- Annick de Groof

- Consultant, Zanders

- Diana Diaz Curiel

- Senior Consultant, Zanders

Robotic process automation (RPA) offers businesses the opportunity to “harness the power of a digital workforce”. Here, Diana Diaz Curiel, Senior Consultant at Zanders, and Annick de Groof, Consultant at Zanders explain how treasurers can best fit RPA into the wider digital transformation journey, and why it is a tool that will redefine and elevate corporate treasury.

The treasury environment is increasingly complex, with new business models, changing regulations, growing competition, and an increasing focus on real-time information. Change and uncertainty have become the new normal. The pandemic has accelerated the momentum towards digital-first strategies as companies aim to stay competitive and relevant. While in many finance functions robotic process automation (RPA) technology is moving towards its adoption phase, treasury seems to be lagging. What are the causes behind this ‘drag’ in RPA adoption? Why is the deployment of RPA in treasury departments strategically relevant?

According to the latest forecast from Gartner, Inc1, global RPA software revenue is predicted to reach nearly USD$2bn in 2021. Grand View Research2 has indicated RPA revenue could reach USD$13.74bn in 2028. The latest Deloitte SSC and Outsourcing survey3 also highlighted that 72% of high-performing global organisations with a digital strategy have already successfully implemented RPA. Finally, IDC4 recently predicted that by 2022, 45% of repetitive tasks will be automated and/or augmented by using “digital co-workers”, powered by artificial intelligence (AI), robotics, and RPA.

These statistics show that the adoption of RPA is becoming mainstream across industries with the potential of becoming part of almost every organisation within the next five to 10 years. However, with the digital workforce becoming a reality, where is corporate treasury in the adoption curve? The 2020-2021 Journeys to Treasury report – compiled through a collaboration between BNP Paribas, the European Association of Corporate Treasurers (EACT), PwC and SAP5 – identified that 46% of treasurers use or plan to start using RPA in the next 12 months.

When compared with the broader enterprise-level adoption rates, an overall lack of clarity and understanding of RPA technology and its relevance to the treasury function is one of the primary factors behind the current adoption lag. An explanation would be that treasury has many different processes with only a limited number of users executing them . Considering this, the benefit for treasury would therefore more likely be in recognising RPA potential for high-volume manual input, and enriching data analytics performance, not necessarily by decreasing the number of users, as is often the case with accounts payables and receivables processes.

RPA Use Cases for Treasury

When we consider the digital transformation journey for treasury, it is important to understand the relevance of the plethora of new and emerging technologies. While the more advanced cognitive technologies will enable the greatest benefits to treasury through a combination of predictive and prescriptive analytics, there is still a place for RPA within the overall technology ecosystem. RPA provides the opportunity to harness the power of a digital workforce and is ideally suited to supporting manually intensive, time-consuming and repetitive tasks. RPA technology enables employees to focus on higher-priority and greater-skilled tasks.

As in many other areas, treasury can also take the lead as RPA thrives in the process-driven environment. For that reason, we want to focus on some specific use cases that will ultimately illustrate some of the benefits that can be achieved through RPA adoption, such as the reduction of errors and processing times and the increase in productivity.

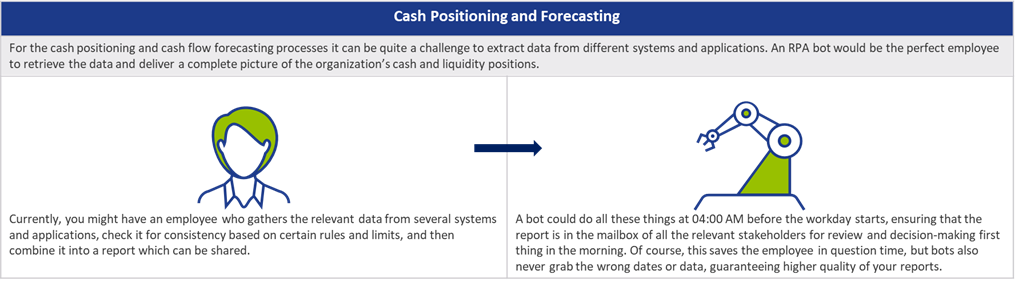

Improve Accuracy of Cash Positioning and Forecasting

Accurate cash positioning and cash flow forecasting is critical for corporations to ensure optimal management of their cash and liquidity while limiting their financial risk. The importance of real-time cash positioning and cash flow forecasting has increased exponentially during the pandemic. However, it is noticed that many treasuries struggle with the manual and time-consuming tasks around retrieving, compiling, and formatting the information from the different sources. This leaves little to no time for in-depth analysis. RPA could support treasury with extracting and compiling information from the different sources so it can be further analysed by the team.

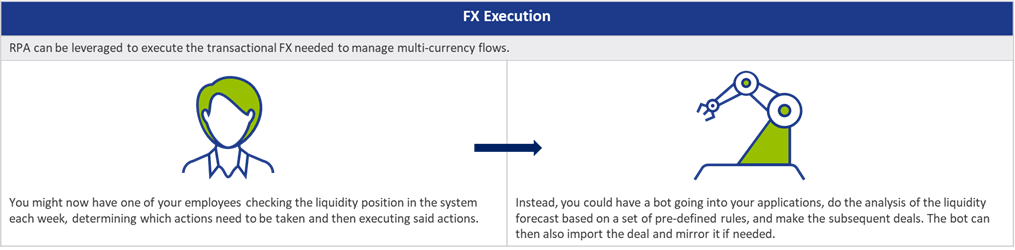

Straight-through Execution of FX Deals

Many corporate treasurers are facing great pressure to identify all foreign exchange (FX) exposures in real time. Treasury seems to be somewhat reactive instead of proactive when it comes to managing this risk. Exposures are often still identified and managed manually, which leads to errors and can also become quite costly. RPA can be leveraged to deal with the transactional FX needed to manage multi-currency flows. For short-term FX exposure forecasting, RPA can be less costly and more flexible than building interfaces. Furthermore, it can be used for other required activities in the FX exposure management process such as validation of thresholds and variance controls, consolidating different data or retrieving market data such as FX rates or forward points.

Speed up your TMS Implementation

RPA can also serve as a quick and efficient tool to use while implementing a new software application such as a treasury management system (TMS). Some implementation tasks can become quite tedious for humans to perform. Instead of manually inputting master data, data transfer activities or set up reports, a bot can take over these manual tasks, saving days (or in some cases even weeks) of implementation time, while also reducing errors.

Despite the attention RPA is attracting at an enterprise level, the treasury view seems to be that it mainly facilitates automation rather than data analysis, which is where the major benefit is for treasury. However, RPA is becoming mainstream, and its value proposition is the automation of repetitive, manually intensive tasks, such as manual cash pooling, financial closings, and data consolidation. While some of the current inertia might simply be down to relative priorities, it is a foundational technology that will be an essential part of the digital-first ecosystem.

As the journey towards becoming a digital treasury gains momentum, we will see a redefinition of the partnership between humans and machines. The adoption of RPA within treasury departments will increase as it enables greater automation, removes friction, and accelerates processes. The question is not if, but when treasury adopts RPA.

Sources