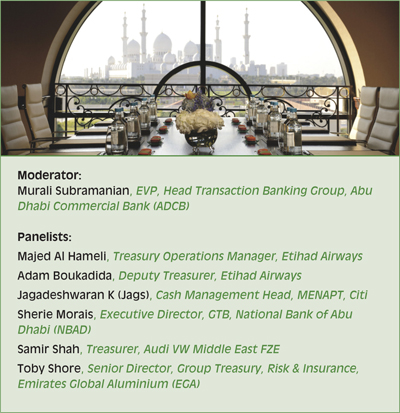

A TMI roundtable in association with D+H

In May 2015, a panel of leading corporate treasurers and both international and local banks gathered to discuss some of the most important priorities for corporate treasurers in UAE, and how the banks are responding to these evolving needs. The following is an edited transcript of this conversation. With thanks to panellists, participants and D+H for sponsoring this event.

Murali Subramanian, ADCB

What we would like to focus on first is today’s priorities and drivers for change in corporate treasury. Corporate treasury has evolved considerably in the Middle East, with far closer parallels with global best practices than five or 10 years ago. Not only are treasurers looking after bank relationships and cost management but also liquidity, funding, enterprise risk management and so on.

Toby Shore, EGA

Emirates Global Aluminium [EGA] was formed in 2014 as a joint venture between Mubadala Development Company of Abu Dhabi and the Investment Corporation of Dubai, and our core operating assets are Dubai Aluminium (DUBAL) and Emirates Aluminium (EMAL). As a new company, our priority for the next 12 to 24 months is to progress the integration of the two businesses, and leverage the strengths of both predecessor companies. DUBAL implemented a treasury management system (TMS) in 2012-13 which is integrated both with the ERP and with an online trading platform, creating end-to-end straight-through processing for treasury transactions from exposure inception through to accounting and journal entries. An early priority was therefore to extend this efficiency throughout the EGA Group.

Risk management is also huge focus area for us. We have two of the world’s largest aluminium smelters within 60 kilometres of each other, we have a refinery construction project under way, and a bauxite mine in Guinea where we are embarking upon a feasibility study. We are also acquiring assets in China. Consequently, we have numerous, quite diverse risk management challenges to deal with. From a treasury angle, we are looking to implement a common platform across the group leveraging what we have achieved so far in the TMS space and taking an enterprise-wide approach to risk. By achieving a single view across the group, we achieve a ‘single source of truth’ and can report consistently to the board and to our shareholders.

Adam Boukadida, Etihad

Our priorities are similar to those that Toby described, although as an airline, our business is quite different. Risk management is important to us too, and we actively hedge our foreign exchange and commodity risk. We also need to finance both our day-to-day business operations and our assets, for which we rely on a panel of key banks and strategic partners. Efficiency and productivity are essential for Etihad, and to achieve this, we are embarking on a two to three year major transformation programme. We have completed a request for proposal (RFP) for both treasury management and enterprise risk, and mandated OpenLink, together with SAP as our strategic technology partner for the Etihad group, which includes both Etihad Airways and the eight airlines in which we have an equity stake. We are also implementing ancillary solutions, such as online dealing and confirmation matching, to achieve end-to-end transaction processing in a similar way to EGA.[[[PAGE]]]

Our priorities are similar to those that Toby described, although as an airline, our business is quite different. Risk management is important to us too, and we actively hedge our foreign exchange and commodity risk. We also need to finance both our day-to-day business operations and our assets, for which we rely on a panel of key banks and strategic partners. Efficiency and productivity are essential for Etihad, and to achieve this, we are embarking on a two to three year major transformation programme. We have completed a request for proposal (RFP) for both treasury management and enterprise risk, and mandated OpenLink, together with SAP as our strategic technology partner for the Etihad group, which includes both Etihad Airways and the eight airlines in which we have an equity stake. We are also implementing ancillary solutions, such as online dealing and confirmation matching, to achieve end-to-end transaction processing in a similar way to EGA.[[[PAGE]]]

