by Pawel Muszalski, Head of Network Management & Product Development, UniCredit Global Securities Services

UniCredit has a leading position in Central & Eastern Europe not only in cash and trade but also in securities services. UniCredit’s Global Securities Services (GSS) offer comprehensive custody and securities servicing capabilities in Central & Eastern Europe (CEE) with a number 1 or 2 position in each market in which we operate. By leveraging an extensive network of subsidiaries across the region, investors are able to access a unique depth of expertise in each market, while benefiting from the strength and integrity of the UniCredit network. Consequently, GSS have developed an enviable track record in meeting the needs of both domestic and international investors. An important step in maintaining and strengthening our market reputation and high quality of customer relationships has been the development of a new electronic platform for securities services, BusinessNet Securities, as part of a wider, innovative electronic banking suite. This article outlines some of the benefits of this solution and the background to its development.

The BusinessNet suite

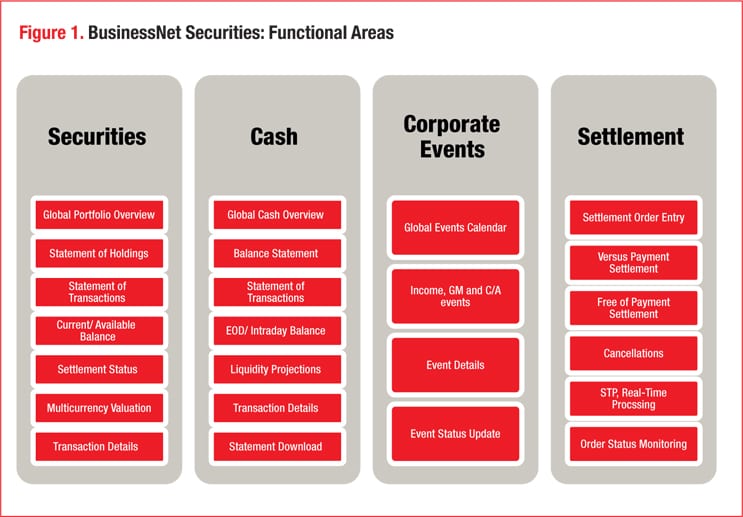

BusinessNet is UniCredit’s electronic banking suite for Central & Eastern Europe (CEE) offering comprehensive functionality to cover the broad spectrum of corporate treasury responsibilities. Within the BusinessNet suite, BusinessNet Securities provides accurate, near real-time management of multiple portfolios and state of the art contingency capabilities across multiple currencies and markets, and with comprehensive functionality across Cash, Securities, Corporate Actions and Settlement (figure 1).

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version