A UniCredit Case Study

by Andreas Müller, Chief Financial Officer, and Atul Malhotra, Head of Procurement, Georg Fischer Automotive

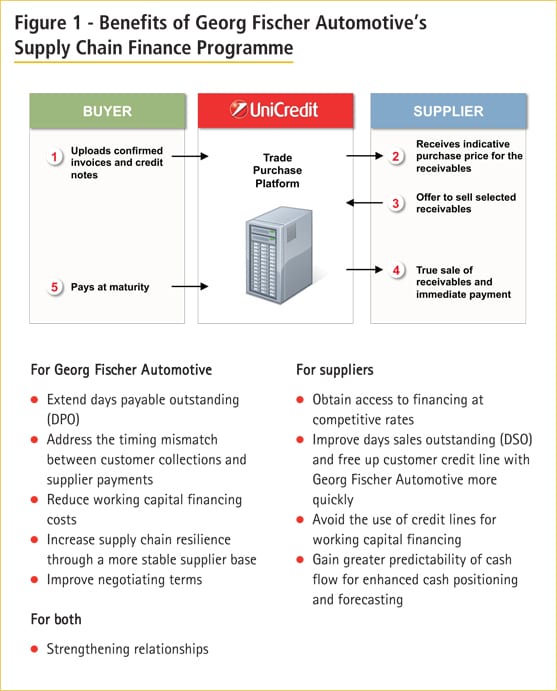

Like many organisations, Georg Fischer Automotive, one of the three core businesses in the Georg Fischer group, was experiencing working capital challenges caused by the timing mismatch between customer collections and supplier payments. To address this, Georg Fischer Automotive made the decision to implement a supply chain finance programme with UniCredit. This article outlines some of their experiences and the outcomes of implementing the programme so far.

Working capital challenges

Although the Georg Fischer is made up of three core business divisions, treasury is managed at a corporate level and manages the cash, treasury and risk management requirements of the group as a whole. Specific divisional needs are managed by the divisional CFO, supported by treasury.

One of Georg Fischer’s most significant treasury challenges is to manage working capital effectively. Before implementing the supply chain finance programme, there was significant divergence between inflows and outflows with a timing gap of 20-25%, which was expensive to finance. Consequently, our aim was to narrow this gap as far as possible. In addition, the 2008-9 crisis encouraged the group to optimise its net working capital, including suppliers, inventory and customers. One of the outcomes of this was to renegotiate payment terms wherever possible, but this was not sufficient in itself to resolve the funding gap, not least as many of our suppliers were experiencing similar liquidity challenges.

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version