Bank of America Merrill Lynch and SunGard Asia Pacific Treasury Management Barometer 2015

Trade, long established as the one of the most influential contributors for the collective economies of Asia Pacific, is experiencing a generational transition. The change can be seen regionally through the growth of intra-regional trade and broadening of manufacturing bases and locations. It is being felt globally via diversification of the supply chain and increasingly, the shift is being observed at the corporate level, whereby working capital strategies have been forced to adapt accordingly.

"Shifts in demographics and trade patterns have extended the collective trade focus beyond Greater China, with India and ASEAN now progressing from developing to established trade zones in this region. As China gradually shifts from an export to consumer-based economy, India and ASEAN will likely find themselves as more influential participants in global trade and supply chain."

- Kuresh Sarjan, Head of Global Trade & Supply Chain Finance, Asia Pacific, Bank of America Merrill Lynch

Click image to enlarge (opens in new window)

The drivers behind Asia Pacific’s shifting trade dynamics are as broad and diversified as the region itself. For example, with each year, new trade corridors are developing, the supply chain broadens to welcome new members from emerging trade economies and the working capital landscape expands to include alternative sources of financing, processing and technological innovation. Viewed through the lens of regional macroeconomic and global demand dynamics, the reach and importance of Asia Pacific trade is clearly broadening. Furthermore, it will be characterised by its ability to evolve with the times for the foreseeable future.

Respondents to the Asia Pacific Treasury Management Barometer illustrate that an evolution is clearly under way. Participating corporations have already established an extensive presence across Asia Pacific, and remain steadfast in expanding their trade objectives and further diversifying their supply chains within the region.[[[PAGE]]]

