by Danne Buchanan, Executive Vice President, Head of North America Operations, D+H

For multinational corporations selling in multiple currencies, the recent strengthening of the US dollar has turned embedded derivatives from a minor consideration into a material issue. To account for and report on embedded derivatives, most corporations have to date applied a ‘rear view’ perspective, identifying and classifying them at the back end of the receivables process rather than up-front. But by automating receivables and capturing them in a centralised hub, organisations can gain 100% real-time visibility into embedded derivatives – thus dramatically reducing the associated risks, while simultaneously realising wider benefits ranging from a higher rate of straight-through processing (STP) to improved working capital.

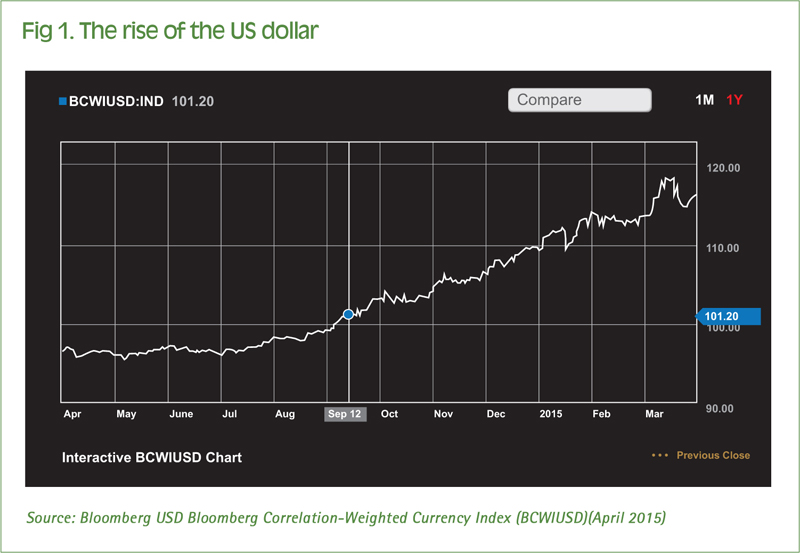

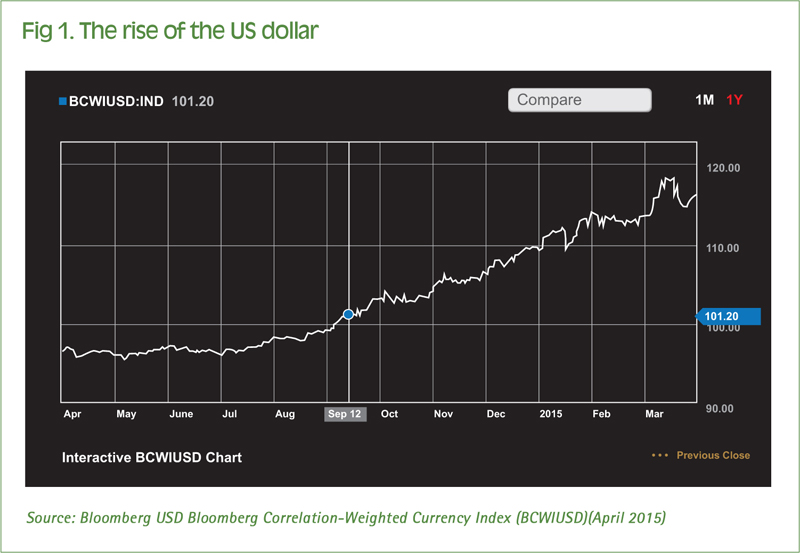

Surge in US dollar value

In March 2015, it was reported that the US dollar was undergoing its “fastest rise in four decades” [1] – a climb accelerated by the US economy’s increasingly robust recovery and a weakening of the euro. For multinational corporations conducting transactions across different currency zones, the strengthening of the dollar’s international value – as illustrated in Figure 1 – represents a significant shift in the business environment.

Click image to enlarge

As a result, many corporations have taken swift action in response. Their moves include convening boards and senior executive teams to review their pricing in overseas markets, as well as broadly re-examining their foreign currency and commodity hedging strategies – particularly in cases where the US dollar is involved.

Accounting for embedded derivatives

The stronger dollar has also led many companies and audit firms to renew their focus on a topic that had slipped down the corporate agenda in recent years: the accounting standards that apply to embedded derivatives – namely ASC 815 in the US, and IAS 39 in Europe and other territories.

To explain why embedded derivatives are once again on the radar, here’s a brief primer on why and how they arise. Imagine a scenario in which Company ABC, whose base accounting currency is UK sterling (making it ‘GBP functional’), is selling goods or services to Company DEF, which accounts in euros (‘EUR functional’), and the denomination currency of the transaction is US dollars (USD). Since the denomination currency is not the functional currency of either party to the transaction, the sale creates embedded derivative GBP-USD on Company ABC’s books and EUR-USD on Company DEF’s books. For the purposes of this example, we’ll look at the derivative only from the perspective of Company ABC.[[[PAGE]]]

Clearly, embedded derivatives are not new – and neither is the need to account for them. But until recently, the relative weakness of the US dollar and broad stability of most major currencies meant that the impact of embedded derivatives on companies’ bottom line was not material. This is why corporations have been fairly relaxed about embedded derivatives for the past few years.

