by José-Carlos Cuevas, Regional Treasurer Europe, Alstom

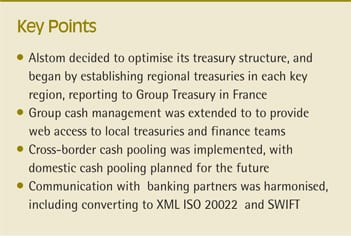

Alstom works in four distinct business segments (thermal power, renewable power, grid and transport) each comprising a large number of subsidiaries operating globally, it was difficult to align cash and processes. To address these challenges, we made the decision to centralise and optimise our treasury structures, and enhance communication between treasury stakeholders. This article outlines some of the ways in which we have achieved this, and our plans for the future.

Centralising cash and treasury management

As a first step, we revised and restated our corporate treasury objectives. We determined that cash is a corporate asset and a common resource for all Alstom entities; therefore, it should be managed centrally. We aim to minimise the impact of financial risk on our balance sheet and the potentially negative effect of fluctuations in the foreign exchange and capital markets on our profits. We achieve this by identifying, hedging and actively managing risks, within well-defined objectives and limits, as well as actively evaluating and monitoring the cost of debt.

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version