Gartner Survey Shows 58% of Finance Functions Using AI in 2024

Published: September 11, 2024

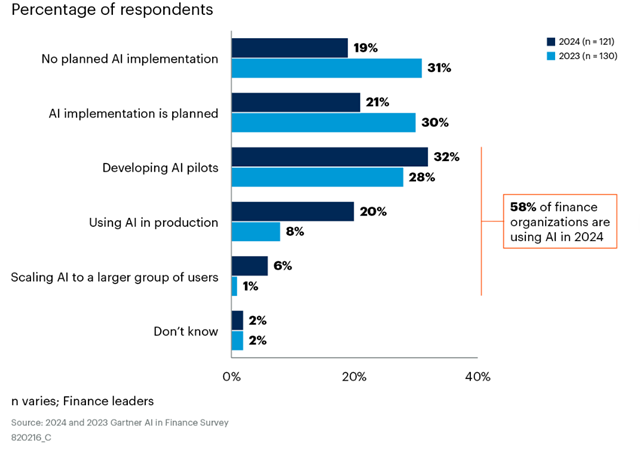

The adoption of finance AI by finance functions has increased significantly in the past year with 58% using the technology in 2024 - a rise of 21 percentage points from 2023 - according to a survey by Gartner, Inc.

Gartner surveyed 121 finance leaders in June 2024 to understand their use of AI technologies for the finance function. Gartner experts are discussing key issues around finance AI at the Gartner CFO & Finance Executive Conference 2024 taking place in London today.

“AI adoption in the finance function is advancing quickly,” said Marco Steecker, senior director, research in the Gartner finance practice. “It’s also encouraging to note that two-thirds of finance leaders feel more optimistic about AI’s impact than they did a year ago, particularly among those who have already made progress leveraging AI solutions.”

While 42% of finance functions are not currently using AI, half of these are planning implementation (see Figure 1).

Figure 1: Current Levels of AI Use in Finance, 2023 vs 2024

Source: Gartner (September 2024)

“In this survey last year, other administrative functions (such as HR, legal, and procurement) were twice as likely to be using or scaling out AI solutions compared to the finance function. This year the gap is almost nonexistent,” said Steecker.

Four main use cases stood out amongst those adopting AI in finance:

- Intelligent process automation (used by 44% of finance functions) — Automation that leverages the AI capabilities of existing automation tools (such as RPA) to enhance information processing.

- Anomaly and error detection (used by 39% of finance functions) — AI-enabled identification and reporting of errors and outliers in large datasets (e.g., internal claims, expenses, and invoices).

- Analytics (used by 28% of finance functions) — The creation of better financial forecasts and results analysis that can lead to improved decision making.

- Operational assistance and augmentation (used by 27% of finance functions) — Emulation of human-judgment-based decisions in operations through AI (often generative AI).

Data and Talent Shortages Present Challenges

Finance leaders’ top two challenges related to AI adoption were inadequate data quality/availability and low levels of data literacy/technical skills.

“Because interest in AI is rising across the board both inside and outside their organisations, CFOs are finding it tough to source the talent they need to meet their AI ambitions, and this problem is likely to get worse,” said Steecker. “It’s therefore essential they have an overarching functional strategy to identify, acquire and develop AI skills.”

To do this CFOs will need to address three primary challenges that hinder finance AI talent plans: a limited understanding of the necessary roles and skills involved in AI implementation; a difficulty attracting and retaining AI talent; and slow progress developing AI skills within existing employees.

In terms of data quality, Gartner experts recommend considering leaving behind a “single version of the truth” data management philosophy because it is almost impossible to attain this kind of perfection given the volume and volatility of data in modern companies. The alternative is a “sufficient versions of the truth” approach that balances data quality with ensuring it is useful in decision making.