US Policies Trigger Gloom Among CFOs

Published: June 27, 2025

After grappling with the complex challenge of aligning budget priorities with both the anticipated growth and ongoing economic uncertainty during the first quarter of 2025, CFOs have been increasingly concerned about the US economic outlook for Q2.

This apprehension is primarily driven by recent US federal economic policies and the resulting uncertainties. Randeep Rathindran, Distinguished Vice President, Research, explores the outcomes.

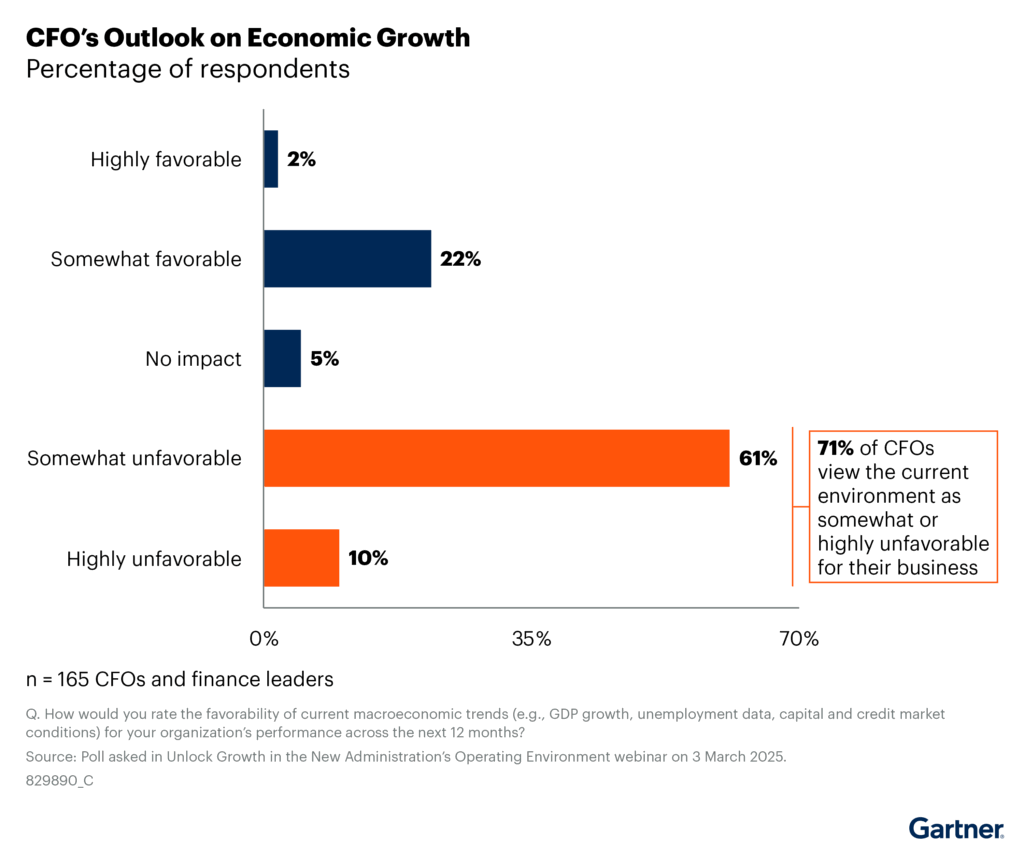

Two years into a sluggish economy characterised by elevated costs and expensive capital, CFOs who had felt cautiously optimistic about growth prospects earlier this year now feel a significant decline in optimism. A survey conducted in Q2 2025 by the American Institute of Certified Public Accountants (AICPA) and the Chartered Institute of Management Accountants (CIMA) revealed only 47% of respondents expressed a positive outlook, down from 67% in the previous quarter . This sharp drop is largely attributed to uncertainties surrounding tariffs, interest rates, and inflation. This sentiment aligns with respondents in a Gartner survey taken in March 2025 (fig. 1).

Figure 1: CFOs’ Outlook on Economic Growth

In the final months of 2024, a Gartner survey of just over 300 CFOs and finance leaders revealed plans to markedly increase budgets that supported growth functions such as IT, sales, and marketing. At the same time, there was sustained emphasis on technology investments.

However, when Gartner surveyed C-suite executives and business executives in Q2 about the actions they would take in Q2 in light of the economic impact and US federal policies, 49% indicated plans to reduce their budget or spending within their functional areas. This underlines a shift toto control costs to maintain margins amid potential growth slowdowns.

Further, 26% stated they would pause major projects due to uncertainty surrounding government spending, tariffs, and broader executive order policies. Additionally, 38% expressed intentions to alter their go-to-market product strategy or geographic mix. Despite these challenges, only 5% of organisations plan to temporarily scale back their AI initiatives, suggesting that companies will continue investing in AI throughout a potentially contractionary economic cycle. This sentiment underscores the enduring value of AI investments and their potential to transform cost productivity and growth outcomes, enabling organisations to rebound stronger post any contractionary period.

In Q2, CFOs identified specific areas for budget reductions. A significant 56% indicated they would decrease overhead and general administrative expenses, while 50% planned to cut vendor and third-party expenditures. Additionally, 28% of CFOs aimed to reduce headcount; however, only 24% prioritised technology project cuts, and a negligible 2% intended to lower sales and marketing budgets, suggesting that the economic downturn could be brief if sales and marketing maintain consistent funding.

The commitment toenterprise technology budgets holds steady, underscoring the critical role of digital investments in maintaining competitiveness and achieving strategic objectives. This commitment to technology spending reflects the growing demands of functional and business transformations, alongside expected price hikes from technology vendors for contract renewals. The continued focus on technology also aligns with the burgeoning promise of traditional and generative AI in driving new offerings, enhancing decision-making, and boosting productivity.

Prioritisation and positioning

CFOs are prepared to invest during the short period of reduced demand and uncertainty to strategically position their companies for success later in the year and into 2026. This approach is in line with expected favourable conditions in the latter half and into the following year, spurred by deregulation and tax reforms that could encourage further investments from CFOs.

When Gartmer asked about the changes CFOs would make to growth strategies as a result of US federal policy changes and their economic impact on businesses, a significant 39% indicated plans to target new customers, while 19% intended to modify their go-to-market strategy in Q2.

Additionally, 39% expressed intentions to adjust their product mix by introducing or phasing out products. Furthermore, 23% planned to increase M&A, joint ventures, and strategic partnerships. It's noteworthy that this percentage is considerably lower than the expectations CFOs and boards had at the beginning of 2025 when there were high hopes for a substantial increase in M&A deals.

Finance transformation goals and headcount dynamics

Despite ambitious transformation goals, finance functions are not translating these into planned headcount changes. While finance data and analytics roles are expected to see headcount increases, more than half of CFOs plan nominal changes to technically skilled roles. This disconnect highlights a challenge: while CFOs recognise the importance of funding AI and technology, they are slower to invest in the digital talent necessary for successful implementation.

To bridge this gap, CFOs should focus on building digital talent and enticing skilled professionals to achieve transformation objectives. Understanding the digital talent required and employing effective hiring tactics are crucial steps in realising the full potential of technology and AI in finance.

As CFOs navigate the complexities of 2025 during this time of rapid change and ongoing ambiguity, it will be important to leverage benchmarks as they become available and to collaborate among business functions to keep an eye towards efficiency and future growth.

Additionally, maintaining open communication channels with stakeholders will be crucial to ensure alignment and adaptability in response to evolving economic conditions. By fostering a culture of innovation and resilience, organisations can better position themselves to capitalise on emerging opportunities and mitigate potential risks.