- Mikael Kepp

- Chief Expert, CM partner bank and Vendor management relationship, Nordea

by Mikael Kepp, Chief Expert, CM partner bank and Vendor management relationship, Nordea

Digital business

The adoption of financial technology and faster, more agile e-systems in banking has had profound implications in corporate finance. It is becoming increasingly rare to find a corporate financial process that has not been digitised.

At Nordea, we are committed to offering digital banking solutions that make life easier for our customers, whether that is an e-banking platform or cash-forecasting tools. We know that the quality of our online and integrated host-to-host (H2H) solutions is important — after all, 86% of finance professionals say the capabilities of a bank’s technology platform is an important factor when choosing a banking partner[1] — but we know that this alone is not enough.

End-to-end automation is the goal

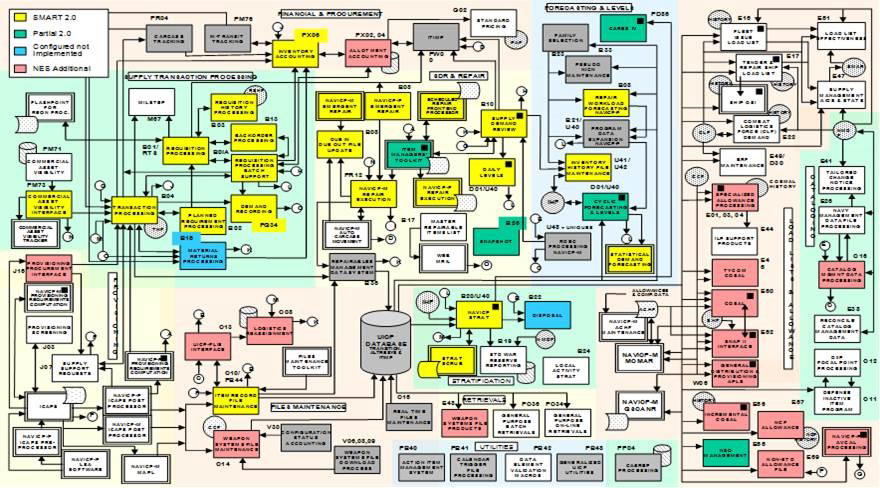

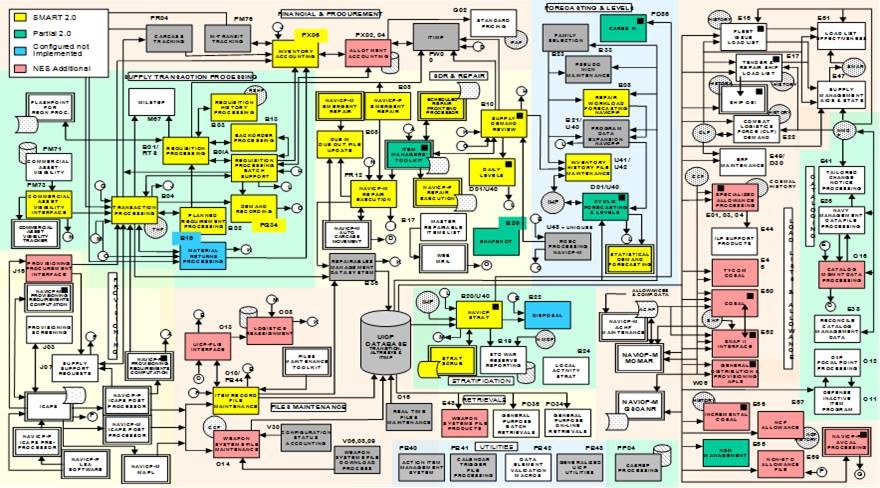

No business has just one system, and business processes often succeed or fail depending on how well multiple systems are integrated. You expect your transactions and file transfers to be processed seamlessly, in real time and without error, from your treasury management system (TMS) or enterprise resource planning (ERP) system to your banking partners, customers and suppliers, via messaging standards. Below, you will find an example of an IT-system portfolio and how a long range of systems and processes are integrated and interlinked.

Click image to enlarge (opens in new window)

Integration is needed for a range of processes including account payables and account receivables, payroll, invoicing, expense management and payment reconciliation, so staff can use their regular systems to execute tasks. Your staff want to be able to do this without having to visit your bank’s online portal or using a dedicated bank-supplied app. When your systems are fully integrated, you save time, save money, avoid errors, and can focus staff on optimising other processes.