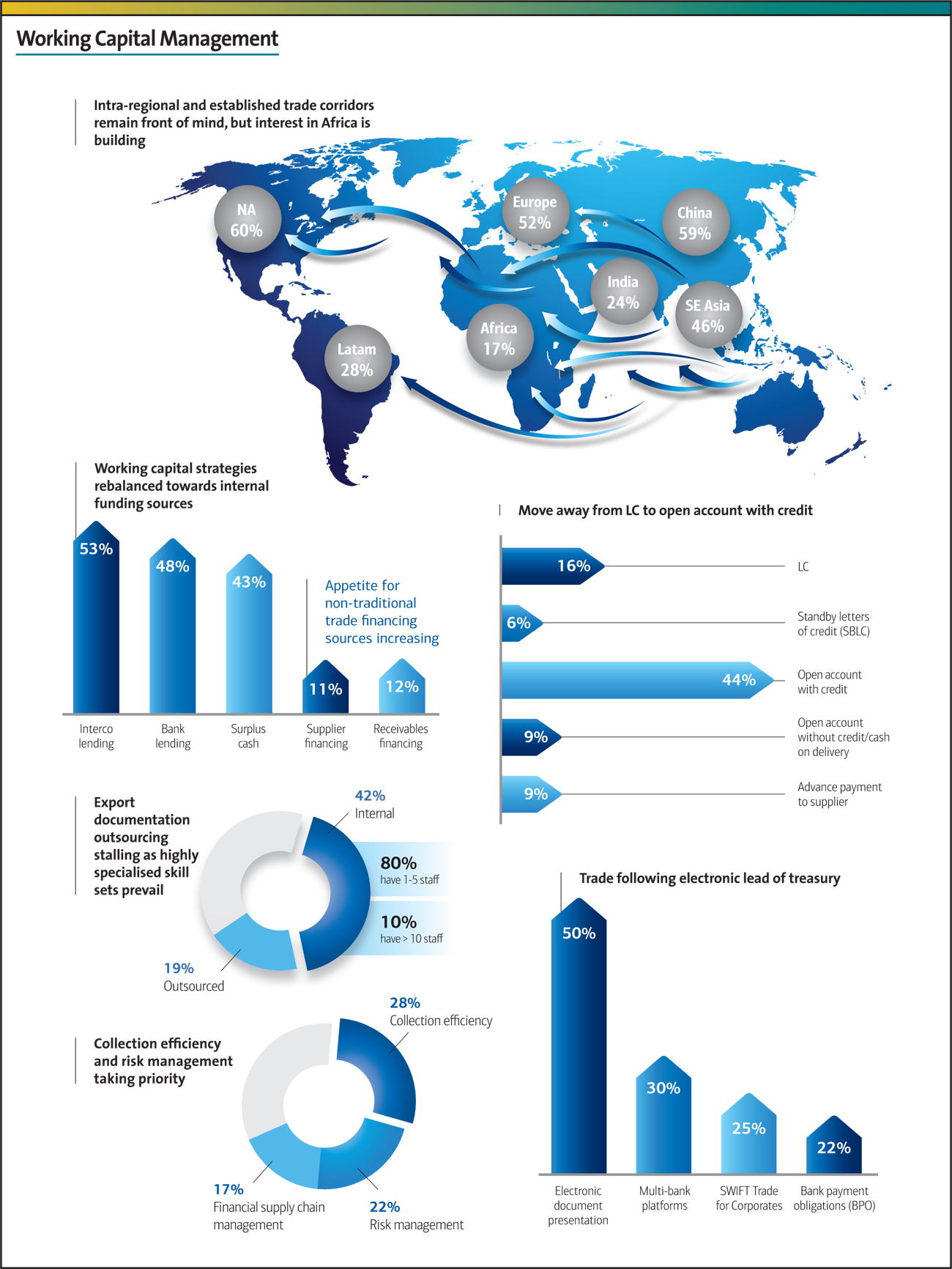

At face value, geographical shifts have been one of the most conspicuous characteristics to emerge in the Asia Pacific trade space in the past two years. Respondents reinforce this fact. For example, Greater China (China, Hong Kong and Taiwan) exemplifies this theme in 2015 whereby growth rates have slowed. This is particularly the case in China, as the country shifts from an investment and infrastructure-based economy towards a consumer-based economy. While corporations remain committed to opportunities, pinpointing Greater China as the largest market for anticipated growth (59%) in the region (Figure 1), the attractiveness gap between this economic bloc and other Asia Pacific regions is clearly narrowing.

Corporations now consistently emphasise that the focus of the trade activities is not exclusively on Greater China. South East Asia (46%) and the Indian sub-continent (24%) are cited as vital growth regions by respondents. This collective opinion is significant. Not only are corporations clearly more willing to expand trade activities beyond Greater China, but they now appear to be more prepared to confront operational issues including currency and regulatory considerations, taxation issues and cultural idiosyncrasies when conducting local and international business.

Furthermore, exporters are not restricting their strategic vision to Asia Pacific markets as engines for potential growth. As Figure 2 illustrates, both traditional and non-traditional global markets play an equal role in companies’ growth strategies. North America, for example, is as an important trade player as China, noted by 60% of respondents. Despite the headwinds of economic volatility and demand stagnation, Europe (52%) was also cited as a strategic zone by respondents, emphasising the importance of trade corridors between these regions and Asia Pacific, such as for manufacturing and energy. Unsurprisingly, international policy is supporting these sentiments. Over the past 24 months, a growing number of bilateral trade agreements between United States and Canada and Asia Pacific countries have been forged and will likely facilitate more opportunities to expand multi-lateral trade.

Although less of a focus compared with other regions, 17% of respondents noted that Africa would become a more important export market for their business. While the trade corridors between Africa and Asia Pacific are less well-trodden than more established trade routes, increasing investment on the continent by both western and Asian corporations is spurring activity. Foremost, China which has for the past decade facilitated the uptick in Asia Pacific and Africa trade, underscores the growing importance of this continent.

Financing growth: the importance of working capital

Given that trade and financing are intimately linked, it is unsurprising that the application of non- traditional and innovative working capital strategies continue to gain traction in Asia Pacific. Since the global financial crisis, it has become increasingly difficult for many corporations to access the equity and bond markets, and pricing of external financing has become less attractive in many cases. Consequently, alternatives to bank facilities for financing working capital are becoming an integral part of contemporary corporate culture.

Click image to enlarge (opens in new window)

Click image to enlarge (opens in new window)

Increasingly, particularly amongst smaller or lower-rated companies, this change in financing culture has become more of a necessity than an alternative. For example, even amongst corporations that face no challenges in obtaining financing, many treasurers are seeking to reduce their dependence on banks for working capital, and are leveraging bank facilities instead to invest in growth rather than daily liquidity. As the Asia Pacific Treasury Management Barometer results illustrate (Figure 3) while bank lending remains important for working capital financing (48%), intercompany lending is the preferred financing method (53%).[[[PAGE]]]

With many companies building up large cash balances prior to and during the crisis years, surpluses are now being applied to fund working capital rather than seeking outside financing (43%) vehicles. In other words, corporations are in a better position to mobilise cash surpluses in some parts of the business to finance deficits in others.

Increasingly, companies are recognising the potential to monetise their business flows. For example, supply chain finance and receivables financing (12%), and supplier financing (11%) are becoming more visible components of an optimised working capital strategy. Both external and intercompany flows can be used as collateral for financing. This is most evident where intercompany flows reflect genuine underlying transactions especially in areas such as commodities financing. As banks are required to comply with the requirements of Basel III over the coming 12-24 months, and in some cases, become more selective about the organisations to whom they lend their balance sheets, alternative forms of financing are likely to grow in importance for working capital purposes.

These financing solutions, such as receivables financing and supplier financing, are typically closely tailored to the specific needs of each organisation and will likely gain further traction in the coming years.

