- Ben Poole

- Editorial Team, Treasury Management International (TMI)

Hampered by manual bank account processes, rapidly expanding renewable energy firm Scatec knew a digital onboarding solution would ease its pain points. Here, Lilyana Vinokurova, Treasury Manager, Scatec, and BNP Paribas’ Kristin Qvale, Head of Cash Management Norway, and Stephanie Niemi, Head of Digital Onboarding for Corporate, discuss the milestone transition.

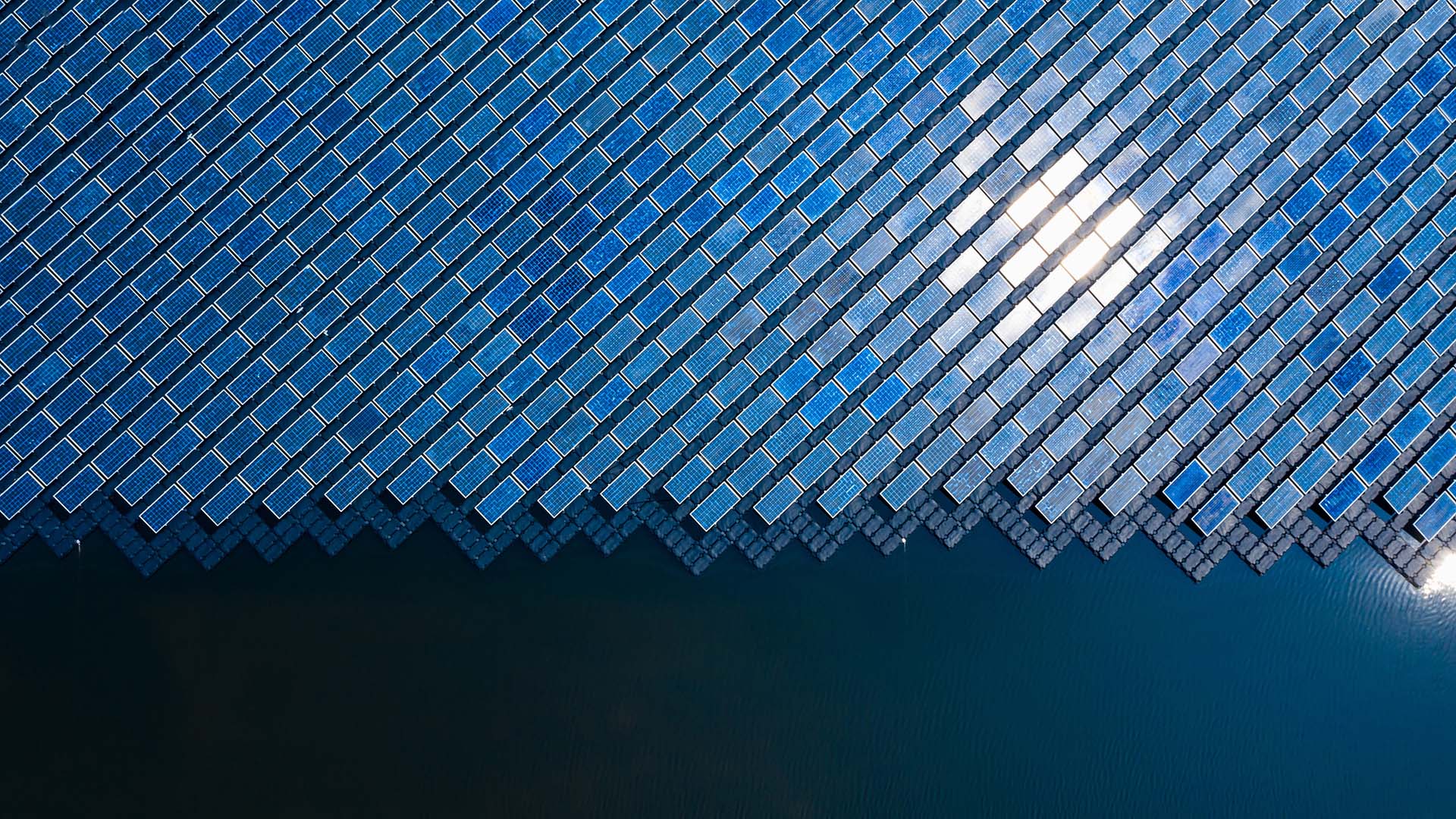

Scatec, a major renewable energy solutions provider to emerging markets, has 600 employees and saw revenues of approximately €449m in its 2021 financial year. The Norwegian Stock Exchange-listed company’s global projects are managed by special purpose vehicles (SPVs) through holding companies in the Netherlands.

Lilyana Vinokurova

Treasury Manager, Scatec

As well as being Scatec’s leading international banking partner, BNP Paribas is the cash management bank for the Dutch legal entities, covering approximately 40 entities and 50 bank accounts. To help optimise the company’s liquidity, these legal entities are included in a BNP Paribas notional cash pool as a non-resident master account with the Norwegian parent company.

Effortless and paperless

With Scatec’s swift growth in recent years, there has been a constant need for the treasury team to open new current accounts. However, this process was giving rise to a variety of inefficiencies. Vinokurova explains: “When we opened accounts, we had to send documents via email to the relevant parties. There was a lot of hassle involved, and time wasted, trying to obtain the wet signatures required to open a new bank account.”

Fortunately, Scatec’s relationship with BNP Paribas provided an elegant answer. The bank had recently launched Welcome. This is a digital platform designed to simplify the onboarding process by enabling the relatively effortless (and paper-free) collection of KYC documents, account opening, and e-banking subscriptions.

Kristin Qvale

Head of Cash Management Norway, BNP Paribas

