Despite the challenges, the UK’s departure from the EU is an opportunity for corporates on both sides of the channel to re-engineer treasury workflows, overhaul legacy processes, and revamp treasury models. Andrés Baltar, Head of Europe, Corporate Banking at Barclays and Daniela Eder, Head of Payments & Cash Management Europe, Barclays, share up-to-the-minute insights on best practice treasury post-Brexit and outline how leading corporates are positioning their organisations for growth in the ‘new Europe’.

Turn back the clock to 2016 – the year that music legends David Bowie and Prince passed away and Donald Trump became president of the United States. On 23rd June that same year, the UK voted to leave the European Union. Brexit negotiations swiftly became the order of the day for politicians, and corporates began planning for all potential exit scenarios.

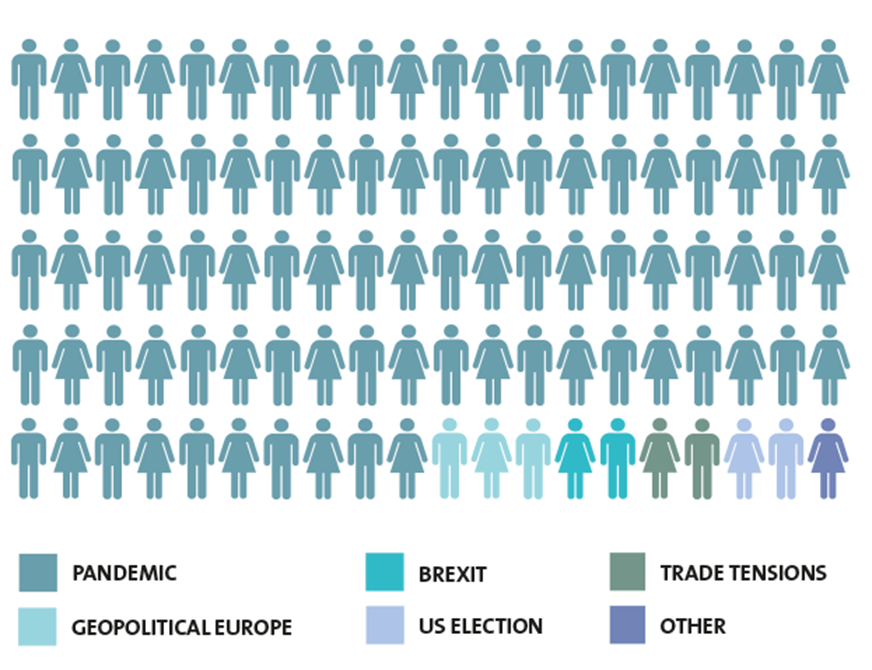

Fast forward to 2020, and the UK has now officially left the EU, but is in a transition period until the end of the year. Critically, however, no Brexit ‘deal’ has yet been reached and ongoing negotiations have been overshadowed by the global Covid-19 pandemic (see figure 1). Baltar comments: “Corporate treasurers’ attention has been diverted away from Brexit by the immediate need to focus on cash and liquidity as a result of the coronavirus crisis. This is understandable, but given the treasurer’s risk management responsibilities, Brexit must also remain firmly on the radar.”

Fig 1: Respondents’ number one geopolitical concern for 2020 Source: TMI and Barclays research report: ‘New Europe: Is Your Treasury Fit for the Challenge?’ Source: TMI and Barclays research report: ‘New Europe: Is Your Treasury Fit for the Challenge?’ |

In fact, Baltar believes it is time to revisit Brexit plans that were formulated in the wake of the referendum four years ago, and to refresh them for the current environment. “Much has moved on since 2016,” he notes. “While uncertainty remains, the opportunities that Brexit presents are becoming clearer and leading companies are making the most of the momentum. Treasury digitisation has also accelerated, which is helping corporates to put in place an optimal cash management set-up – one that is flexible enough to change with the shifting operating environment.”

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version