An important contributor to our treasury efficiency is D+H, who will be supporting us in payment messaging, cash management and technology integration to create a robust, secure and highly automated processing and communications infrastructure across the 110 banking relationships that we have in place. We are reviewing these relationships too, however, and have recently launched a global cash management bank RFP. Most importantly, we are using our transformation project to reflect, analyse and implement what we see as global best practices in cash management. This is not as straightforward as simply rationalising banking partners. As an airline, we have a truly international operating model across 70 countries and over 120 cities. We will continue to work with multiple banks, but what is important is that we are looking for more than service providers, we need strategic partners. We will start in the UAE as our home territory and then consider both our transaction banking needs, and the bank relationships we need to support them, in each region in turn.

Samir Shah, Audi VW

At Audi VW, we take a different approach to banking partners, and are basically looking for a ‘one-stop shop’. As the regional business for Audi and VW, we finance all our dealers for 180 days. We also have surplus cash, so risk management, liquidity solutions and competitive yields are all important. Visibility is crucial, so the online banking platform that a bank provides is one of our key selection criteria.

Murali Subramanian, ADCB

Turning now to the banks: having heard corporate treasurers’ priorities, such as enterprise risk, liquidity, global visibility and the technology platforms that support them, how do you see banks responding to these priorities?

Jags, Citi

We conduct an annual survey of treasurers across EMEA, which reveals three common priorities, closely aligned with those described by Toby and Adam. Number one is to support organisational growth. Second is managing contingencies, particularly given both geopolitical instability and foreign currency-related volatility. The third is return on investment. The companies have invested heavily in professional teams and technology, so they are looking to leverage these investments to deliver value.

We conduct an annual survey of treasurers across EMEA, which reveals three common priorities, closely aligned with those described by Toby and Adam. Number one is to support organisational growth. Second is managing contingencies, particularly given both geopolitical instability and foreign currency-related volatility. The third is return on investment. The companies have invested heavily in professional teams and technology, so they are looking to leverage these investments to deliver value.

Sherie Morais, NBAD

An additional dynamic I wanted to point out is the important trend we are observing towards ‘back to basics’. Treasurers need visibility first and foremost, and given the age-old saying ‘cash is king’, they need to know where their cash is at any point in time and potentially, have access to this cash. To achieve visibility, the issue of automation becomes critical; however, there are still a number of hurdles. For example, there are still organisations where senior managers want the assurance of signing instructions manually, so banks, as advisors, need to spend more time with these clients to help provide confidence on workflow, system security, process control, etc. and jointly plan a transformation strategy.

Cash management processes and analytics are also important to support cash flow forecasting and reconciliation. Ultimately, visibility and automation are key to the accuracy and efficiency of both of these activities. Today, many organisations need to spend a great deal of time and effort in these areas, so as advisors, banks need to be more proactive in terms of understanding the organisation’s strategy and aligning appropriate investment and resources to support them.

Murali Subramanian, ADCB

To what extent have treasurers already got the technology in place to achieve the objectives we’ve discussed, in addition to wider initiatives such as procure-to-pay integration? Is it simply a case of leveraging what’s already there, or do they need to invest further?

Toby Shore, EGA

When we talk about technology from a corporate’s perspective, it’s important to focus on the objective. The level of investment itself is not important if the result does not meet the business need. One important issue should be to reduce the risk of error, such as incorrect input, and fraud. For a business such as ours that conducts 100-150 FX trades a month of $50m - $80m, even one mistake can be very costly. A second key issue for us is to free up resources from clerical activities to be able to engage in more value-added activities. There’s far more value to the business paying an employee to do regression analysis, Monte Carlo simulations and really understand the market and our risks than simply keying data into different systems. Therefore, integration between our systems is essential for us so that data is input or uploaded only once.

Murali Subramanian, ADCB

The point you make about using data effectively is interesting. We have talked about ‘big data’ for the past ten years, and there is undoubtedly value in analysing the information you have to understand patterns and modify behaviour according to those patterns. I wonder how many treasuries are really geared up to analyse the data they already have.