BNP Paribas’ Qvale comments: “Treasurers want to move away from paper and manual processes, particularly when opening bank accounts. Understandably, they want to avoid sending large numbers of emails back and forth, something that can be a real pain point for entities regularly opening accounts. Welcome significantly speeds up this process.”

As soon as BNP Paribas launched Welcome, Scatec’s team acted quickly to test and then fully implement the system. “We received an introduction to the system, log-in details and instructions on how to use it,” recalls Vinokurova. “From that point, I began testing it and, in parallel, providing the KYC documents necessary to open bank accounts. My first introduction was in fact not the opening KYC for a new bank account but rather re-certifying KYC for an existing account. That’s where it all started for us.”

KYC can often be a complex issue for corporates, so BNP Paribas was keen for Welcome to be a user-friendly application. The platform was co-designed in the bank’s customer workshops, bringing in a user experience (UX) designer to ensure that it is intuitive and straightforward for everyone to use.

BNP Paribas’ Niemi reveals that Welcome’s user-friendliness not only covers the uploading and e-signing of documents but also fully digitises complex questionnaires. “The corporate client answers a few questions, and the Welcome application automatically generates a form to be electronically signed. It’s all about simplifying these traditionally complex processes,” she explains. “Should there be any questions or uncertainty, we can give the customer a thorough demonstration of the platform. There is also support if the corporate has any concerns when filling in an application.”

Stephanie Niemi

Head of Digital Onboarding for Corporates, BNP Paribas

The Welcome journey unfolds according to the answers provided by the corporate, which means that treasurers using the system no longer have to face the vast range of complexities usually created by KYC.

Harmonised, time sensitive, simple

Scatec’s treasury team immediately felt the positive change in workflow with Welcome. “It was instantly apparent that this is a fantastically quick system,” recalls Vinokurova. “I no longer have to spend days filling in documents or chasing up various people for their signatures. We really like this system.”

