- Sheetal Shah

- Director, Head of Large Corporate & Public Sector Sales and Global Solution Sales, Sub Saharan Africa, Treasury and Trade Service, Citi

- Steven Buonvino

- Large Corporate and Public Sector Sales, MEA & Healthcare, Consumer and Wellness Sector Head, UK, Europe, MEA, Citi

- Tom Alford

- Deputy Editor, Treasury Management International

Citi’s Long-term Influence on Trade Between the Middle East and Africa

Trade links between the Middle East and Africa are ancient yet still developing at pace as new lines of business open up in both directions. Committed banking support for corporate treasurers has proven to be a vital component of success, as Citi’s Sheetal Shah, Director, Head of Large Corporate & Public Sector Sales and Global Solution Sales, Sub Saharan Africa, Treasury and Trade Service, and Steven Buonvino, Large Corporate and Public Sector Sales, MEA & Healthcare, Consumer and Wellness Sector Head, UK, Europe, MEA explain.

Trade routes that have been open for millennia will naturally see the types of goods and the character of business change many times as the years go by. It’s still the natural order of commerce today, albeit with the pressure to change exerted by different forces.

A number of Middle East countries have been purposefully diversifying away from oil and, to an extent, gas, over the past decade. It’s clear that the world is moving on from fossil fuels and that resources are limited. The goal of the Gulf Cooperation Council (GCC) countries and Saudi Arabia, for example, is one of change, as even the oil majors edge towards new and more sustainable commercial objectives.

This has seen some of the largest investment vehicles in the region starting to target assets in suitable industry verticals in various global locations, including Africa. Indeed, according to the World Economic Forum, the last decade has seen GCC countries collectively invest over $100bn in Africa. Projects include mining and airport construction while the Economist suggests this might be part of broader trend of incoming investment from the Middle East.

As part of this move, the banking community has been called upon to connect the various parties and facilitate that trade. To help bridge sometimes contrasting commercial and cultural outlooks, Buonvino believes that Citi is well placed to assist such transactions “from conception to conclusion and long after”. It can do this, he adds, by leveraging not only its trade products and services but also its long-term on-the-ground presence, sector knowledge, and diverse client base across the Middle East and Africa.

Closer commercial ties between these two regions are very much in evidence, notes Shah. A prime example includes UAE’s recently unveiled $35bn investment in Egypt, which saw the acquisition of development rights on parts of the Mediterranean coast. The agreement presents Egypt with a solution to its FX deficit, and creates a massive boost to local infrastructure and its service sector, while giving investors access to portfolio diversification.

Citi has also worked with clients from outside of the region to boost trade flow efficiency within. In 2023, it announced a test with a shipping company and a canal authority which demonstrates how the programmable transfer of tokenised deposits, using smart contracts, could create instant payments for a shipping company’s canal transit fees. The process is expected to reduce transaction times from days to minutes (see below for more details).

Beyond Citi, Kenya signed deals with UAE’s Abu Dhabi National Oil Company (ADNOC) and Saudi Aramco for the supply of petroleum products with a longer payment period and payment in Kenyan Shillings. The aim of the governments-to-government trade programme says Shah, is to ease Kenya’s USD liquidity deficit and to manage the demand for dollars that had weakened the local currency.

