- Daniel Farrell

- Head of International Fixed Income, Northern Trust Asset Management

Exclusive insight for TMI subscribers! Northern Trust Asset Management share a monthly market commentary for treasurers.

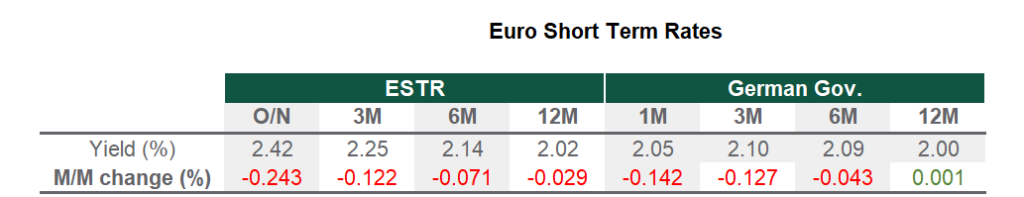

Eurozone Market Update

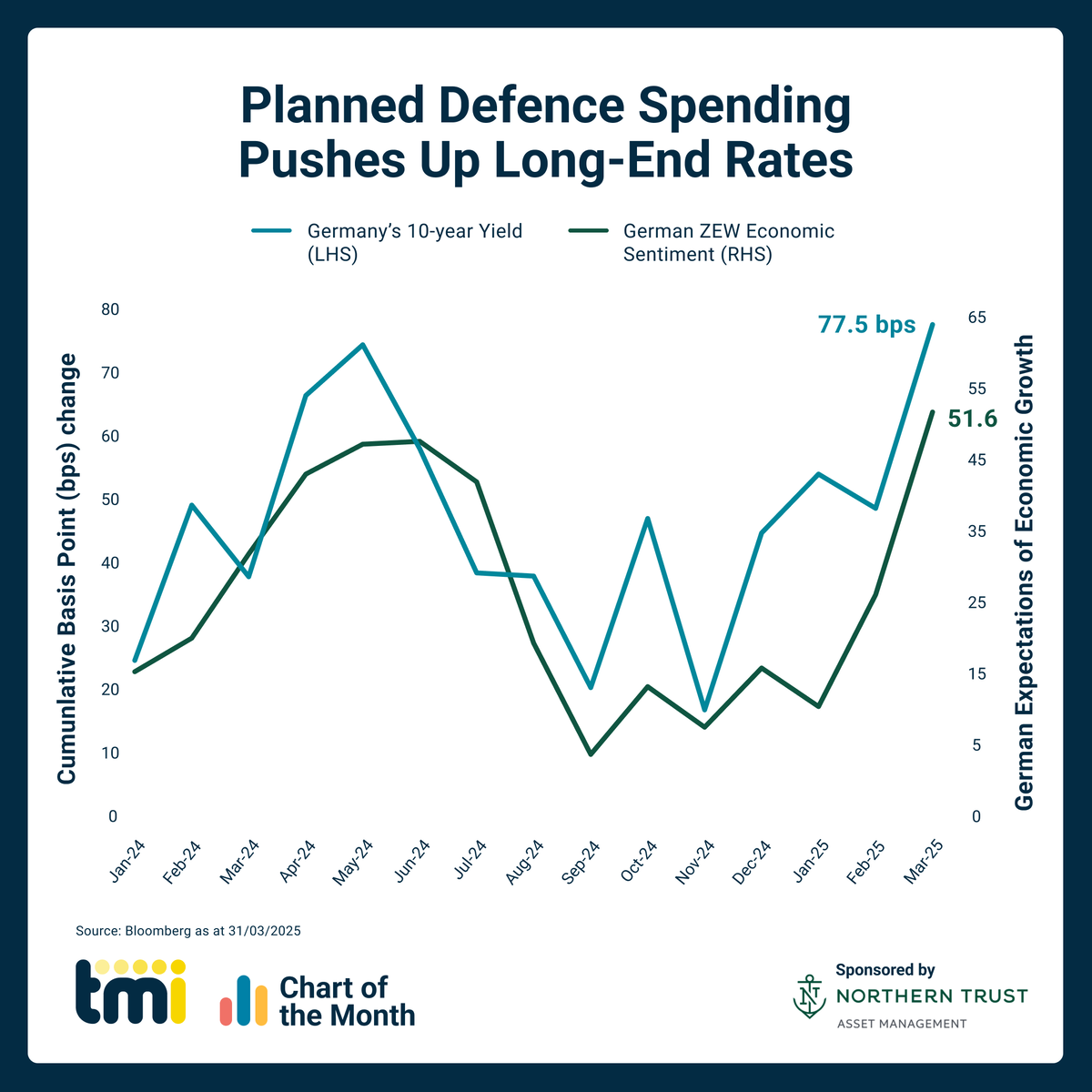

The ECB cut its deposit rate by 25 bps to 2.5% in March, continuing its easing cycle. Growth forecasts were revised down, reflecting the impact of global geopolitical uncertainty, with GDP expectations at 0.9% in 2025 (down from 1.1%) and 1.2% in 2026 (from 1.4%). The 2027 headline inflation projection was also revised down to 2.0%, with core inflation projected for 1.9%, reinforcing the ECB’s disinflation narrative. The ECB called its stance “meaningfully less restrictive” and emphasised data dependence going forward. The central bank’s positioning should be viewed in the context of significant fiscal developments in Germany (see Chart of the Month), where planned constitutional amendments will enable increased defence spending and a €500bn infrastructure fund. These measures could support medium-term Eurozone growth and reduce the likelihood of rates falling below neutral.

Source: Bloomberg, data as of 31 March 2025

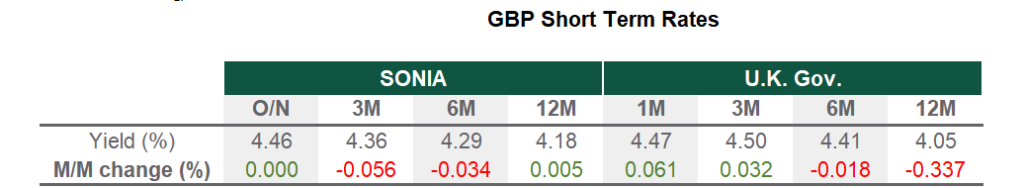

UK Market Update

In March, the BoE voted 8-1 to maintain the Bank Rate at 4.5%, citing persistent services inflation and wage growth as justification for a gradual approach to easing. The Office for Budget Responsibility’s (OBR) Spring Forecast lowered 2025 GDP growth to 1% and projected inflation at 3.2%, with a return to target by 2027. Chancellor Rachel Reeves preserved a £9.9bn fiscal buffer in the government’s Spring Statement, driven by £4.8bn in welfare reforms and modest tax measures. Without these, slower growth and higher yields would have erased the margin. The Debt Management Office announced £299.2bn in planned gilt issuance, slightly below expectations, supporting market sentiment. Despite the buffer, the OBR sees just a 54% chance of balancing the budget by 2029–30, reflecting ongoing fiscal fragility.

