by Jim Fuell, Managing Director, Head of Global Liquidity for EMEA, J.P. Morgan Asset Management

In a world where markets are constantly changing, a well-structured investment policy can help treasurers achieve their corporate investment goals. But just as the investment landscape can swiftly change so too can corporate cash objectives. That is why it is important for organisations to establish an investment policy that clearly states their objectives and permissible investments, while also promoting long-term discipline in establishing investment goals.

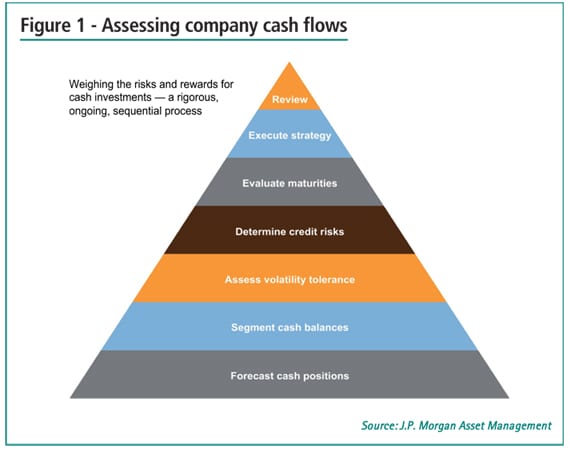

In this article, we go step by step through an approach that treasurers can use to help make their surplus cash more effective, including an overview of the various investment options available for cash.

Defining an effective liquidity strategy

Effective liquidity management can increase cash efficiency by extracting the maximum value from cash resources and optimising working capital performance. The liquidity management process starts with a well-stated investment policy, which provides the guidelines that treasurers can follow to maximise their cash returns.

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version