by Eveline Stam, Head of Treasury, BearingPoint

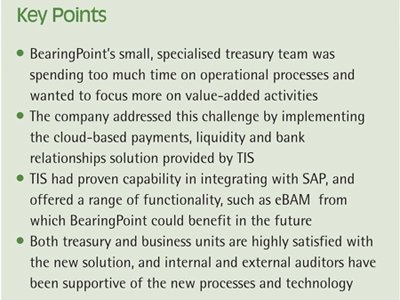

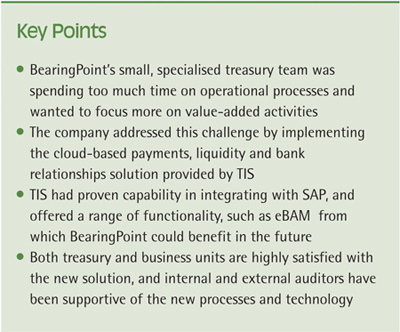

Our treasury function comprises a team of three based in Amsterdam, who support the business across 20 countries, working closely with financial controllers in each location and the group CFO in Frankfurt. We are responsible for market risk, counterparty risk, cash management and liquidity, but we also manage BearingPoint’s payment infrastructure. In the past, we were responsible for payments processing, but with a small, specialist team, we recognised that we would make better use of our resources by taking more of an oversight role. In our business, with a primarily European footprint, treasury is taking a greater role in issues such as intercompany loan management, as well as its regular activities.

Infrastructure challenges

In order to migrate from an operational to a strategic treasury role, we needed to streamline, simplify and automate our payments infrastructure as far as possible. We had more than ten different banking systems in place, many of which were obsolete. Connecting with multiple systems meant that we had to manage separate interfaces, formats, security protocols and business processes, which added complexity and risk to our payment processes. Furthermore, it was difficult to monitor cash flow on a consistent basis given that data was presented in various systems and formats.

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version