by Neil Hutchison, Executive Director, J.P. Morgan Asset Management

Corporate investors are no strangers to the complex market issues that are encumbering decisions on how to invest surplus cash. Negative interest rates are creating particular challenges, and it becomes difficult to counteract these issues using the most familiar and popular cash investment instruments. Although the past two years have witnessed an increase in M&A activity, corporate cash reserves remain at a record high. At the end of 2013, for example, the top thousand public, non-financial companies were holding $3.53tr. (source: The Cash Paradox, Deloitte LLP) with no considerable change since then. Given the scale of investment challenge experienced by many corporations, treasurers are now starting to look beyond traditional cash investment instruments and find out what choices and opportunities they have to boost returns within a controlled risk framework.

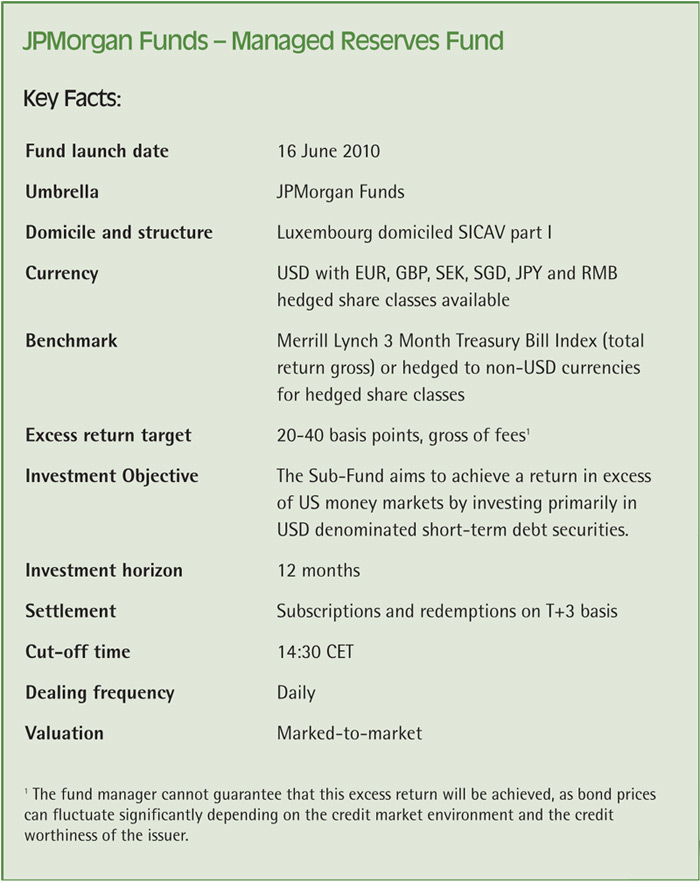

Market constraints on investment

With most corporate treasurers taking a conservative approach to portfolio risk, deposits and short-term liquidity funds such as money market funds (MMFs) remain their most common investment choices. These are straightforward to transact, allowing treasurers to diversify their risk across counterparties (particularly with MMFs) and maximise access to liquidity. Now that the overnight euro market rate has fallen to 20 or 25 basis points (bps) below zero at best, and is likely to fall further, the convenience and familiarity of deposits needs to be weighted against the negative return. Yields on euro denominated MMFs are also now slipping into negative territory as they start to reflect current market conditions.

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version