by Liz P. Minick, Head of US Corporate Treasury Sales, Global Treasury Solutions, Bank of America Merrill Lynch and Jason Dubinsky, Treasurer, Walgreen Co.

In today’s market environment, it is essential for companies to be open to transforming their current operations to enable new and sustainable growth. As many leading United States (US) corporates have discovered, it is no longer possible to rely on organic growth alone to deliver the financial performance needed to satisfy investors and analysts. A critical factor in the success of any transformation effort is the integration of treasury into corporate strategy. Today’s corporate treasurers have a vital role to play when it comes to strategy, and their input and a critical seat at the table can help ensure an optimal result. Their advice on matters such as transaction structures, funding sources and capital allocation can fundamentally affect the success of expansion programmes. Treasury is also well positioned to help the company grow financial returns and increase efficiency by providing guidance on topics such as centralisation, risk, financial control, regulation, currency controls, plus cash and liquidity management.

Walgreens: doing it right

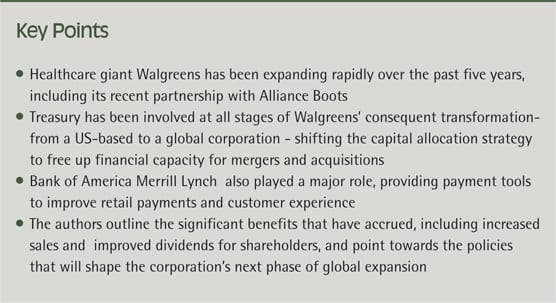

Walgreen Co. is an illustration of how involving treasury in this way can deliver a great result. Already the largest pharmacy retailer in the US, Walgreens undertook a transformation effort in 2008 to position itself as America’s first choice for health and daily living needs. The firm today serves more than 40 million customers a week in more than 8,000 stores across the US and Puerto Rico. Nearly two-thirds of Americans live within three miles of a Walgreens store.

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version