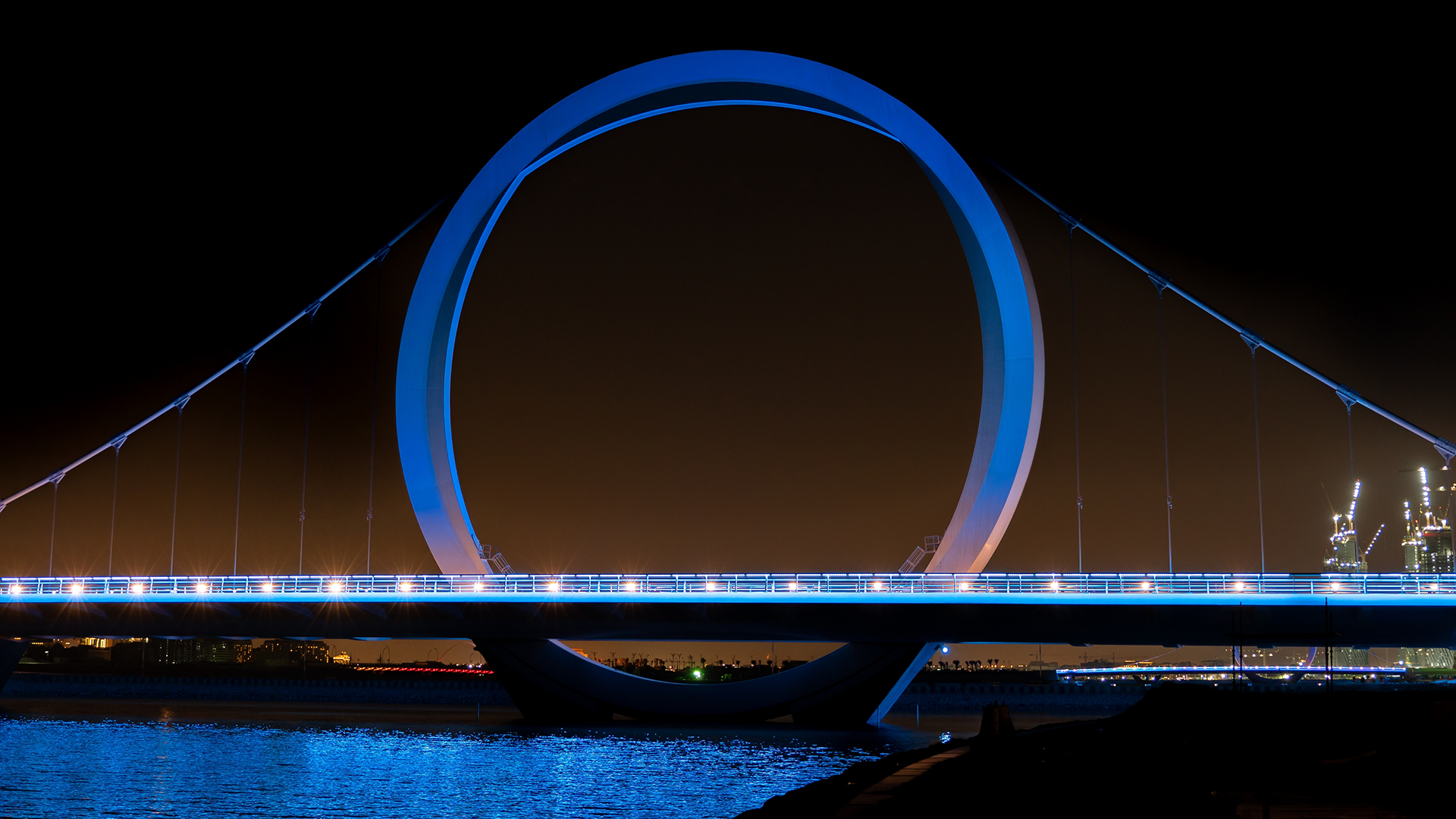

DP World, the Emirati multinational logistics company based in Dubai, announced in 2023 that it had signed a 30-year concession agreement with the Tanzanian government to operate the key port of Dar es Salaam, effectively connecting the regional rail system to the rest of the world.

Two-way flow

These events demonstrate that Middle Eastern companies are indeed making moves into multiple verticals in other regions as they shift away from their traditional sources of trade, and that banks such as Citi are enabling the flow of trade with a range of solutions.

It’s clear, too, that African businesses and countries are seeking new infrastructure solutions, especially in road, air, and sea transportation facilities. But flowing the other way, notes Shah, is a notable strength of supply in agribusiness, with the issue of food security ramping up for Middle Eastern countries.

There is also a huge export trade in natural resources coming out of Africa, notes Buonvino. This includes vital commodities such as lithium from the Democratic Republic of the Congo (DRC), Ethiopia, Ghana, Mali, Namibia, and Zimbabwe (which has Africa’s largest lithium reserves) as demand for electric vehicle battery production scales ever-upwards.

