by Klaus Gerdes, Head of Treasury, ALTANA Group

ALTANA was operating as a pharmaceutical company with a small chemicals division until it was sold to Nycomed. Boosted by a series of acquisitions, ALTANA repositioned its business as a speciality chemicals company. The former treasury function remained with the pharmaceutical business, so the new ALTANA needed to set up a new Group Treasury function. In this article, Klaus Gerdes, Head of Treasury at ALTANA, describes Group Treasury’s experience of acquiring a treasury management system (TMS) to support the new business.

ALTANA was operating as a pharmaceutical company with a small chemicals division until it was sold to Nycomed. Boosted by a series of acquisitions, ALTANA repositioned its business as a speciality chemicals company. The former treasury function remained with the pharmaceutical business, so the new ALTANA needed to set up a new Group Treasury function. In this article, Klaus Gerdes, Head of Treasury at ALTANA, describes Group Treasury’s experience of acquiring a treasury management system (TMS) to support the new business.

Evolving technology needs

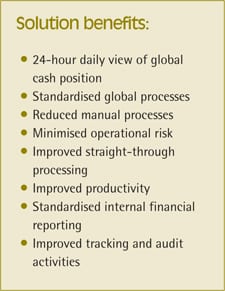

When we first set up our Group Treasury function, our functional requirements were relatively straightforward so a specialist TMS was not required. Over time, however, our treasury requirements have expanded and become more complex, which prompted a TMS selection project.

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version