Toby Shore, EGA

Absolutely: firstly, you need the right technology, secondly, you have to know how to use it. It’s important to have a clear business case for a TMS for example, which is not cheap, and there are always different demands for every investment dollar. So unless you can show a compelling return on investment, whether it be preventing fraud, achieving efficiencies, or adding value, it’s a very tough sell.

Adam Boukadida, Etihad

From Etihad’s perspective, we are on the next phase in our treasury technology journey. We put our TMS in place nine years ago when the treasury function was first established, and the system met our needs at that time and in the few years that followed. When we reviewed our technology infrastructure and started our evaluation process around a year ago, we recognised that we needed to update our systems to meet our treasury needs as they stand today, and as we expect them to unfold in the forseeable future. It has taken a long time, however, to illustrate the benefits of this investment. From our experience, therefore, I would say that it’s not only important to invest in the right technology and strategic partners, but you have to do the analysis upfront to ensure you’re getting best value from your investment.[[[PAGE]]]

Murali Subramanian, ADCB

Sherie, how should banks complement the investment that their corporate customers are making in technology?

Sherie Morais, NBAD

There’s a bit of a catch-22 situation, as people don’t always know what they need until it’s too late. For example, during the financial crisis, a number of companies found that they did not have a clear cash position. This ultimately forced the industry to focus on investing in these solutions, particularly taking into account the complexity of multinational corporations that have often grown through acquisition.

As a result, we have witnessed a very dynamic period in the cash management technology space, with new technologies being deployed in the industry such as mobile payments/ wallets. In addition, the strong industry trend towards centralisation is driving the new opportunities for standardisation, efficiency and control.

Murali Subramanian, ADCB

The challenge for banks might therefore be whether they should invest in technology themselves, or whether they should act as advisers and intermediaries between technology providers and corporate customers.

Sherie Morais, NBAD

Yes, this is an interesting issue. From my perspective, I believe banks should focus on the advisory role, offering feedback on industry trends and sharing best practices, whilst engaging with reputable providers/ vendors to deliver the efficiencies that customers need. So banks have a complementary but key role to play. It should be understood that this is not simply a short-term objective but a longer-term strategic journey, given that cash and treasury management challenges and solutions evolve over time.

Jags, Citi

Banks have invested heavily in technology, and continue to do so. The proportion of investment directed towards regulatory ‘asks’ is becoming more balanced towards business-related ‘asks’. Customers should leverage these bank-driven investments wherever possible, especially the information gathering and reporting tools, and thereby reduce their overall technology spend. It is important for banks to continue investing in technology to maintain competitive advantage and reduce complexity for customers.

Toby Shore, EGA

The trouble is, while these proprietary solutions may reduce complexity for a customer when dealing with that bank, what is the real benefit to a company that has 110 banks as Adam has described?

Murali Subramanian, ADCB

Clearly one of the outcomes of this dilemma is the emergence of non-proprietary solutions that are not linked to any single bank. Corporates’ technology needs differ, however, so both proprietary and bank-independent solutions have a role to play. Whatever their specific needs, corporates expect banks to fulfil the role of trusted advisor.

Clearly one of the outcomes of this dilemma is the emergence of non-proprietary solutions that are not linked to any single bank. Corporates’ technology needs differ, however, so both proprietary and bank-independent solutions have a role to play. Whatever their specific needs, corporates expect banks to fulfil the role of trusted advisor.

In the Middle East, there is growing competition in these corporate-to-bank relationships with both local and international banks vying for corporate treasurers’ attention. Every bank is investing in technology. Every bank wants to be an operating bank for tits customers and do more for them. Every corporate treasurer is looking for comparable solutions to qualify potential banking partners. So in an environment where there is greater pressure for uniformity, what are your priorities when selecting international and local banks?

Samir Shah, Audi VW

For us, pricing and technology are the key drivers, not only transaction pricing and fees, but also investment yields, particularly given the low interest rate environment. Assuming similar pricing, our head office would then play a role in determining the choice of banks.