A less obvious ‘commodity’ from both Africa and the Middle East, and one that is not tied to traditional infrastructure development, says Shah, is renewable energy trade. A number of African and Middle Eastern businesses have achieved ‘net credit’ by leveraging local weather conditions and technology to lower their carbon footprints. Citi has been able to connect them with European companies that are seeking to net off their ‘net debit’ carbon credit status to meet their stated UN Sustainable Development Goal obligations.

Hub of activity

There is a genuine will from both regions to develop an equitable trade relationship, say Shah and Buonvino. “Dubai is typically used as a procurement hub for many African companies, especially those from Nigeria,” explains Shah. Seller companies from outside of the region often prefer LCs to be arranged through familiar banking partners, she explains. “Nigerian companies, for example, will therefore work with a bank such as Citi to establish their Dubai procurement hubs so that we, as a trusted and highly rated partner on both sides of the trade, issue trade documentation from this location.”

Nigerian companies are also setting up treasury centres in the Abu Dhabi Global Market (ADGM) international financial centre to leverage the favourable tax regime, continues Shah. Others may use Mauritius as their offshore financial hub, routing investments into Africa through the island to leverage trade agreements it has with various African countries. This can serve as a means of mitigating the risk of regulatory instability in some African countries.

However, a UAE hub has certain additional advantages for firms looking to leverage trade between Africa and the Middle East, says Buonvino. Dubai is a key location for many. In addition to certain tax efficiencies, it offers a bigger pool of experienced professionals, and has a well-established and efficient infrastructure both for operations and global travel.

With its procurement hub set up in Dubai, one of Africa’s largest mobile network operators is able to co-ordinate its operations across 19 markets in Africa and the Middle East, notes Shah. Similarly, a multinational food and drink processing conglomerate established a regional treasury centre in Dubai from which it manages its African and Middle Eastern operations.

Handling challenges

Treasurers can expect to face challenges wherever they operate, and top of mind for those in the Middle East and Africa will be trapped cash, regulation and access to liquidity, notes Buonvino. “Most companies that operate in these regions will either be foreign subsidiaries or home-grown,” he notes. “The home-grown firms will be able to navigate the landscape with relative ease. Those from outside will face additional trading challenges; no two jurisdictions are the same and that can be difficult to govern.”

It’s a candid observation, and one that needs to be acknowledged, because without the obvious homogeneity of a region such as the Eurozone to smooth the flow of business (and even here there are local quirks to address), he warns that operating in parts of Africa and the Middle East can trip up the unwary.

It’s why a global banking partner is sometimes essential. In Niger in West Central Africa, where political unrest and payments sanctions prevail, Shah recalls how a nonprofit organisation was experiencing difficulties in making local salary payments. “Through our connections, we are able to facilitate these payments to employees, keeping vital in-country humanitarian operations running.”

In the DRC, where the population faces a range of serious challenges on a daily basis, businesses are opting to use the services of Citi for upstream banking, even if local collections are handled by domestic providers. “Where financial regulations can literally change overnight, and accounts can be instantly frozen, the reliability of a top tier, global bank can provide some assurance,” says Shah.

“Regulation can indeed change quickly, almost overnight in some cases, as can the trade risk profile. Companies expecting certainty in their day-to-day business need a common denominator to mitigate some of that risk,” cautions Buonvino.

Obviously, Citi cannot remove sovereign risk. However, he says, it can provide a single platform for overall visibility and insight, even across other banks where Citi has local correspondent relationships. “Clients can feel comfortable using these domestic providers — to set up their LCs, for example — because we are in the chain.”

Perhaps of even greater value is the fact that Citi has feet on the ground in these regions. “We know the central banks and the regulators, so we can inform clients of any changes sooner rather than later, providing them with an appropriate course of action.”

Easing trade flows

Despite the challenges, there are many opportunities for businesses trading across the Middle East and Africa, not least, as Shah notes, because “margins in Africa tend to be much larger than in other regions”. It’s why growth in many verticals, especially in consumer goods, has appeal for many multinational companies. “The more they can mitigate the risks, the stronger their performance,” comments Buonvino. “This is where a global provider can add value across all elements of trade.”