Your bank needs to be prepared for the future

Given that integration is so important to the smooth functioning of so many financial processes, it is vital that your bank is up to speed with the latest regulations and standards for data formats and messaging. These include ISO20022XML, SWIFT, and SEPA — all of which aim to make it easier to exchange financial data without manual intervention.

To ensure smooth integration of systems and to give you the choice of best-suited communication formats, your bank should be working closely with both global and domestic software-vendors of ERP, TMS and other services. Banks should also collaborate with other types of vendors within system-implementation, bank-communication and file-conversion services - so that your specific needs and requirements can be best met.

But even if you, your bank and your vendors have a close working relationship, you should not underestimate the work involved.

One size does not fit all

Every ERP implementation and every corporate financial process has its own quirks and idiosyncrasies. As a result, you will know that the introduction of new, state-of-the-art systems can be a significant undertaking.

Integration can become problematic if your partners promise unrealistic timescales — especially as missed deadlines typically result in project cost overruns. At Nordea, we take the commitments we make to customers very seriously.

Medical device manufacturer GN ReSound is a good example. At its German business unit, the introduction of SEPA meant it needed to reengineer its ERP systems and financial processes. GN ReSound Germany is a big user of direct debit, which allows it to reliably collect small payments from thousands of individual stores across the country.[[[PAGE]]]

“Everyone needs to understand local payment formats and the information they contain — the devil is in the detail, and every data field and file format we created had to be checked, locally, for compatibility with our ERP systems, and by the bank,” says Alexander Wulf, Finance Director for GN ReSound Germany.

Nordea met with the team in Germany to outline the challenges they might encounter and give specific advice about how SEPA would affect GN ReSound’s documentary requirements and cash pool structure.

Delivering on promises

As GN ReSound’s experience shows, it is not enough for banking systems to have the features on paper: you need your bank to be responsive at every stage of the implementation and integration process, and have people on the ground that can give you advice and offer creative solutions to thorny problems.

At Nordea, we are proud of the way our people help customers integrate and implement the best solutions for their needs, day in, day out. We rigorously measure their performance and accept nothing less than the highest ratings for customer satisfaction with our implementation process.

We achieve this because we know it is not enough to work with teams in each country to stay abreast of vendor technology developments, or to build close working relationships with the vendors. We know that we have to understand how organisations like yours are using ERP and TMS in the real world.

Of course, our close working relationships with vendors gives us great insight into their roadmaps and enables us to act as a voice for customers like you. But we can only truly represent our customers’ needs once we have developed strong relationship with them first.

Looking ahead

We are also focusing on the future, and what organisations will most likely need from their IT systems in the years ahead. For instance, as treasury centralisation progresses, you may be merging, migrating or updating many ERP and TMS, which may require complex integration with bank systems. Many companies are also looking at moving to cloud-based systems, as a kind of outsourcing initiative to simplify the task of systems integration. Whatever the strategy, integration is rarely a one-off project — it needs constant attention.

Implementation projects is not going away, but we are doing what we can to make it easier. We are hopeful that it will become less onerous in the future, largely driven by the use of data exchange standards. We play an active role in standards bodies and working groups such as ISO 20022, SWIFT and National Bankers associations — helping ensure final standards reflect our customers’ requirements.

Next steps

Your banking partner or software supplier can only do so much to simplify systems integration and implementation — your role is pivotal. So what steps can you take to minimise the chances of your integration programme being delayed? From our experience working with dozens of companies of all sizes, we believe you can increase the chances of success by:

- Establishing a project team that has full commitment from all C-level stakeholders, to ensure the project is adequately resourced

- Scoping out your current state, and building a schedule that allows you to reach your goal

- Defining clear project objectives and milestones at the start

- Agreeing the project scope and common process and tools

- Challenging your bank about their experience of working with your software suppliers and on similar projects

Relationship is everything

It is a time of great change and we know integration is only going to become more important to how effectively your treasury runs. That is why we are so committed to developing our integration services and to giving you the advice and support you need at every stage.

1http://gtnews.afponline.org/Research/PDF/2014_gtnews_Transaction_Banking...