More than two-thirds of credit and collections professionals report that overdue Accounts Receivable (A/R) averages are greater than 10% of their portfolio, according to the FIS 2019 Credit and Collections Market Report: Modernising Credit-to-Cash with Artificial Intelligence that surveyed more than 100 credit and collections professionals. Of the respondents 78% report that over the past 24 months, their days sales outstanding (DSO) has remained flat or increased. Doing business using the same processes and systems is not getting the results that companies are seeking.

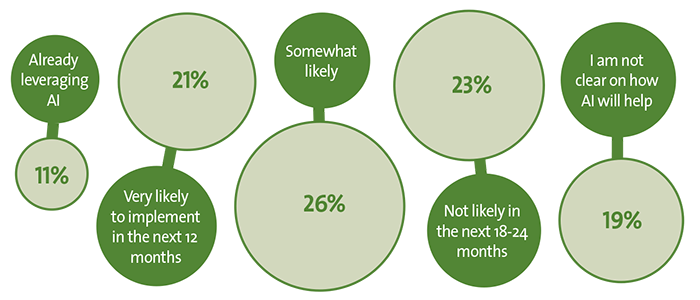

The good news is that companies are exploring new technology opportunities such as specialised technology combined with artificial intelligence (AI) and process automation to overcome these challenges. Just over half, 58%, of companies have either already adopted it or are looking to implement some form of AI in the next 18 to 24 months (fig. 1). This article uncovers more of the challenges companies are facing and examines how they are modernising the credit-to-cash process with specialised solutions combined with AI and process automation.

Fig 1: how likely are you to implement ai in your credit-to-cash operations?  |

Top challenges holding credit and collections departments back

The increasing collection volumes is the number one challenge with which credit and collections departments are struggling to keep up. According to the report, 31% indicate collections volume has gone up with same or reduced staffing (fig. 2).

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version