After the Ballots

How the ‘year of elections’ reshaped treasury priorities

Published: October 10, 2014

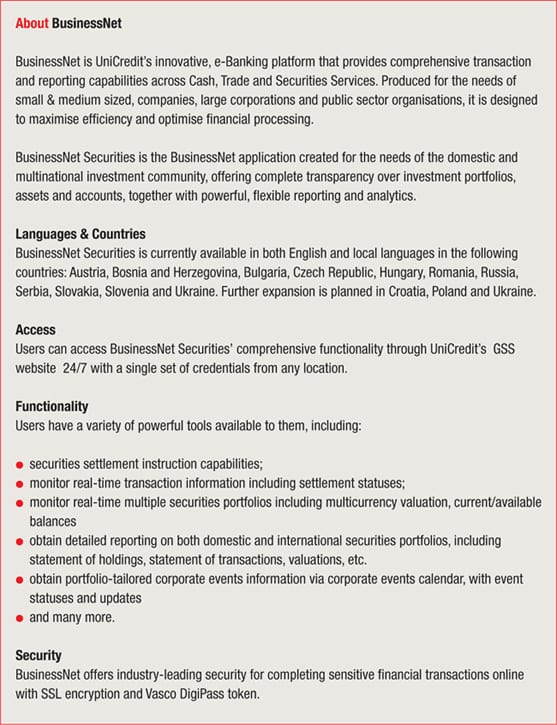

UniCredit has a leading position in Central & Eastern Europe not only in cash and trade but also in securities services. UniCredit’s Global Securities Services (GSS) offer comprehensive custody and securities servicing capabilities in Central & Eastern Europe (CEE) with a number 1 or 2 position in each market in which we operate. By leveraging an extensive network of subsidiaries across the region, investors are able to access a unique depth of expertise in each market, while benefiting from the strength and integrity of the UniCredit network. Consequently, GSS have developed an enviable track record in meeting the needs of both domestic and international investors. An important step in maintaining and strengthening our market reputation and high quality of customer relationships has been the development of a new electronic platform for securities services, BusinessNet Securities, as part of a wider, innovative electronic banking suite. This article outlines some of the benefits of this solution and the background to its development.

BusinessNet is UniCredit’s electronic banking suite for Central & Eastern Europe (CEE) offering comprehensive functionality to cover the broad spectrum of corporate treasury responsibilities. Within the BusinessNet suite, BusinessNet Securities provides accurate, near real-time management of multiple portfolios and state of the art contingency capabilities across multiple currencies and markets, and with comprehensive functionality across Cash, Securities, Corporate Actions and Settlement (figure 1).

We have worked extensively with our customers to identify and prioritise the functionality and usability tools that address their specific needs and challenges. The result is that BusinessNet Securities offers an unusually powerful, comprehensive solution for investors in a single market or multiple markets. Consequently, it is suitable for both smaller domestic investors and large multinationals. While some of these larger customers will typically use SWIFT for settlement and reporting purposes (and use BusinessNet Securities as a back-up solution), they have been very positive about the benefits of using BusinessNet Securities to gain instant access to full transaction status and details, tailored corporate actions information, reporting and analytics.[[[PAGE]]]

BusinessNet Securities has been designed according to best-in-class security principles, including SSL encryption and a Vasco DigiPass token for settlement instruction entry. The solution is fully interoperable with other BusinessNet solutions and offers a single log-on process for convenient user access to all functionality, across all countries, subject to detailed user rights. Customers often need to integrate the solution within their wider systems infrastructure. The ability to support industry-standard formats is key to achieving this, so BusinessNet Securities is based on industry-recognised SWIFT formats rather than proprietary formats, providing our customers with confidence and flexibility. There are other advantages to a standardised approach to integration and processing. For example, by promoting settlement instruction capture and validation on the client-end of the process, we can achieve much higher rates of straight-through processing, significantly reducing the need for manual intervention.

A key benefit of BusinessNet Securities is its powerful, flexible reporting tools. While the ability to provide data to customers is important, it is just as important to enable customers to harness this data to support portfolio analytics, management reporting and process automation. Each user has specific needs, so rather than bombarding them with data that may not be meaningful or useful, we offer users the ability to access relevant data in the format they require, from individual transactions through to multimarket, multicurrency portfolio valuations. Furthermore, as many users’ responsibilities extend beyond investment into areas such as cash, authorised users have visibility over cash accounts as well as securities through a single channel.

Customers’ response to BusinessNet Custody has been very positive and marks a major milestone in UniCredit’s customer delivery strategy. With pilot projects now under way, we are actively preparing a wider rollout strategy to enable customers to migrate smoothly onto the platform and take advantage of the new functionality and integration capabilities that it offers. As customer needs continue to evolve and develop, we are continuing to develop the next generation of functionality, integration and usability features to meet and exceed the needs of our customers.