Carbonomics 101: using science-based targets to reduce emissions – where to start?

Published: October 18, 2022

In the seventh article in this series we take a closer look at how a company’s carbon footprint is defined, how it can be reduced in line with climate science, and how the reduction of emissions can be integrated into sustainability-linked financing instruments.

If the world is to avert the worst of climate change, greenhouse gas (GHG) emissions must halve by 2030 and drop to net zero by 2050 at the latest [. With limited time for action, reducing GHG emissions is an imperative for all companies and organisations. At the same time, capital providers increasingly expect companies to adopt science-based targets when incorporating climate objectives into treasury activities. So, where to start?

Key takeaways

- GHG emissions reporting is categorised into three Scopes by the most widely used international accounting tool, the GHG Protocol.

- The Science-Based Targets initiative (SBTi) helps companies validate their emissions targets with the latest climate science.

- Once a company has emissions reduction targets in place, these can be integrated into the corporate treasury strategy using sustainability-linked financing instruments, such as loans or bonds, with SBTi-verified targets viewed as best practice.

- Investors are increasingly viewing the adoption of SBTi targets as one of the key focus areas when engaging with corporates, alongside the integration of wider ESG data within their investment analysis.

Building on previous Carbonomics articles, we outline how a company’s carbon footprint is defined, how it can be reduced in line with climate science, and how the reduction of emissions can be integrated into sustainability-linked financing instruments.

Scope 1, 2 and 3 emissions explained

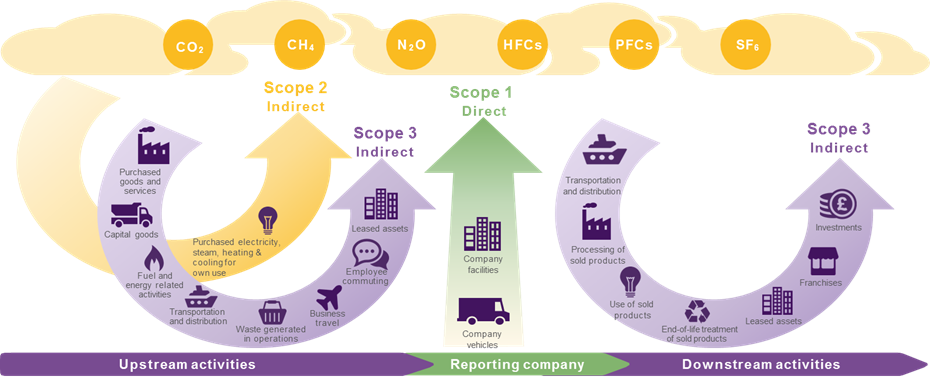

GHG emissions are categorised into three groups or ‘Scopes’ by the most widely used international accounting tool, the GHG Protocol [2]:

- Scope 1 covers direct emissions from owned or controlled sources.

- Scope 2 covers indirect emissions from the generation of purchased electricity, steam, heating, and cooling consumed by the reporting company.

- Scope 3 includes all other indirect emissions that occur in the value chain of the reporting company, including both upstream and downstream activities.

A breakdown of Scopes 1, 2 and 3 emissions

Source: Greenhouse Gas Protocol Corporate Standard

To effectively measure Scope 3 emissions, a company must dive deeper into its value chain as few companies own the entire value chain of their products and services. Taken as an average of the 1,220 European companies that reported to the Carbon Disclosure Project (CDP) in 2021, Scope 3 emissions accounted for 86% of total emissions [3].

Near-term, long-term, and net-zero science-based targets

Once a company has measured its carbon footprint and has tools in place to track its GHG emissions, it can establish reduction targets over different time horizons. The Task Force on Climate-Related Financial Disclosures (TCFD) recommends disclosing the metrics used to assess climate-related risks, Scope 1 & 2 (and if appropriate Scope 3), and subsequent reduction targets [4]. In 2025 it will be mandatory across the UK economy, for companies to report and disclose in accordance with the TCFDs guidelines.

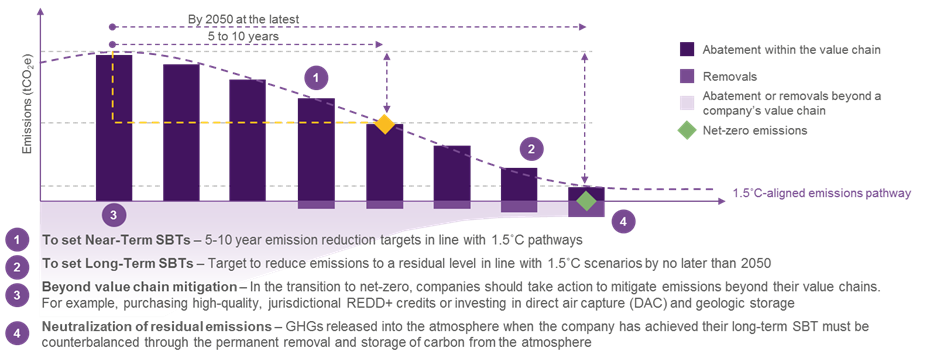

Through the Science-Based Targets Initiative (SBTi), companies can commit to validated near-term targets (up to five to 10 years), and long-term targets (up to 2050) consistent with the trajectory to achieve net zero and limiting global temperature rise to 1.5°C above pre-industrial levels.

The corporate journey to net zero is outlined in the chart below.

Net-zero emissions reduction pathway

Source: Science Based Targets initiative, Corporate Net-Zero Standard [5]

Once a company has committed to set a SBTi target, it has 24 months to submit its targets for validation. Once validated, companies are required to publicly announce the targets and report company-wide emissions and progress on an annual basis [6]. As science has evolved, SBTi has updated its requirement and from 15 July 2022 will require companies setting new SBTs to align to 1.5°C (previously, targets could also be set to be aligned with well below 2 °C or 2°C) [7].

