by Treasury and Trade Solutions, Citi

Shared service centres (SSCs) have reached an inflection point in their development. Expanding in scope – particularly as ongoing economic challenges encourage the pursuit of cost and process efficiencies – the role of SSCs can now look beyond ‘efficiency’ to long-term “effectiveness”, and play a pivotal role in delivering sustainable, strategic business outcomes. To support this evolution, Citi recently hosted a Shared Service Centre Forum170, bringing together market experts from a cross-section of industries to discuss the opportunities and challenges at hand.

SSCs – organisations’ internal hubs that centralise the in-common functions of otherwise separate business divisions – have been a growing feature of the corporate landscape since the 1980s, offering numerous benefits with regard to cost and process efficiencies. And, as continuing economic uncertainty and the impact of new regulations heighten the need for such efficiencies, SSCs have become more popular than ever. Indeed – according to a 2012 report by KPMG – growth in the use of SSCs now outstrips that of traditional outsourcing models, with new innovations in technology revolutionising the ability of such centres to support increasingly global businesses.

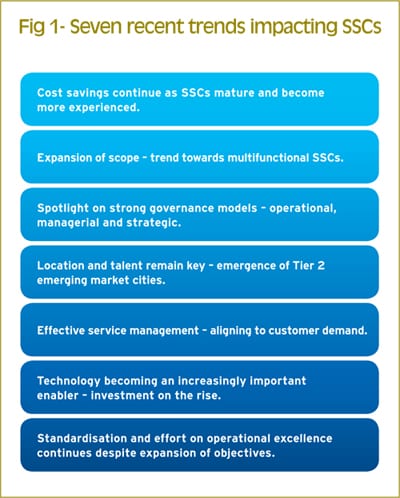

Against a backdrop of continuing economic uncertainty and new regulations, SSCs have become more popular than ever, outstripping traditional outsourcing models as new innovations in technology revolutionise SSCs’ ability to support global business. In fact, the role of the SSC has reached a major turning point in its development, expanding beyond more immediate centralisation and standardisation benefits to play a critical role in delivering sustainable business outcomes to the wider organisation, in partnership with a growing variety of business and functional stakeholders. By expanding in scope – both functionally and geographically – SSC activities can become more closely aligned with organisations’ strategic aims, and better translate ‘quick-hit’ efficiencies into long-term effectiveness.

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version