Toby Shore, EGA

At EGA, we take bank relationship management very seriously, and we were very proud to be awarded the Adam Smith Award for best-in-class benchmarking this year. While pricing is important, it is not our first priority. Treasury in the Middle East has changed unrecognisably since 2007. In 2007 and 2008, Dubai and Abu Dhabi were booming and the streets were awash with liquidity. By 2009, the situation for any net borrower was vastly different. During bad times, it is not pricing that matters but survival, so you need bank relationships that support your needs during both good times and bad times. This is not to say that we are always in perfect alignment, as we are not of course. But mutual respect and a common understanding of long-term partnerships stand you in good stead for years like 2009 and 2010.

This may not always be the cheapest approach, but ultimately everyone, including the banks, needs to make money. Why would the banks give you money or provide services for free? If the relationship isn’t profitable for them, they’re unlikely to be there when your business is in real danger. We don’t have 110 banks like Etihad, but we do have around 45, so a lot of my time is spent on relationship management. We also analyse the business we do with each bank carefully and give regular feedback on their performance. Typically, the better the relationship, and the quality of service we receive, the more ancillary business they can expect.

Majed Al Hameli, Etihad

We need to look at bank relationships both from a central perspective, i.e., our Abu Dhabi treasury, and that of our outstations outside of the country. In these cases, we don’t always have a choice, as there may only be one bank with the relevant proximity.

In Abu Dhabi, relationships are key, as Toby mentioned. It’s important for us to learn from the banks, understand best practices, and listen to their advice based on experience with other customers. We therefore particularly value banks that know our company and our industry well, and are therefore well-placed to cater for our requirements.[[[PAGE]]]

Murali Subramanian, ADCB

What role do you think local versus international banks play in the Middle East?

Sherie Morais, NBAD

There’s certainly room for everyone, but we should also appreciate that the corporates’ buying behaviour and selection criteria have changed. Pre- 2008, there was more of a trend amongst corporates towards global providers. However, since the financial crisis, the trend has been moving towards a more regional approach. So strategic partnerships based on each bank’s particular strengths are very important. Proximity to clients is key, whether you are a local or international bank, as is the ability to maintain a relationship during good times and not so good times. We’ve talked about price, but value is just as significant.

Bank appointments only become long-term relationships if corporates receive excellent service/ customer experience, not only in the delivery of automated processes, but also high quality strategic advice and professional day-to-day business support. This takes time and requires professional, experienced and skilled resources, and not all banks have the appetite to make this sort of investment.

Jags, Citi

This is an exciting time for banking in markets such as Asia, Middle East and Africa, as this is where growth is coming from. As banks, we follow our clients’ lead to support their international growth strategies. As they expand, our corporate clients tell us that they need one common platform, one common process and even one common relationship manager. As a bank that is already in 100 markets, we offer natural advantages to multinational clients, and it would be difficult for other banks to replicate this over the next five or ten years. Consequently, we anticipate closer partnerships between regional banks and international banks to provide the integrated coverage that clients need.

Murali Subramanian, ADCB

Looking specifically at UAE, would it come naturally for UAE-headquartered corporates, and foreign multinationals with a presence here, to use the country as a gateway to regions such as Africa?

Toby Shore, EGA

The airlines, Etihad and Emirates Airways, have done a tremendous job on putting the UAE on the map. You can travel almost anywhere from Abu Dhabi or Dubai, which has really helped the financial and wider business community, and makes UAE a logical gateway to Africa and other parts of the world. This is particularly the case for countries that are considered exotic and particularly challenging to manage from other regions, such as Syria, Lebanon, Jordan. When you’re in UAE, these are effectively home markets, so there is far more experience of how to do business there. In this context, there is a role for both domestic and international banks. Everyone has a speciality. Everyone is good at something, but no one is good at everything, so you need to find the right partners for your business.

Adam Boukadida, Etihad

In my opinion, UAE is probably the best place in the world to be right now. It’s an emerging market, but with high income levels and no taxes. It’s a desirable location to live or to visit, and as Toby mentioned, it’s a hub for the rest of the world. Global connections are also becoming easier: for example, automatic clearing arrangements with the US mean that there is no need for passport control. These are very attractive considerations when deciding where to locate regional centres, not only for the Middle East, but also Africa and Asia.