Source: Bloomberg, data as of 31 March 2025

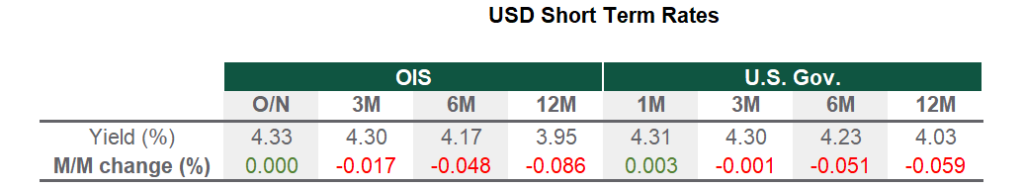

US Market Update

The Fed left rates unchanged in March, signalling a wait-and-see approach amid rising uncertainty. The median “Dot Plot” projection still shows two rate cuts in 2025, though more participants now expect fewer cuts. Growth expectations for 2025 were revised down to 1.7%, while core inflation was revised up to 2.8%, broadly in line with market expectations. Chair Powell described the outlook as “unusually uncertain,” citing challenges in interpreting data. President Trump declared 2 April “Liberation Day,” unveiling 25% tariffs on auto-related imports and signalling further measures on lumber, semiconductors and pharmaceuticals. The move sparked a sell-off in auto stocks and raised trade tensions, with Germany, Japan, South Korea and Mexico likely to be most affected. One-year inflation swaps rose to a two-year high of 3.16%, driven by tariff concerns and a stronger-than-expected Personal Consumption Expenditures (PCE) Price Index report.

Source: Bloomberg, data as of 28 February 2025

Looking Ahead

Uncertainty continues to define the global outlook, shaped by geopolitical risks, trade tensions and differing fiscal strategies. These forces are likely to keep influencing both markets and central bank decision-making in the near term. In the UK, we expect the BoE to begin cutting rates from May, with 25 bps moves at each Monetary Policy Report meeting, taking the Bank Rate to 3.75% by year-end. This reflects a more dovish stance than markets currently imply. In the Eurozone, Germany’s fiscal stimulus should help offset tariff-related pressures and may limit how far the ECB takes rates below neutral. We see steady cuts continuing until inflation reaches the target. Meanwhile, the Fed appears ready to look through near-term tariff-driven inflation, at least for now. We anticipate it will keep rates on hold through the first half of the year and then deliver two cuts later in 2025. Across all three regions, flexibility and vigilance will be key for central banks as conditions evolve.

