- Kee Joo Wong

- Managing Director – Regional Head of Global Liquidity and Cash Management, Asia Pacific, HSBC

by Kee Joo Wong, Head of Global Payments and Cash Management, Asia Pacific, The Hongkong and Shanghai Banking Corporation Limited

Despite mobile devices becoming ubiquitous in almost every country around the world, it has taken longer to realise the potential for mobile banking solutions to transform the payments landscape. This is now changing as individuals become more accustomed to using mobile devices for personal banking, and are therefore seeking to achieve comparable advantage at an organisational level. Similarly, a growing number of corporations are leveraging the value from the mobile money solutions that are expanding across developing markets to improve collections security and efficiency.

The mobile catalyst

The use of mobile phones for banking and transaction purposes has evolved in a variety of ways over recent years. In the developed world in particular, mobile banking initiatives were initially targeted at retail banking customers, firstly for balance checking and transfers, then for C2C and increasingly C2B payments using only a mobile phone number.

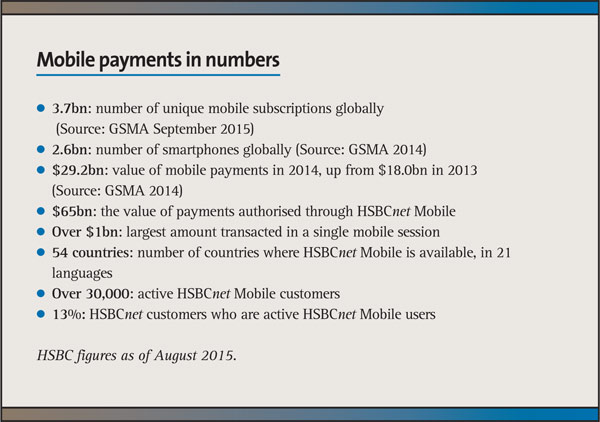

In the developing world, mobile money has already been transformative in shifting people’s reliance on cash and manual payments to secure, immediate convenient payments. The most notable example is M-PESA. As the mobile networks association, GSMA’s State of the Industry 2014 report illustrates, with 3.6 billion unique mobile subscribers worldwide and 103 million active mobile money accounts so far, the success – and potential - of these initiatives is groundbreaking, not only for users, but as a catalyst for innovative new business models.

Taking the initiative

With its cultural and economic diversity, Asia is taking a pioneering role in the development of both mobile banking, including mobile-to-mobile payments, and mobile money solutions. The five top countries globally for the use of mobile banking, for example (excluding SMS-based mobile solutions such as M-PESA) are all in Asia: South Korea (47% of the adult population); China (42%); Hong Kong (41%); Singapore (38%) and India (37%) according to 2015 data. There are three key reasons for this:

Firstly, Asia combines both the sophisticated user base and large underbanked populations that are driving the success of mobile banking and mobile money solutions respectively.

Secondly, there is strong regulatory support for mobile-based banking and electronic wallet solutions, including in countries such as Vietnam, Philippines, Thailand, Indonesia and Bangladesh.

Thirdly, banks such as HSBC are playing a seminal role in designing practical, robust solutions for implementation that will meet the needs of both retail and corporate customers, such as HSBC Mobile Collections and solutions that leverage real-time payments infrastructure in developed markets.[[[PAGE]]]

The combination of these factors is resulting in a large potential user base that already has a high level of acceptance of the use of mobile devices for banking and payments, which is likely to be fuelled further by new large-scale mobile-to-mobile payments such as ApplePay.

Consequently, we are now seeing considerable growth in the mobile-to-mobile initiatives that are under way. For example, in Thailand, AIS-MPay enables cash withdrawals and transfers, bill payments and purchases. In Vietnam, where cash still accounts for around 60% of corporate collections, and only 20% of the population holds a bank account, collection via mobile money presents a compelling opportunity to reduce the amount of physical cash that companies need to collect and process. As a result, mobile services provider mService has launched the MoMo electronic wallet solution supporting both B2B and C2B flows. The MoMo wallet offers a strong value proposition for both the urban population, and the rural population that often lacks access to bank branches.

It is not only developing countries where mobile-to-mobile and electronic wallet solutions are making an impact. In Australia, APCA (Australian Payments Clearing Association) has launched a New Payments Platform (NPP) initiative, operated by SWIFT. NPP has open access infrastructure, enabling mobile-to-mobile services that allow businesses and consumers to link their mobile phone number to their bank account, removing the need for the payer to hold bank account instructions of the person they are paying.

The CFO imperative

While these initiatives illustrate that mobile-to-mobile payments are well on the way to transforming retail transactions, it has taken longer for innovations in consumer technologies and personal banking to drive change in professional behaviour. As a first step, for example, as CFOs and treasurers become more comfortable with using mobile devices for personal banking, they are increasingly embracing this technology for corporate banking. As a result, the value of transactions executed through HSBC’s mobile corporate banking platform, HSBCnet Mobile, has now reached USD 68bn. Thirteen per cent of HSBCnet customers are already active HSBCnet Mobile users, but the potential is clearly enormous when comparing this with the prevalence of mobile banking across the wider population. At the current rate of growth, we expect to reach USD100bn in global payments in the next 18 months.

The next question for treasurers and CFOs, however, is how to harness the growing appetite and availability of mobile-to-mobile solutions to address key business challenges. One major problem expressed by many companies is how to reconcile and allocate collections more efficiently, typically due to a lack of high-quality, consistent remittance data. Mobile payments have the potential to eradicate this issue, particularly for industries with a large retail customer base such as insurance, telecoms and utilities, by allowing the company to define remittance data and even influence the timing of payments using SMS payment requests, mobile bill presentment and QR code capture.

In the B2B space too, the potential for mobile payments is enormous. Industries such as food and drink, apparel and fast-moving consumer goods often have large sales and distribution networks in countries such as Indonesia, which distribute products to a large variety of retailers, from large retail outlets to small ‘mom and pop’ shops, many of which may be unbanked. Cash typically dominates these transactions, and leads to enormous cost, security issues, and often long lead times between the receipt of physical cash and credit onto the bank account. By using mobile payment solutions such as HSBC’s Mobile Collections, the transaction is made electronically and securely in real-time, eliminating the cost, risk and delay associated with processing physical cash.

Positive disruption

Inevitably, migrating to mobile payment solutions is not a panacea and the cultural and regulatory acceptance, and suitability of the payments infrastructure to support mobile payments, will vary in each country, and potentially by industry. However, as both payers and payees increasingly recognise the benefits of mobile payments, and regulators and infrastructure providers respond to evolving demand, the payments landscape is likely to be transformed over the coming years. There is frequently talk about the potential for disruptive technology but disruption is only positive if it solves existing problems and enables new behaviours. Mobile banking and mobile money are model examples of positive disruption, as enablers and powerful forces for change. Companies that look at mobile opportunities creatively and adapt quickly are likely to gain competitive advantage over those that are slower to do so.