by Michael D. Golden, SVP, Product Management Executive, Bank of America, Global Product Solutions

The global credit crisis has eroded the availability of financing and liquidity—a company’s lifeblood—and has increased its costs. In this challenging financial climate, it is vital that companies harness internal liquidity and optimise its use.

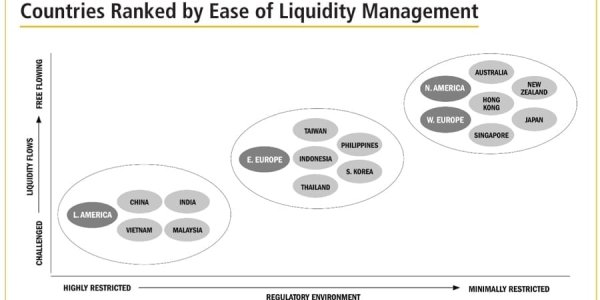

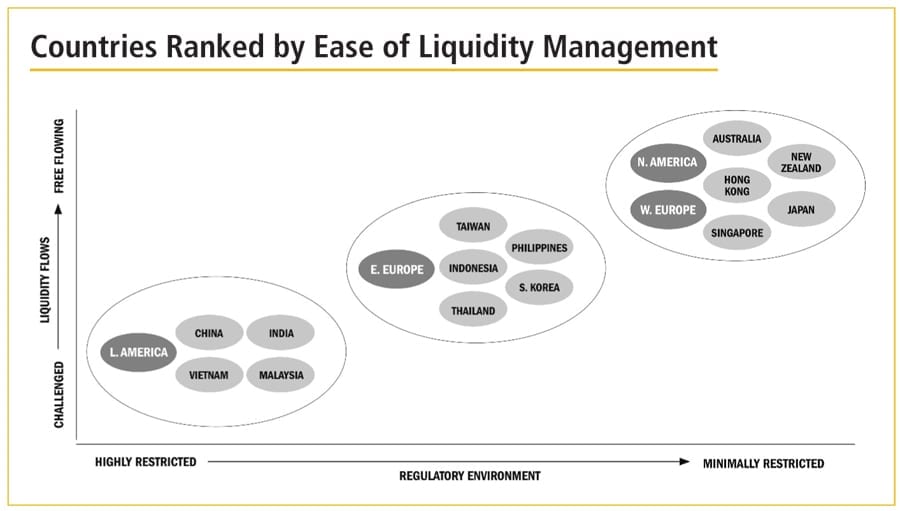

Yet for companies operating globally, some excess liquidity may be restricted as it cannot be repatriated easily from another country, due to currency controls and other regulations. This remains a key challenge, as what feels like ‘trapped cash’ has historically been associated with the opportunity cost of underutilised liquidity, especially relevant to emerging markets. However, in the context of current events, this takes on a broader meaning—one which shifts attention from opportunity cost to risk—whether country, counterparty, or FX risk—and from emerging markets to all markets.

In this article, we explore the movement of local, regional and global cash flows as a key issue in liquidity optimisation, including:

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version