by Travis Barker, Outgoing Chairman, Institutional Money Market Funds Association

Critics of MMFs have argued that MMFs would be less ‘bank-like’ (i.e., not shadow banks) insofar as constant net asset value (CNAV) MMFs converted into variable net asset value (VNAV) MMFs. But what is a CNAV MMF? What are the supposed risks posed by CNAV funds? And should CNAV funds be required to adopt a VNAV?

What is a CNAV MMF?

Like any other investment fund, the share price of an MMF is calculated by dividing its net asset value by the number of shares in issue: therefore increases or decreases in the net asset value of the fund, will cause increases or decreases in its share price. The precise relationship between the net asset value and the share price of a fund is determined by the degrees of significance to which its shares are priced. This is best illustrated by way of example.

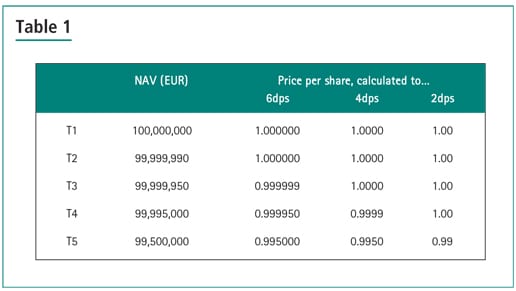

Assume at T1 a newly formed MMF issues 100m shares upon receipt of an initial subscription of EUR100m, and invests the subscription in a diversified portfolio of short-term, high quality money market instruments. Assume the net asset value (NAV, i.e., the mark-to-market value of the fund’s assets and liabilities) of the fund changes over time as shown in Table 1. Assume the fund receives no further subscriptions or redemptions during that period, and ignore income and expenses. Then depending on whether the fund prices its shares to six, four or two decimal places, and assuming they round to the nearest number, then the price per share would increase/decrease as shown in table 1.

CNAV funds price their shares to two decimal places – a practice know as ‘penny rounding’. As can be seen from that example, penny rounded shares are sensitive to movements in the funds’ NAV of 0.5% (or 50bps). Because it is rare for the NAV of a MMF to move by as much as 50bps, the share price of a CNAV fund tends to remain constant, hence the description of the fund as tending to have a ‘constant’ NAV. CNAV funds that fail to maintain a constant price are described as having ‘broken the buck’, as occurs at T5. In the past 40 years, this has only occurred twice, and because of a credit event in the CNAV fund’s portfolio.

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version