Samir Shah, Audi VW

We are present in the GCC and the Near East and have hopes of entering Iran. We don’t cover Africa as of now, but you never know in the future. I completely agree with the popular view that UAE is the place to be, and more specifically Dubai.

Murali Subramanian, ADCB

In addition, the range of working capital and risk management solutions available in UAE to support African operations significantly outweighs what is available in Africa. It is also a very trade-friendly location that is highly motivated to facilitate a great, modern Africa.

Peter Reynolds, Managing Director, EMEA, D+H

To what extent is corporate treasury becoming more strategic, as opposed to operational, in UAE?

Adam Boukadida, Etihad

This is a definite trend at Etihad. Although corporate treasury will always remain a cost centre, we are also risk managers across the whole enterprise. In addition, we offer value-added services that provide a cost benefit. For example, we recently set up a supply chain finance programme that offers financial benefits for us but also supports our local and international supply base. This is a concept that is still quite new in this part of the world.

Toby Shore, EGA

I would echo that. Treasury is not there to be a profit centre: although we shouldn’t be losing money, it’s not about making money either. What we are about is adding value and managing risk. Treasury globally has raised its profile, its range of responsibilities and established a more strategic focus, particularly since the global financial crisis, and in this respect, treasury in the UAE is no different.

Harish Pai, Senior Manager, Treasury Operations, TDIC

We see pros and cons of working with local banks rather than international banks. Local banks don’t always have the experience in global best practices, but they are easier to deal with, decisions are quicker as they are made locally, and they have the in-country solutions and expertise that the international banks lack. Our issue is that we need the benefits of both local and international banks.[[[PAGE]]]

Jags, Citi

You’re right, there are competing strengths and priorities. On the one hand, corporates are moving towards centralisation, standardisation, common processes and platforms. On the other hand, international banks that can support these requirements take longer to build up local expertise and solutions, and to customise their platforms to meet local needs. As a result, it is important that international banks recognise the level of investment that is required when entering a new market to overcome these challenges, which few banks are in a position to do, hence the ongoing value of local and regional banks.

Sherie Morais, NBAD

International banks have obviously had a head start in developing high quality platforms and service offerings, often across a wide footprint. But local banks are catching up. They are hiring people with the relevant experience, investing in modern technology without the same legacy considerations, and can offer local expertise. Partnerships of course have a role to play, although they bring their own set of challenges. Most clients prefer one point of contact to simplify engagement with their banking partners, so that it is clear where responsibility lies, and there is a consistent approach to relationship management, account management and customer services, service levels etc.

Diana Gregory, Business Development Consultant, Association of Corporate Treasurers, UK

With a young population across the Gulf and more widely across Africa, the next generation are ‘digital natives’ i.e., those that have grown up in a digital world, and they will likely have very different expectations of payment processes and doing business generally to ours. How does this impact on your strategies for how you deliver cash management services, for example?

With a young population across the Gulf and more widely across Africa, the next generation are ‘digital natives’ i.e., those that have grown up in a digital world, and they will likely have very different expectations of payment processes and doing business generally to ours. How does this impact on your strategies for how you deliver cash management services, for example?

Sherie Morais, NBAD

I think you’re right. Currently, however efficient or sophisticated a company’s use of technology, there is often still a piece of paper involved somewhere in their business model or the back-office functions that support it. Banks – and the companies themselves - need to be doing more to anticipate their customers’ and their employees’ expectations in the future, which is why we emphasise the importance of long-term partnerships.

Jags, Citi

The speed not only of innovation, but of bandwidth and capacity is incredible, which will result in new opportunities that are hard to envisage today. Mobile banking, use of tablets etc. is already ubiquitous, but many of the opportunities for new business models are still untapped.

Murali Subramanian, ADCB

One of the problems is that while computing power continues to enable faster processing of larger volumes, this is tempered by the need for governance. Large organisations have high levels of digital literacy, but the overheads to manage these processes with the necessary controls are immense.

We all have a great deal to digest and think about. Thank you to our panellists, the audience for their questions, and to D+H for sponsoring today’s event. We look forward to seeing how some of these trends develop at future roundtables.