by Martin Schlageter, Head of Treasury Operations, Roche

Over the past decade, Roche has developed a world-class global treasury organisation, a process that has been distinguished by the close collaboration between treasury and IT to become a key service provider to the business. Since 2007 when Roche first featured its SAP implementation in TMI, treasury and IT have gone on to optimise many of its treasury processes. Most recently, Marco Brähler described Roche’s automated SAP and SWIFT-based confirmation exchange and matching solution. In this edition, we are delighted to welcome Martin Schlageter who describes how Roche’s treasury has continued to leverage its centralised platform to centralise and optimise processes, and enhance the value it offers to the group.

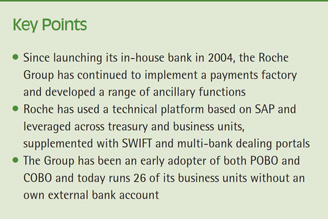

Corporate treasury is often not well understood by the wider business – and vice versa – so as a result, treasury often becomes disconnected with the needs of the organisation which in turn limits its value. Since we first launched our in-house bank in 2004, which has been a major collaboration between treasury and IT, we have transformed our role and recognition within the Roche group. Initially, our focus was to centralise treasury activities across the group, which then extended to implementing our payments factory and subsequently, to develop our capabilities in a range of ancillary functions. By doing so, we are now firmly positioned as a value-added business partner to entities across the group, with close co-operation to facilitate growth and manage risk.

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version