by Yuri Avramenko, Director, Head of Sales in Russia, CIS, Central and Eastern Europe, Treasury and Trade Solutions, Citi

Central and Eastern Europe (CEE) has experienced huge change over the last two decades, with many countries making a successful transition from state-run, closed economic systems to fast-developing, competitive market economies. As the economic, regulatory, cultural and infrastructural environment continues to improve, an increasing number of multinational corporations are investing in CEE. While corporations in manufacturing-intensive industries, such as the automotive, technology, electronics, pharmaceutical and chemical sectors were amongst the first to do so, companies from sectors such as FMCG are now looking to CEE as a key sales and sourcing location, and as a base for manufacturing and centralised business services. As they do so, they need a reliable banking partner to support them across their target countries and integrate their flows, balances and information within a wider regional or global cash, liquidity and risk management framework.

Resilience and growth

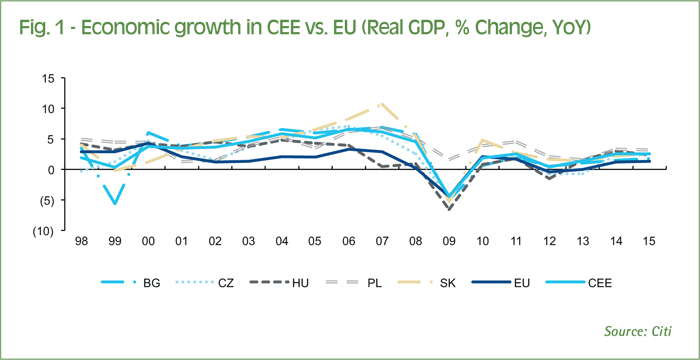

Unlike many economies in Western Europe, CEE recovered quickly from the global financial crisis. Governments in countries such as Poland, Czech Republic, Slovakia, Hungary, Bulgaria and Romania continue to focus on closing the development gap with Western Europe and enhance their competitiveness globally. As a result, a number of key CEE countries have reported strong, steady growth figures over the past five years, particularly the past 12 months (figure 1). This is particularly noteworthy given that this period coincided with a global economic slowdown, geopolitical uncertainty in Russia and Ukraine, and increasing risks in Turkey. This reflects the strong macro-economic fundamentals in the CEE region, and the increasingly favourable business conditions.

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version