One of the key benefits that Welcome offers multinational companies such as Scatec is the harmonisation of the onboarding process, giving a uniform experience regardless of location. “A major issue for many onboarding processes is the lack of consistency among the different countries,” notes Niemi. “One of the main objectives of Welcome is to provide a single, consistent experience, with the same requirements, forms and questions among the different countries – while respecting the local regulations and everything required to perform KYC. Our international clients need to be able to experience the same journey in any country.”

Another strength of the solution is that BNP Paribas’ Due Diligence team assists treasurers to proactively address any potential issues by providing instant email alerts. “We receive an email instantly if something is not quite right,” Vinokurova says. “This is a positive part of the service, and not all banks do this.”

The raison d’être of Welcome is to simplify the onboarding and account opening process for corporates. This extends to form filling. KYC can be a laborious process, so BNP Paribas has enabled intelligent data collection. The platform can pre-fill forms for the corporate client if the bank already has the information.

“We try to maintain our golden rule of ‘no more, no less’,” comments Niemi. “In every case, we avoid troubling the client by asking for details we already have. That’s why in Welcome our corporate clients will always see data pre-filled by the bank. Everything we already know is there, so we need only ask for what we don’t know or don’t have. That’s key: there is little more annoying for corporates than being asked for the tenth time by their bank for information that it already has.”

This collaborative approach is a factor that has been felt and appreciated by the Scatec treasury team during Welcome’s implementation. Vinokurova enthuses: “We are impressed by how well BNP Paribas’ team know us, how quickly they understood our needs, and how they are always looking for ways to improve our collaboration even further.”

As an example, because Scatec’s structure is quite complex, it might require a number of directors to sign a document. “BNP Paribas has been very helpful in enabling electronic signatures to be accepted, and is always looking to make our life easier,” she comments. “I love the BNP Paribas team’s friendly approach, it helps to create trust. Not only do they listen to our needs but they also react quickly and make us feel like we are a priority.”

The strength of that relationship means that Scatec feels comfortable asking BNP Paribas to make certain changes to the Welcome service to reflect the specific needs of the company. As Vinokurova explains: “The tax form requires us to provide the ownership code for the controlling individual – they may be a director or an owner, for instance,” she explains. “While the Welcome system allowed for terms like ‘director’ or ‘owner’, we could not input the code for the title. I raised this issue with the BNP Paribas team and they’re working to improve it. I’m really looking forward to this change.”

More ideas in the pipeline

The roll-out of Welcome is ongoing in all countries where BNP Paribas is present. In addition to its current functionality, the bank has more innovative ideas in the pipeline to further benefit its corporate clients. “We currently use this platform to perform KYC collection, account opening and re-certification,” comments Niemi. “We would like to go one step further by enabling our clients to digitally sign their other contractual documents, in areas such as e-banking or cash pooling, for example. These are further steps that we are working on.”

An additional benefit of the platform is its environmental footprint. Of course, digitising processes and cutting paper out of treasury activities is beneficial, but BNP Paribas has gone even further, as Niemi outlines. “We are contributing to the global sustainability objectives of the bank. This began with the conception of the platform. Following an audit, we received an Eco Index score of 70 out of 100, which is a great result. On top of that, we partner with a company called Reforest’Action. Now, a tree is planted every time there is a case finalised by Scatec, or indeed any corporate client, in Welcome. This programme is currently in Europe, and we are looking at how we might be able to expand it.”

As for the treasury team at Scatec, the implementation of Welcome is just one step on an ongoing digitisation journey in partnership with BNP Paribas. “We are working on host-to-host connectivity to get all bank statements directly into our system,” explains Vinokurova. “We are also considering implementing a TMS, so this is another project in development. Additionally, we are looking to BNP Paribas to collaborate on areas such as automatic payments and bank statements, by leveraging APIs. We are really in the development phase of all these projects, and it is an exciting time. BNP Paribas is very interested in what we do, understands the nature of our operations, assists us in creating efficiencies, and even helps us avoid unnecessary costs. We could not ask for more,” she concludes.