Companies with targets approved in 2020 or earlier will have until 2025 to update these in line with 1.5°C. To ensure continuous alignment to the latest climate science, companies will need to review and update their SBTi aligned emission reduction targets at least every five years [8].

The SBTi also supports SMEs , which it defines as non-subsidiary, independent companies with fewer than 500 employees, to submit targets through a streamlined process. This process enables SMEs to set a science-based target for their Scope 1 and 2 emissions by choosing from one of several predefined target options.

For any company to achieve net-zero status, it must first look to reduce absolute emissions as much as possible, however, companies may reach a point where emissions cannot be reduced further – sometimes referred to as ‘residual’ or ‘unabated’ emissions. In this case, carbon credits can be an option to offset the residual emissions. As noted in a previous article, a net-zero commitment requires a company to use carbon removal credits to offset any residual emissions. Removal credits support the funding of projects that remove CO2 from the atmosphere – for instance, through CO2 removal technologies or afforestation.

Applying science-based targets to sustainability-linked financing Scope 3 considerations

Once a company has emissions reduction targets in place, these can be integrated into corporate treasury strategy using a growing range of sustainability-linked financing instruments, including loans, bonds and private placements. There is an increasing expectation among capital providers for emission-reduction targets used by companies to be science-based with SBTi verification acting as a key external benchmark that supports the ambition of the targets. This would also provide assurance that absolute emissions will be reduced in line with science.

As outlined in a previous article, GHG or carbon emissions reduction targets are regularly used in sustainability-linked bond issuances. Companies are increasingly using SBTi alignment to demonstrate the ambition of their target: 65% of sustainability-linked bond issuers with environmentally focused structures included SBTi aligned targets in Q1 2022 versus 61% at the end of Q4 2021. Investors are increasingly viewing the adoption of SBTi targets as one of the key focus areas when engaging with companies, alongside the integration of wider ESG data within their investment analysis.

[quote] “65% of sustainability-linked bond issuers with environmentally focused structures included SBTi aligned targets in Q1 2022 versus 61% at the end of Q4 2021”

Source: NatWest, Bloomberg

For many companies, Scope 3 emissions account for a large percentage of total emissions and consequently there is an increasing expectation for sustainability-linked financing to include Scope 3 targets. However, Scope 3 emissions are complex (comprising 15 categories across the value chain) and measuring them can be challenging, requiring strong collaboration particularly across the supply chain. As capabilities progress, some companies are considering targets around their most material and measurable Scope 3 categories in the near term, with a view to encompass all relevant categories in the future when they can be more accurately measured. Others have targeted a specific issue (e.g., plastic waste, food waste) in their value chain.

The SBTi recognises these challenges. An SBTi Scope 3 target is currently required only if these emissions are greater than or equal to 40% of a company’s total emissions [9]. For SMEs, SBTi does not require companies to set Scope 3 targets, however it does call for SMEs to commit to measure and reduce their Scope 3 emissions [10]. During 2022, the SBTi will conduct a comprehensive review of its Scope 3 target-setting methods and criteria to ensure alignment with best practices and with its new Net-Zero Standard [11].

There are many initiatives working to support improved Scope 3 capabilities. For example, CDP is working with large purchasing organisations such as Microsoft, Diageo, and Sainsbury’s [12] as part of its Supply Chain programme to encourage more than 11,000 companies in their respective supply chains to disclose their GHG emissions, a 40% rise year on year [13]. NatWest has recently launched a Green Loan product to help companies of all sizes to finance green and environmentally beneficial projects. Additionally, companies such as Tesco and Walmart have recently announced ESG-linked SCF programmes.

Tackling climate change and the wider transition to a more sustainable way of living are challenges shared by everyone. The increased focus on Scope 3 and value-chain emissions encourages all to collaboratively work to reduce our collective impact on the environment. Although there is some progress being made, there remains much room for improvement. Despite a clear momentum towards increased commitments to targets verified by the SBTi in line with the 1.5°C pathway, there are currently only 1,255 companies with science-based targets and just 1,356 companies committed to setting 1.5°C aligned targets [14].

Follow NatWest’s Carbonomics 101 series to stay informed on the development of the carbon markets and learn about the role they could play in your sustainability strategy. To access the full Carbonomics 101 series you can visit the bank’s Carbon Hub, where they also include essential tools and insights to help you on your climate transition journey.

[1] https://www.ipcc.ch/sr15/chapter/spm/

[2] https://ghgprotocol.org/corporate-standard

[4] https://assets.bbhub.io/company/sites/60/2021/10/FINAL-2017-TCFD-Report.pdf

[5] https://sciencebasedtargets.org/resources/files/Net-Zero-Standard.pdf

[6] https://sciencebasedtargets.org/how-it-works#how-do-you-validate-targets-as-science-based

[7] https://sciencebasedtargets.org/news/sbti-raises-the-bar-to-1-5-c

[8] https://sciencebasedtargets.org/news/sbti-raises-the-bar-to-1-5-c

[9] https://sciencebasedtargets.org/resources/files/SBTi-criteria.pdf

[11] SBTi Action Plan for 2022 Includes Scope 3 Target Setting, Sector-Specific Guidance - ESG Today

[12] https://www.cdp.net/en/supply-chain

[13] CDP Worldwide Group of companies’ accounts 2021

[14] https://sciencebasedtargets.org/companies-taking-action sourced on 30/03/2022