by Melissa Gargagliano, Head of Commercial Cards, Global Transaction Services, EMEA, Bank of America Merrill Lynch

The use of commercial cards has evolved considerably over recent years, with product innovation, growing corporate awareness of solutions such as virtual cards, and a continuing focus on working capital amongst corporations of all sizes. These trends are contributing to a rapid increase in adoption as professionals in treasury, finance, procurement and corporate travel appreciate the valuable contribution that commercial cards can make to an effective working capital strategy, in addition to their value in terms of convenience, control and reporting.

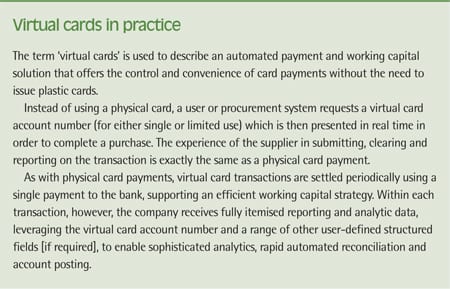

Virtual cards, concrete solutions

When it comes to payables, purchasing cards are in many ways becoming a misnomer as, virtual cards are increasingly replacing the concept of plastic purchasing cards offering sophisticated, end-to-end payment and working capital solutions. Not only are payment transactions both convenient and controlled, but the entire workflow is automated from transaction to reconciliation, together with a predictable transaction date, a single external payment to cover card transactions, and full visibility over the detail of each transaction.

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version