At first glance, the mechanical interpretation of accounts receivables appears to be simple: provide a product or service to a customer and receive payment for it. Unfortunately, the reality cannot be further from this – a number of factors impact the effectiveness of this process. These factors can delay the time in which payments are received and therefore increase days sales outstanding (DSO) and negatively affect working capital.

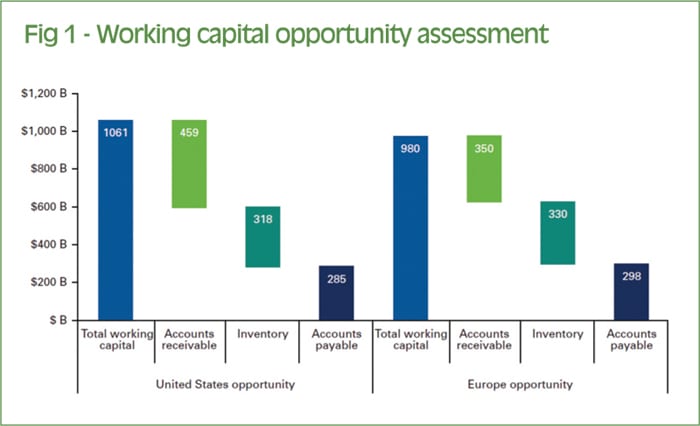

According to The Hackett Group’s 2013 Working Capital Survey of the largest public companies in each region, there is significant opportunity for improvement in working capital overall, with $1,061bn in the US and $980bn in Europe (Figure 1). This opportunity could be seized by process improvement to release the amount of cash tied up in working capital.

Accounts receivable is shown to be the greater area of opportunity for both regions. The US survey identified a total of $459bn in opportunity for accounts receivable; for Europe the opportunity is $350bn. This opportunity relates to billed receivables and does not consider the amount of unbilled receivables that may exist. More often than not, when looking into improving accounts receivable performance, the value of unbilled receivables is not considered.

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version