After the Ballots

How the ‘year of elections’ reshaped treasury priorities

Published: February 01, 2013

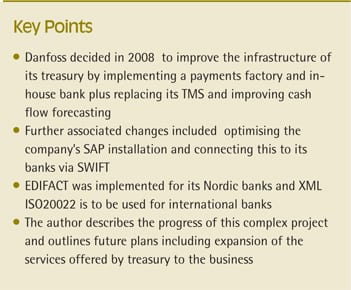

Danfoss has a commitment to excellence across all of its business operations, so in late 2008 we embarked on an initial study of potential improvements that could be made to our treasury management infrastructure. While our treasury already demonstrated industry best practices in many of our activities, we recognised that there were some areas of potential improvement. For example, we identified that payments processes could be improved and automated through a payments factory and in-house bank, supported with enhanced bank connectivity. We also wanted to replace our legacy treasury management system (TMS) and improve our cash flow forecasting processes.

Our business case for the in-house bank and bank connectivity was based on improved efficiency and control in our payments process, and lower internal and external costs by increasing automation and replacing external payments between Danfoss business units with internal payments via the in-house bank. Our management committee approved project expenditure in late 2009 at which point we selected appropriate business partners, and we started the project in January 2010.

The project comprised four phases: implementation of the in-house bank; bank connectivity; TMS installation, and cash and liquidity management. We identified bank connectivity as being the longest project phase, so this has continued throughout the TMS implementation. The project included extending our SAP installation to the In-House Cash module which would enable us to optimise our intercompany payments. We have an internal policy within Danfoss that we should use SAP whenever it provides the required capabilities. We explored SAP’s treasury functionality in detail, and benchmarked it against alternative solutions. On the basis of this evaluation, we made the decision to implement SAP. We also decided to connect SAP to our banks via SWIFT for both external payments and retrieval of bank statements. Before embarking on the evaluation project, we were not familiar with SWIFT. However, having attended conferences, spoken with our banks and consulted the treasury media, we recognised that SWIFT would provide the resilience, security and multi-bank connectivity that we were seeking.

We have four key cash management banks, so we sought their advice and support in our SWIFT implementation. As a privately owned company, Danfoss was not eligible to join SWIFT without bank sponsorship under previous rules, which one of our banks did for us, although this requirement no longer applies. Each bank connection was essentially a new project: even though we took a standardised approach there still are differences when connecting to different banks. We implemented EDIFACT for our first two (Nordic) banks, which handle both domestic and international payments as well as cash management, and we will use XML ISO20022 with our two international banks.

We did not have the resources or appetite internally to connect directly to SWIFT so we needed to appoint a service bureau to provide connectivity services. We conducted an initial review of potential providers and shortlisted three companies including BBP, a Fundtech company. This decision was based on the company’s stability, expertise, and track record in SWIFT connectivity for corporates. This relationship has proved very positive and we have benefited from the expertise and experience offered by BBP to achieve our SWIFT connectivity objectives.[[[PAGE]]]

The in-house bank is now fully functional for internal payments. SWIFT connectivity is implemented and we are able to make external payments via our two Nordic banks. The project with our international banks is in progress, with one connection in progress and the final one to follow.

A project with multiple components and significant complexity inevitably brings certain challenges. We were expecting our banks to have a higher degree of expertise on SWIFT onboarding than was the case in practice, but we have overcome this in close collaboration with each bank, and by developing our own experience as we connect to each of the banks. When dealing with multiple systems, there is also the challenge of data alignment to ensure consistent processing, and it has taken some time to work out the most appropriate master data set-up. It is challenging to connect multiple internal systems to a single connectivity platform when setting up a centralised payments function, not least because of differences in the way that master data is held, but we are working on this and expect to finalise the outstanding master data issues during the first half of 2013.

Despite the challenges we have encountered, and the pressures created by the global financial crisis, we have already achieved cost benefits in the range of EUR 4 – 5m per year in addition to a range of other advantages. Before we started the project, we expected to implement the new TMS first of all. We recognise that changing systems does not deliver improvements in itself, processes need to be optimised as well. As an example, the TMS provides the relevant automation, information reporting and control. As a result, we have now simplified and accelerated our month end close significantly: while this used to take about four man days, it now takes about one man day or less.

We have also focused on aligning and optimising cash management processes such as payments across the business in order to concentrate cash in treasury. We have a large number of entities such as production and sales facilities, which results in quite a complex structure for intercompany deals, but we have now achieved harmonisation of processes such as invoicing, payment and advices for a number of business units.

Once we have connected to all four banks via SWIFT, we will have automated both internal and external payments for all our major markets, which will all be channeled through SAP In-House Cash. This will allow us to have better visibility and control over payments in treasury and further reduce costs by using domestic rather than cross-border payments wherever possible. We will also be able to replace the existing process of local business units downloading bank statements into SAP with an automated process centrally. This will enable us to increase the degree of automation in our reconciliation processes.

Looking forward, we need to complete the project phases we have already identified, and then include entities in countries with more restrictive regulatory environments that we have omitted from the project so far. We will then be in a position to leverage our improved infrastructure and processes to expand the range of services we offer to the business. An efficient, robust technology infrastructure and process definition is an essential prerequisite for increasing the contribution that treasury makes to the business and a vital investment for the future.