A qualitative study on the rising role of distributor finance programmes in enabling downstream business in international supply chains

by Phillip Kerle, Chief Executive Officer, Demica

As trading business undergoes a shift from letters of credit (LC) to open account transactions, financial supply chain management solutions have become increasingly relevant. The credit squeeze triggered by the financial crisis has made large corporates more alert to issues surrounding liquidity and risk in their supply chains. To ensure supply chain stability, forward looking companies are seeking value-added financing facilities that benefit the various stakeholders located along the corporate supply chain. This new attitude has contributed to the increased uptake of supply chain finance (SCF), as attested by global banking institutions in previous research reports commissioned and released by Demica in recent years.

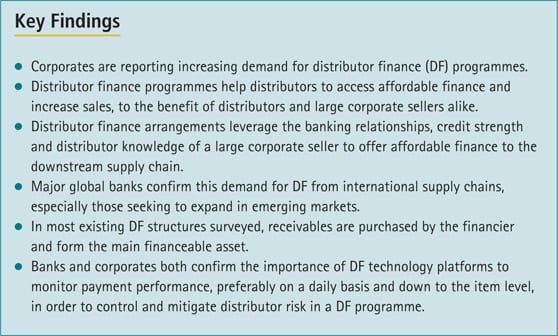

The heightened awareness of supply chain risk is also drawing amplified attention to downstream distributor finance (DF) – an area that has so far attracted less interest than SCF and yet a crucial topic that should not be neglected. In many emerging markets, small and medium enterprise (SME) distributors are struggling to obtain affordable credit. This is further compounded by sellers’ pressure to increase sales. As major corporates are expanding further afield in high growth regions, DF holds the key to opening up new markets and unlocking sales potential. It complements SCF to provide efficient financing for SMEs both up- and downstream in a major corporate’s supply chain, supporting the full process to market with short-term working capital funding.

In order to examine the current usage of DF in the market, especially in developing economies, Demica, along with the support of the management consultancy Capacent, has interviewed a number of global corporates to investigate the scale and fashion with which DF is being offered to their distributors. Together they have also interviewed a sample of international banking corporations to understand their approach to DF. This qualitative research report aims to deepen understanding of this emerging credit facility as well as to provide a primary assessment on market potential.

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version