by Paige Chesser, Strategic Solution Delivery Executive, Global Business Solutions, Bank of America Merrill Lynch and Drew Strzepek, Engagement Executive, Global Business Solutions, Bank of America Merrill Lynch

The new mandate for treasury and finance leaders is to assume a more influential role within their business. Strategic planning can help them get and keep a ‘seat at the table’. Creating and executing a strategic plan can accelerate the move from transactional activities to a more strategic and value-added focus. A clearly articulated and well communicated blueprint for change drives significant benefits while elevating and repositioning the critical role that finance professionals have in their organisation.

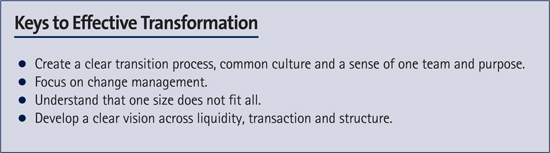

With the heightened focus on board-level visibility and transparency of cash, treasurers must rewrite the role they and their department play in the overall organisation. The challenge of moving from a traditional transactional focus to a proactive, strategic resource requires both a mindset and operational change for the treasurer, the treasury team and the organisation. Additional factors contributing to the need for this transformation include growth expectations, global expansion, a heightened regulatory environment, as well as decentralised and fragmented systems and processes.

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version