A BNP Paribas Cash Management University Panel Discussion

Effective liquidity management is an ambition for every treasurer globally. During the 5th Cash Management University, hosted by BNP Paribas, workshop participants discussed some of the ways that they had optimised liquidity management, with both a regional and global view. The panel comprised the following:

- Niels van Popta, Director Global Treasury, Heineken;

- Sirkku Markula SVP, Corporate Treasurer, KONE Corporation;

- Tom Cools, Director, Corporate Treasury Solutions, PricewaterhouseCoopers;

- Jan Rottiers, Head of Liquidity Management Products, BNP Paribas

- Helen Sanders, Editor, TMI (chair)

Treasury Priorities

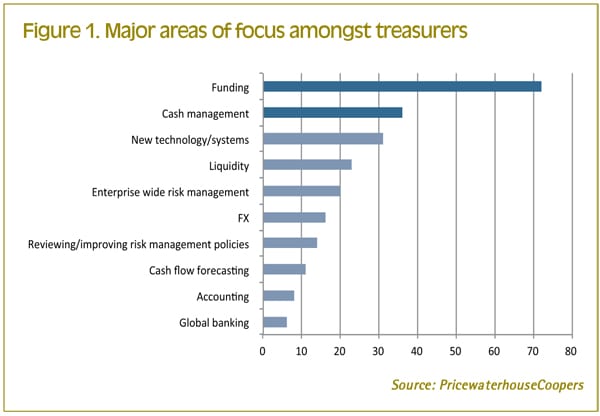

Tom Cools, PricewaterhouseCoopers provided some interesting statistics on trends amongst corporate treasuries globally (figure 1). These were derived from a survey that PricewaterhouseCoopers had conducted during 2011, including 583 respondents. He illustrated that while funding was the primary concern for treasurers (73%), 60% of treasurers indicated that cash and liquidity management were priorities. Just over 30% of respondents also indicated that treasury technology and automation was a key issue.

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version