by Steve Lethaby, Senior Sales Manager, GSF Sales/Relationship Management– UK, Ireland, South Africa and the Americas, Clearstream

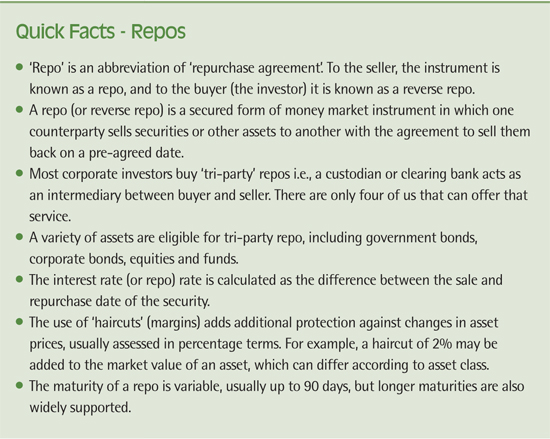

While investing surplus cash has always been a challenging process for corporate treasurers in order to manage counterparty risk, maintain access to liquidity and generate above-inflation returns, decisions over the choice of investment product have typically been more straightforward. Treasurers’ cash investment mandate is generally conservative, with deposits and to some extent money market funds (MMFs) predominating, together with instruments such as certificates of deposit (CDs) and commercial paper (CP) amongst those with larger cash balances. Today, however, a range of market, regulatory and internal factors are forcing treasurers to rethink the choice of investment solutions in which they invest. The difficulty for treasurers, therefore, is to find instruments that continue to meet the corporation’s liquidity, risk and yield objectives within this new environment. Increasingly, tri-party repos are proving an attractive choice.

Pressure on investment choices

While regulatory change is a fact of corporate life, there are two key developments that are prompting treasurers to rethink their investment practices now, and will do so more strongly in the months ahead. Firstly, Basel III and in particular the liquidity coverage ratio (LCR), is making short-term deposits of non-operating cash (effectively any deposit that is not linked to other activities such as payments and collections management) far less attractive to banks than in the past. While deposits of a minimum tenor, e.g., 90 days, will be more attractive to banks, and therefore they are likely to incentivise their corporate clients accordingly, this lack of flexibility in maturity dates is likely to compromise many corporations’ liquidity requirements.

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version