Chart of the Month

Source: Bloomberg as of 31 March 2025

IMPORTANT INFORMATION

For Asia-Pacific (APAC) and Europe, Middle East and Africa (EMEA) markets, this information is directed to institutional, professional and wholesale clients or investors only and should not be relied upon by retail clients or investors.

The information contained herein is intended for use with current or prospective clients of Northern Trust Investments, Inc (NTI) or its affiliates. The information is not intended for distribution or use by any person in any jurisdiction where such distribution would be contrary to local law or regulation. Northern Trust Asset Management’s (NTAM) and its affiliates may have positions in and may effect transactions in the markets, contracts and related investments different than described in this information. This information is obtained from sources believed to be reliable, its accuracy and completeness are not guaranteed, and is subject to change. Information does not constitute a recommendation of any investment strategy, is not intended as investment advice and does not take into account all the circumstances of each investor. This report is provided for informational purposes only and is not intended to be, and should not be construed as, an offer, solicitation or recommendation with respect to any transaction and should not be treated as legal advice, investment advice or tax advice. Recipients should not rely upon this information as a substitute for obtaining specific legal or tax advice from their own professional legal or tax advisors. References to specific securities and their issuers are for illustrative purposes only and are not intended and should not be interpreted as recommendations to purchase or sell such securities. Indices and trademarks are the property of their respective owners. Information is subject to change based on market or other conditions.

All securities investing and trading activities risk the loss of capital. Each portfolio is subject to substantial risks including market risks, strategy risks, advisor risk, and risks with respect to its investment in other structures. There can be no assurance that any portfolio investment objectives will be achieved, or that any investment will achieve profits or avoid incurring substantial losses. No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment. Risk controls and models do not promise any level of performance or guarantee against loss of principal. Any discussion of risk management is intended to describe NTAM’s efforts to monitor and manage risk but does not imply low risk.

Past performance is not a guarantee of future results. Performance returns and the principal value of an investment will fluctuate. Performance returns contained herein are subject to revision by NTAM. Comparative indices shown are provided as an indication of the performance of a particular segment of the capital markets and/or alternative strategies in general. Index performance returns do not reflect any management fees, transaction costs or expenses. It is not possible to invest directly in any index. Net performance returns are reduced by investment management fees and other expenses relating to the management of the account. Gross performance returns contained herein include reinvestment of dividends and other earnings, transaction costs, and all fees and expenses other than investment management fees, unless indicated otherwise. For additional information on fees, please refer to Part 2A of the Form ADV or consult an NTI representative.

Forward-looking statements and assumptions are NTAM’s current estimates or expectations of future events or future results based upon proprietary research and should not be construed as an estimate or promise of results that a portfolio may achieve. Actual results could differ materially from the results indicated by this information.

Hypothetical portfolio information provided does not represent results of an actual investment portfolio but reflects representative historical performance of the strategies, funds or accounts listed herein, which were selected with the benefit of hindsight. Hypothetical performance results do not reflect actual trading. No representation is being made that any portfolio will achieve a performance record similar to that shown. A hypothetical investment does not necessarily take into account the fees, risks, economic or market factors/conditions an investor might experience in actual trading. Hypothetical results may have under- or over-compensation for the impact, if any, of certain market factors such as lack of liquidity, economic or market factors/conditions. The investment returns of other clients may differ materially from the portfolio portrayed. There are numerous other factors related to the markets in general or to the implementation of any specific program that cannot be fully accounted for in the preparation of hypothetical performance results. The information is confidential and may not be duplicated in any form or disseminated without the prior consent of NTAM.

This information is intended for purposes of NTI and/or its affiliates marketing as providers of the products and services described herein and not to provide any fiduciary investment advice within the meaning of Section 3(21) of the Employee Retirement Income Security Act of 1974, as amended (ERISA). NTI and/or its affiliates are not undertaking to provide impartial investment advice or give advice in a fiduciary capacity to the recipient of these materials, which are for marketing purposes and are not intended to serve as a primary basis for investment decisions. NTI and its affiliates receive fees and other compensation in connection with the products and services described herein as well as for custody, fund administration, transfer agent, investment operations outsourcing and other services rendered to various proprietary and third party investment products and firms that may be the subject of or become associated with the services described herein.

Northern Trust Asset Management is composed of Northern Trust Investments, Inc. Northern Trust Global Investments Limited, Northern Trust Fund Managers (Ireland) Limited, Northern Trust Global Investments Japan, K.K, NT Global Advisors, Inc., 50 South Capital Advisors, LLC, , Northern Trust Asset Management Australia Pty Ltd, and investment personnel of The Northern Trust Company of Hong Kong Limited and The Northern Trust Company.

NOT FDIC INSURED | MAY LOSE VALUE | NO BANK GUARANTEE

© 2025 Northern Trust Corporation. Head Office: 50 South La Salle Street, Chicago, Illinois 60603 U.S.A.