by D+H

When today’s multinational corporate treasurers are asked to sum up the underlying challenge facing them today, a common theme emerges: needing to do much more with much less. Increasingly, treasurers are looking to their banks and their technology partners to help them do this.

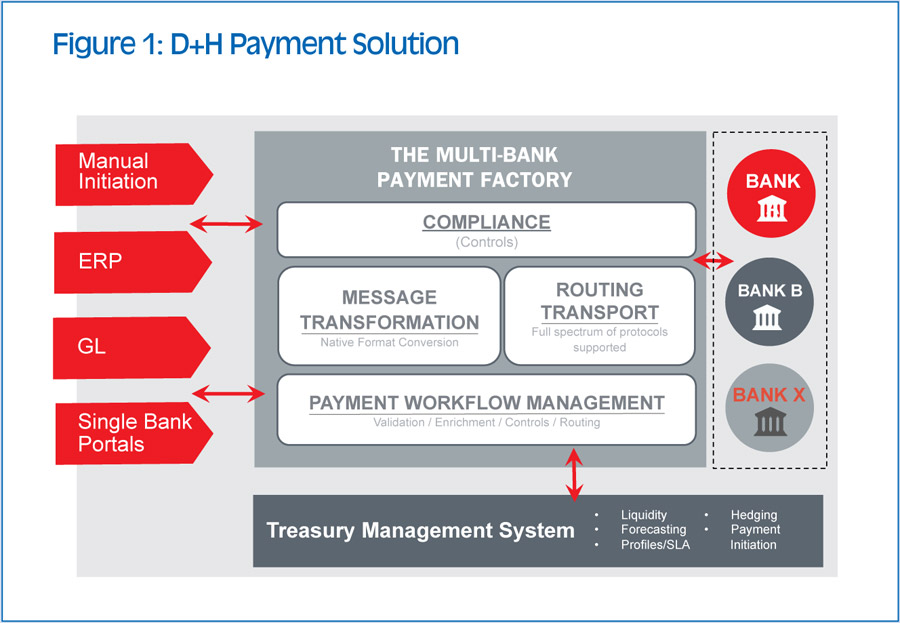

In keeping with this trend, the corporate payment hub or ‘multibank payment factory’ is an appealing option for corporates that need to centralise their payments and/or collection processes, transmit financial messages more easily and efficiently, and gain deeper insight into liquidity with the end goal of optimising working capital for the whole enterprise. The last of these objectives reflects how forward-looking corporate treasurers are going well beyond their traditional role to actively generate revenues by making the firm’s capital work harder.

In line with these goals, corporates across all sectors are increasingly looking to technology partners to perform four key functions:

- Message transformation: Corporates that use external systems for their payment factories typically receive disparate files in various formats from their enterprise resource planning (ERP) and/or treasury management system (TMS) platforms where payments originate. The transformation layer of the payment factory takes these disparate formats to enrich and transform them to ensure they contain required information based on the type and geography of payments.

- Workflow: The extent to which corporates use workflow capabilities in their payment factory solutions tends to vary widely. Some feel that workflow needs to be accomplished in origination platforms (ERP/TMS), while others apply the concept of ‘trusted’ and non-trusted’ sources, and utilise workflow capabilities in their payment factory solution for the ‘non-trusted’ sources only. Still others choose to standardise all of their workflow within the payment hub to ensure global consistency.

- Message routing/transport: Many, indeed most, utilise SWIFT as the transport and routing mechanism, and regard this as a key component of their payment factory. Some use in-house solutions to achieve this capability, while others utilise service bureaus offered by providers such as D+H, formerly known as Fundtech. Where SWIFT is not feasible as a transport option, many corporates look to build host-to-host connectivity either in-house or through a service bureau.

- OFAC/Sanctions list filtering: Using the hub to carry out initial checking of their payments against an Office of Foreign Assets Control (OFAC) or other sanction list is a step that’s on the radar of many organisations. Given heightened security risks, most are currently at the stage of looking for best practices in how to do this.

- Accounting/Reconciliation: While varied generally in practice, corporates typically choose to do the accounting and reconciliation for all transactions passing through the payment hub within the hub and then have these accounting entries sent to their general ledger. The reconciliation of payments sent and payments ultimately received is also done through the payment hub.

The MultiBank Payment Factory: The Way Forward for Corporates

Click image to enlarge (opens in new window)

A multibank payment factory solution – as illustrated in Figure 1 – centralises and automates all the functions required in a payment factory in a flexible, cost-effective and proven environment.

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version