Treasurers globally have prioritised risk management over recent years, adopting a more rigorous approach to identifying, monitoring and managing exposures. In many cases, particularly since the global financial crisis, treasurers and CFOs have recognised that risk management policies cannot be simply left in the drawer and the dust brushed off every few years. Risk is a living, breathing beast that demands constant attention. In most ‘traditional’ economies, such as Europe and North America, it is less challenging to tame the company’s financial risks, not least as a limited number of currencies are involved that are easily convertible. Similarly, risk intelligence on customers and suppliers is generally accessible.

As companies of all sizes extend their activities in emerging markets of Asia, Latin America, Middle East & North Africa and, in the future, sub-Saharan Africa, the beast’s fire-breathing potential becomes far more apparent. This article, featuring comment and insight from Dennis Sweeney, Managing Director and Treasury Solutions Executive, Bank of America Merrill Lynch, considers some of the additional risk management issues that treasurers need to consider when expanding their business activities into ‘emerging’ markets.

The fire-breathing beast(s)

As growth in developed economies continues to be reluctant at best, corporations in all industries and of all sizes are looking further afield for growth opportunities, as we have discussed in a number of articles in TMI recently. Asia and Latin America are the most familiar target regions, but Africa is also starting to blossom for both sales and sourcing. Pursuing a growth strategy in these regions is a different proposition entirely to the more familiar territories of Europe and North America. Dennis Sweeney, Bank of America Merrill Lynch emphasises the importance of managing risk management as part of a corporate expansion strategy,

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version