Africa is home to one of the youngest demographics anywhere. High adoption rates of new mobile-based technologies naturally follow. This, suggests Buonvino, has enabled the region to leapfrog the legacy technology issues that can burden European and North American traders.

“The prevalence of instant payments across Africa and the Middle East outstrips any other region in the world,” he notes. “The world of instant payments is generally driven by consumer interactions — trade payments tend to function on standard terms — and the expectations of users is met when a single banking platform, such as Citi’s, is at the heart of that payment.”

Many instant payment services are mandated by government. With launches in countries such as Egypt, Jordan and Bahrain, storage and access to data on regular payments, by individuals and businesses, is enabling customers to set up multiple instructions on a single bank portal easily.

“The connection between consumer, supplier, and government has become highly digitised, with banks bringing all parties together,” declares Buonvino. “In part, digitisation is an effort to reduce the use of cash and make payments more visible and transparent in terms of trade flows. That insight is helping to even out the regulatory environment.”

Treasury goals

As in most treasury functions these days, working capital improvement is a focus throughout the Midde East and Africa. With higher interest rates in some African countries (Egypt 27.75% and Kenya 13%, for example), and even rates in UAE reaching an all-time high of 5.40% in July 2023, a significant accumulation of interest income is possible, says Buonvino, “but this also raises the risk of companies sitting on too much foreign currency”.

In response, Citi suggests trapped cash in certain countries could be used more aggressively. One approach is to use it for dynamic discounting in which the buyer’s own cash can be deployed via the Citi trade platform to generate lower-cost funding for its local suppliers. Doing so reduces the amount of local currency held, and earns a good yield while supporting the supplier base at a rate lower than they would ordinarily be paying for arranging their own finance.

However, where domestic or regional banks need to be used by clients operating in either region — perhaps because their main relationship bank is not present in a certain location — this can present visibility and control issues for companies, says Shah. A cross-regional view from the single Citi platform opens up access to accounts from all connected banks, with processing capabilities. This returns control to the central treasury centre which, as has been discussed, may be in Dubai.

Tokenising trade

One emerging concept that has the potential to benefit the fluidity of trade processes in these two regions is the tokenisation of payments. By combining tokenised deposits with secure smart contracts, you essentially create a new instrument type for conditional payments, digitise every component of the transaction and replace the risk and complexity of paper-based trade.

This creates other interesting possibilities, highlights Buonvino. In the canal ecosystem scenario referred to above, for example, Citi Token Services for Trade empowered a shipping company and canal authority to leverage smart contracts to execute and complete payments when predetermined criteria were met. In this instance, the transaction was for services rendered by the canal authority to the shipping agent, such as transit fees, reducing processing times from days to minutes, as well as being cost-efficient for the client.

“Given the extent of the use of trade instruments across the Middle East and Africa, smart contract-based processing could potentially be deployed in a wide range of trade scenarios.”

To relieve the uneasiness some clients may have with the idea of digital money, he adds that although the solution is backed by tokens, clients don’t need to interact with them. From their perspective, funds are paid and received directly from their bank account with Citi and using fiat money only.

While Citi Token Services for Trade has been initially piloted in the US and Citi Token Services for Cash is live between New York and Singapore, the aim, says Buonvino, is to expand the branch network to connect many more locations, “The appetite is definitely increasing.”

Beyond the digital, a footprint across these two regions is clearly a vital component of successful trade services. But Buonvino suggests Citi is in line to deliver both advanced digital and more traditional services. “If you know the market, you’re connected to it, and understand it, you can pass all that on to your clients. Couple that with the right technology and good people, and it makes Citi a provider of choice.”

With a number of global banks over the past few years having retrenched from their African and Middle Eastern operations, Shah concurs, declaring that Citi’s commitment is steadfast. “We’ve been here for many years, and we remain committed to helping clients in their trade journeys across Africa and the Middle East.”