The dollar’s rise has changed this situation dramatically. The ASC 815 and IAS 39 rules require embedded derivatives to be identified and accounted for separately from the host (sales) contracts. And as well as needing to report the embedded derivatives they identify, companies must also mark them to market. With the recent volatility in exchange rates, particularly for the US dollar, the increased value of the embedded derivatives from multi-currency transactions is feeding through to fluctuations in earnings and then hitting the profit & loss (P&L) account.

This problem is exacerbated by the way most corporations currently approach the task of identifying embedded derivatives – which is to handle it at the tail end of invoicing through to collection of payment process (commonly known as ‘order-to-cash’) and usually as a standalone exercise. The use of multiple accounting platforms and invoicing methodologies makes it very challenging for organisations to get a clear and complete view of embedded derivatives if their identification is approached in this way. In contrast, by automating receivables and capturing them in a centralised hub, corporations can gain 100% real-time visibility into embedded derivatives at the beginning of the order-to-cash process – resulting in comprehensive and accurate ASC 815 reporting as well as real-time reporting on all accounts receivables.

The need for automated, real-time receivables processing

This opportunity has led many multinationals to examine how they can improve and accelerate their identification and marking-to-market of embedded derivative contracts. Currently, most companies follow a decision process of the type shown in Figure 2 for determining and accounting for their embedded derivatives.

Click image to enlarge

Many US companies have struggled with this process, for a surprisingly simple reason. According to a Billentis report published in July 2014 [2], fewer than 30% of US organisations have real-time visibility into their receivables processing, because the majority have not yet digitised and automated this process. Crucially, this should be the same process through which embedded derivatives are identified.

For most organisations, gaining real-time insight into receivables is made even more challenging by the fact that they are still utilising multiple internal platforms – enterprise resource planning (ERP), manual, local custom-built – with multiple billing mechanisms, and accepting multiple forms of payments. The resulting tangled web of activities in a typical corporate receivables framework, as illustrated in Figure 3, not only creates a very cumbersome order-to-cash process, but also makes it almost impossible to determine a single area where embedded derivatives should be clearly seen and identified.

Click image to enlarge

Identification of embedded derivatives

The framework presented in Figure 3 is actually highly simplified compared to those operating in many real-world corporations, but it does clearly illustrate the complexities involved in the process of invoicing through to collection of payment. Given the combination of numerous source systems, invoicing methodologies and customer types, it’s hardly surprising that companies find it difficult to get complete visibility into their embedded derivatives portfolio.[[[PAGE]]]

The underlying reason why most organisations are struggling with this issue is that they are trying to identify the embedded derivatives at the back end of the process, rather than collecting them systematically at the front end. This leads to a game of finding multiple needles in a very large haystack. And even when this game ends, organisations are often unsure whether they have actually found and accounted for all of the needles.

Click image to enlarge

In contrast to the scenario just described, consider the one illustrated in Figure 4. As it shows, Company ABC has streamlined the aggregation and administration of all of its receivables through consolidation in a hub. As a result, regardless of the format, workflow, delivery, or payment mechanism, the process is able to provide real-time visibility and administer the entire workflow chain of receivables.

This enables Company ABC to not only realise major efficiencies in the processing and collection of the receivables – a substantial benefit in its own right – but also to centralise the process of capturing embedded derivatives. So one of the major advantages from centralising and digitising the receivables capture process as a whole is the ability to identify and report accurately on all embedded derivatives.

This scenario is in stark contrast to the one we described earlier, where the process of embedded derivative reporting needed to be carried out primarily at the back end of the process, usually via collation of data from multiple systems, platforms, and invoice types. By digitising and centralising the capture of receivables in a systematic manner, organisations can move embedded derivative reporting to the front end of the process, and ensure a much higher STP rate for all of their embedded derivatives.

As well as bringing reduced audit scrutiny and higher peace of mind for chief accounting officers and treasurers, transforming receivables processing by moving to an automated hub-based framework brings other added benefits. These include improved working capital metrics such as days sales outstanding (DSO), potentially lower customer service costs due to customers being able to raise and initiate disputes on invoices more readily, and a reduction in the costs of sending, receiving and processing paper-based invoices.

A wake-up call

The message is clear. The recent strengthening of the dollar has thrown the spotlight onto the issue of embedded derivatives, which most companies have by and large ignored for the past few years. With the value of the dollar looking unlikely to fall back any time soon, the impact of embedded derivatives increasingly apparent on earnings and P&L, and auditors applying more stringent scrutiny to the completeness of reporting on embedded derivatives, multinational corporates need to take action in response.

In D+H's view, the most effective and logical solution to this issue is to automate receivables processing. This will not only ensure certainty over the identification and reporting of an organisation’s embedded derivatives portfolio, but will also deliver several wider benefits at the same time. As a result, it’s an investment that will pay for itself many times over. Isn’t it time you made it?

To download a white paper on embedded derivatives, please click here.

Notes

[1] Source: http://money.cnn.com/2015/03/16/investing/us-dollar-fastest-rise-40-years/

[2] Source: http://billentis.com/e-invoicing_ebilling_market_report_EN.htm