Use of trade finance instruments for imports

Click image to enlarge (opens new window)

There is no other region globally where paper and electronic trade instruments coexist more frequently than in Asia Pacific. Although the use of letters of credit (LCs) has generally declined in favour of open account transactions, LCs still play a central role in facilitating international trade in this region. Participants noted that their choice of instrument is equally determined by liquidity and risk considerations (both at 36%) with balance sheet management also a significant priority. When dealing with suppliers for import of goods and services (16%) use LCs reflecting the shift towards open account (53%).

Although paper-based instruments remain prevalent in Asia Pacific, a notable shift towards electronic financing is taking place. Open account transactions with credit terms are now preferred by many corporations (44%) with considerable growth in the use of credit insurance. Nine per cent of corporations polled use open account without credit, or cash on delivery, although less commonly for more complex or higher risk transactions. An equal number pay suppliers in advance (9%).

Stand-by letters of credit (SBLC) and payment guarantees are less popular, with only 6% of corporations using these instruments to finance imports, with similar use of other documentary collections such as documents against acceptance and document against payment (D/P).[[[PAGE]]]

Use of trade finance instruments for exports

Click image to enlarge (opens in new window)

As would be expected, there are considerable similarities on the export side, as reflected in Figure 5. There is more of a trend towards open account transactions with credit terms (41%) and open account without credit, or cash and delivery (10%). Similarly, the proportion of corporations using advance payment (10%) is consistent with our own interactions with clients looking to fulfil certain liquidity and risk management objectives.

Export document preparation

Export documentation is another area where Asia Pacific trade continues to evolve rapidly. Typically, export documentation is prepared by a commercial function, rather than treasury. Given its sensitivity, it is understandable that many companies prefer to maintain this activity in-house (42%) as opposed to outsourcing to a third party. Progress in this area remains a measured process, however, as corporations expand their geographic footprint and the focus on shareholder value increases, there is often a greater appetite for outsourcing export documentation.

It is clear that outsourcing offers considerable appeal given the internal resourcing that is required, as shown in Figure 7, with 10% of companies dedicating more than 10 full time employees to this specialist activity. While outsourcing to a bank or logistics company may be difficult culturally for some organisations, outsourcing providers have the specialist skills in-house and can potentially accelerate the order-to-cash process for exporters as they are already part of the supply chain.[[[PAGE]]]

Focus on best practices

Click image to enlarge (opens new window)

Click image to enlarge (opens new window)

Corporations of all sizes and headquartered in all regions are motivated to identify and implement best practices to enhance efficiency and control across their business activities. Respondents ranked the elements of their trade and supply chain activities that required the most improvement, as shown in Figure 8. Collection efficiency (28%) and risk management (22%) were identified as obvious starting points for an optimal approach to working capital optimisation and supply chain efficiency.

While best practices remain a priority, corporations unsurprisingly remain cognisant of challenges such as balancing growth ambitions with the need to manage risk and manage commercial counterparty relationships. Treasury departments have an important role to play in this respect by structuring trade finance solutions that meet both cash flow and risk objectives. For example, financial supply chain management was noted as an area of potential improvement by 17% of participants.

Unsurprisingly, supply chain financing is not as prevalent in Asia Pacific as in European and North American markets. But rapid growth is expected. Consequently, with fewer programmes and less supplier awareness, corporations have more limited opportunities to flex working capital dynamics, such as extending supplier payment terms. This will inevitably change as corporations headquartered in Asia Pacific align their treasury and financial supply chain management activities more closely with their foreign peers, and foreign multinationals leverage financial supply chain solutions that they have used successfully in other regions.

Trade finance technology

Click image to enlarge (opens new window)

Click image to enlarge (opens new window)

Finally, new technologies, partnerships and alliances continue to emerge and influence trade strategy. While the immediate impact on trade may not be radical, new platforms and relationships will have a profound impact on the dynamics of trade going forward. One such example within Asia is the Pan Asia eCommerce Alliance (PAA) – an alliance that works towards uninterrupted cross- border trading with ready acceptance of cross-border approvals and certification policy. Global banks, including Bank of America Merrill Lynch, closely monitor such developments and continue to embrace innovation and partnerships that add value to customers. As well as offering proprietary technology solutions, adopting “technology-agnostic” platforms and actively partnering with various providers ensures quick adoption and commercialisation of new technology and processes in trade finance to ensure corporations have access to the best in the market. This trend will only evolve.

In addition to technology and new processes, banks will not only help clients access new markets in a seamless and increasingly efficient manner but also better mitigate risk. As the dynamics of Asia Pacific trade diversify geographically, they are facilitated by different financing routes and rely on best practices and heightened innovation. It is incumbent on global banks to partner with clients and facilitate grown aspirations by offering customised and integrated solutions which are delivered to exceptional standards across the globe. This will be become the new normal in the rapidly evolving Asia Pacific trade space.