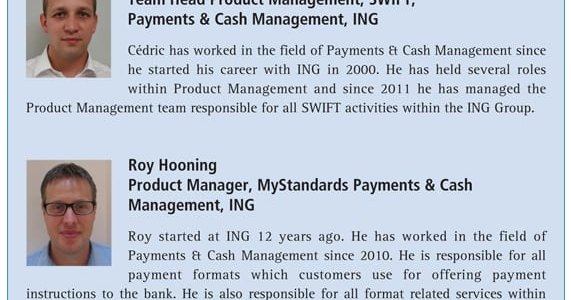

by Cedric Dumont, Team Head Product Management, SWIFT and Roy Hooning, Product Manager, MyStandards Payments & Cash Management, ING

For many years, corporate treasurers and finance managers have struggled to simplify their bank communication, hindered by multiple proprietary systems with different security and integration requirements, and diverse formats. While individual banks such as ING have worked hard to optimise the functionality and integration capabilities of their proprietary systems, and continue to do so, this only goes so far in resolving the challenges of multi-banked corporates. Today, however, corporates have unprecedented opportunity to rationalise their bank communications through a single channel, and standardise file formats using XML-based standards. As part of our ongoing commitment to enhancing our customers’ experience and make it as easy as possible to do business with us, ING is pioneering some important innovations in the areas of both connectivity and format standardisation.

Growth of SWIFT Corporate Access

Corporate access to SWIFT has evolved from being the domain of the world’s largest, most sophisticated corporations to a realistic connectivity choice for a wide spectrum of companies, particularly multinational companies with more than one banking partner. We are witnessing a major expansion in adoption amongst both large multinationals and also smaller organisations, signalling that SWIFTNet has now emerged as a mainstream corporate connectivity solution.

There are a number of factors contributing to this expansion:

- It is essential for all companies that they have complete, timely and consistent visibility over cash, which may be difficult to achieve when working with multiple banks and proprietary banking systems;

- The cost of maintaining and integrating separate banking systems can be high, so rationalising connectivity can bring considerable cost advantages;

- In countries such as France and Belgium, legacy banking systems have been retired or are evolving to an online platform, and this often creates a trigger for companies to closely look at their internal organisation. A proportion of companies have chosen to adopt SWIFT to replace these;

- Companies of all sizes are rationalising banking partners to centralise liquidity and simplify processes. SEPA migration is frequently proving a catalyst for this process. Reviewing bank connectivity is typically an intrinsic part of this project;

- Ongoing economic uncertainty is fuelling SWIFT adoption as treasurers and finance managers seek bank-agnostic connectivity as part of their counterparty risk management strategy.

Facilitating access to SWIFT

Early corporate adopters often had to dedicate considerable technical resources to accessing SWIFTNet, the SWIFT network, but with a number of professional service bureaus now offering proven and mature services to corporate customers to facilitate SWIFT connectivity; it is now far easier for corporate users to communicate with their banks in this way. Costs have also fallen considerably since corporate access opportunities were first unveiled. Although SWIFT’s web-based tool Alliance Lite has received relatively modest attention until now from the corporates market, the new version of this service is likely to encourage a larger number of mid-market corporates to connect to SWIFT, as it offers a wider range of services and greater volume capabilities whilst still providing cost-effective, convenient access to SWIFT. The challenge remains to facilitate the integration of the customers’ own organisation and systems and the SWIFTNet connectivity.

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version