- Tom Alford

- Deputy Editor, Treasury Management International

- Vikram Yadav

- Head of Treasury, British Arab Commercial Bank

BACB’s Treasury on Navigating Frontier Markets

The life of a bank treasurer can be quite different to that of their corporate colleagues. In this second look by TMI at the reality of the role, Vikram Yadav, Head of Treasury, British Arab Commercial Bank (BACB), reveals how his department is a vital component in this UK-incorporated international wholesale bank’s support of trade flows to and from Africa and the Middle East.

As a material risk-taking activity, and a critical balance-sheet management function, running a bank treasury calls for specialist skills, experience – and composure. Having most recently served as Corporate Treasurer at SMBC Nikko Capital Markets, and previously held positions of Chief Risk Adviser at FXGuard, Treasurer for RBS N.V., and EMEA Treasurer for RBS Group, Yadav has the focused knowledge and background necessary to support BACB’s steady and sustainable growth in the region.

BACB’s primary goal is to facilitate the flow of commodities trade between African markets and Europe, a role it has fulfilled since it was founded in 1972. As part of its remit, it aims to help banks and corporates in emerging markets access the international markets.

In addition to providing a range of liquidity solutions, BACB acts as a correspondent bank, backing client trades that touch the UK – typically confirming LCs and providing trade financing – while also maintaining its own network of correspondent partners to facilitate trade activities in other regions.

The core function of treasury in supporting this long-established trade finance business, says Yadav, is to provide FX/derivatives execution and risk solutions to clients and counterparties in these markets, many of which are now seeking a more sophisticated and technology-enabled offering. Furthermore, treasury acts as a money market counterpart in activities such as deposits and placements, and extends its Shariah-compliant product offering to clients in core markets.

Structuring for success

In terms of funding, BACB is a licensed deposit-taking institution. It has liabilities “north of $2bn”, mostly drawn from counterparties in its core North African markets. This, says Yadav, gives BACB a robust capital structure and funding arrangement. But as with most astute large commercial organisations, the structural shape of its balance sheet is constantly reviewed. Towards strengthening its funding base, the bank is focused on diversifying its deposit mix and reviewing various options to achieve this.

Liquidity first

As a bank with a clearly defined position in the market, BACB anticipates certain challenges but also plenty of opportunities as it carries out its day-to-day activities. A key role of BACB treasury is to manage the bank’s balance-sheet resources, in terms of capital, funding, and liquidity. As a commercial treasury, it also executes client trades and provides risk solutions. With regard to operational activities, treasury is responsible for managing different portfolios: key among these is its liquidity and hedging portfolios.

Every bank is subject to specific regulatory requirements. Being incorporated in the UK, BACB is held accountable to the Prudential Regulation Authority (PRA) and Financial Conduct Authority (FCA ). The regulator sets the standards and policies that it expects all financial institutions to meet, and it monitors compliance against these, alongside the rules it has implemented from the wider-reaching Basel Accords.

Treasury is not only required to manage all of the bank’s business and cash flows in terms of daily liquidity management up to three months out but, at the same time, test its response to certain stressed scenarios for those cash flows, notes Yadav.

At a practical level, this is why funding diversification is essential for BACB. It’s also why, in terms of liquidity, it has an ongoing planning structure for both how it positions its portfolio, and ensures the right management actions are in place to respond to any actual stress. These plans are reported by treasury to the board in the formal documents of the internal liquidity adequacy assessment process (ILAAP).

“We are a specialist bank, operating in specialist markets, so the risks we face from a capital, funding, and liquidity perspective are highly nuanced,” comments Yadav. “Which is why some of the stressed scenarios we apply are tailored to the business and markets in which we operate.”

Stress-test scenarios in banking are idiosyncratic. Because each bank is in the best place to understand the risks and challenges it faces, and know what its main vulnerabilities could be, scenarios are set within the bank, at board level, and agreed with the regulator.

“As part of our annual assessments, capital and liquidity calculations are submitted to the PRA,” he explains. “These form the basis of our regulatory engagement, and regulatory confirmation, in terms of our balance-sheet resources being fit for purpose and resilient in the face of the potential stresses.”

But, notes Yadav, the bank also needs to keep up to date with “a host of other regulation”, some of which is highly prescriptive, some open to interpretation. “Either way, we’ve got to be geared up for it, with in-house expertise or through external advice and assurance.”

The governance aspect, and the overall framework within which the bank operates, should “never be underplayed”, he states. “The right approach ensures, all the way up to board level, that there is a solid understanding of how we position ourselves with every current and developing regulation.”

Since Yadav has been with BACB, he has observed “positive” relationships with its regulators. “That’s essential, because managing resources and executing strategy without their validation would be a very difficult place in which to operate.”

Banks are expected to have robust frameworks and processes around financial crime, sanctions and AML. For a bank trading in emerging markets, Yadav notes that this is “even more relevant for us”. These jurisdictions, he says, present certain “more pronounced risks”, especially from a compliance perspective.

“In every case we must build and maintain local knowledge and expertise. One of the main challenges we have, from a treasury and bank-wide perspective, is to proactively stay on top of regulatory or political developments in every market, and build out a regulatory, compliance and business response.”

Resources, resources, resources

There are other more direct challenges, of course. In managing BACB’s balance-sheet resources, Yadav says treasury has a key role to play. “When we consider the bank’s strategic plan over the next, say, three years, we have to ensure we have both the right sort of resources, and the right capacity to operate and deliver that plan. Treasury has a central role in making sure that those resources are available.”

Of course, sources of capital funding and liquidity are finite, and so treasury must find the best balance between those that are available. “Within the parameters in which we operate, building capacity across business areas is crucial, and treasury plays a pivotal role in planning and creating balance-sheet capacity. It requires conversations at both board and executive committee levels, with treasury proposing the most suitable distribution for business while optimising balance sheet utilisation.”

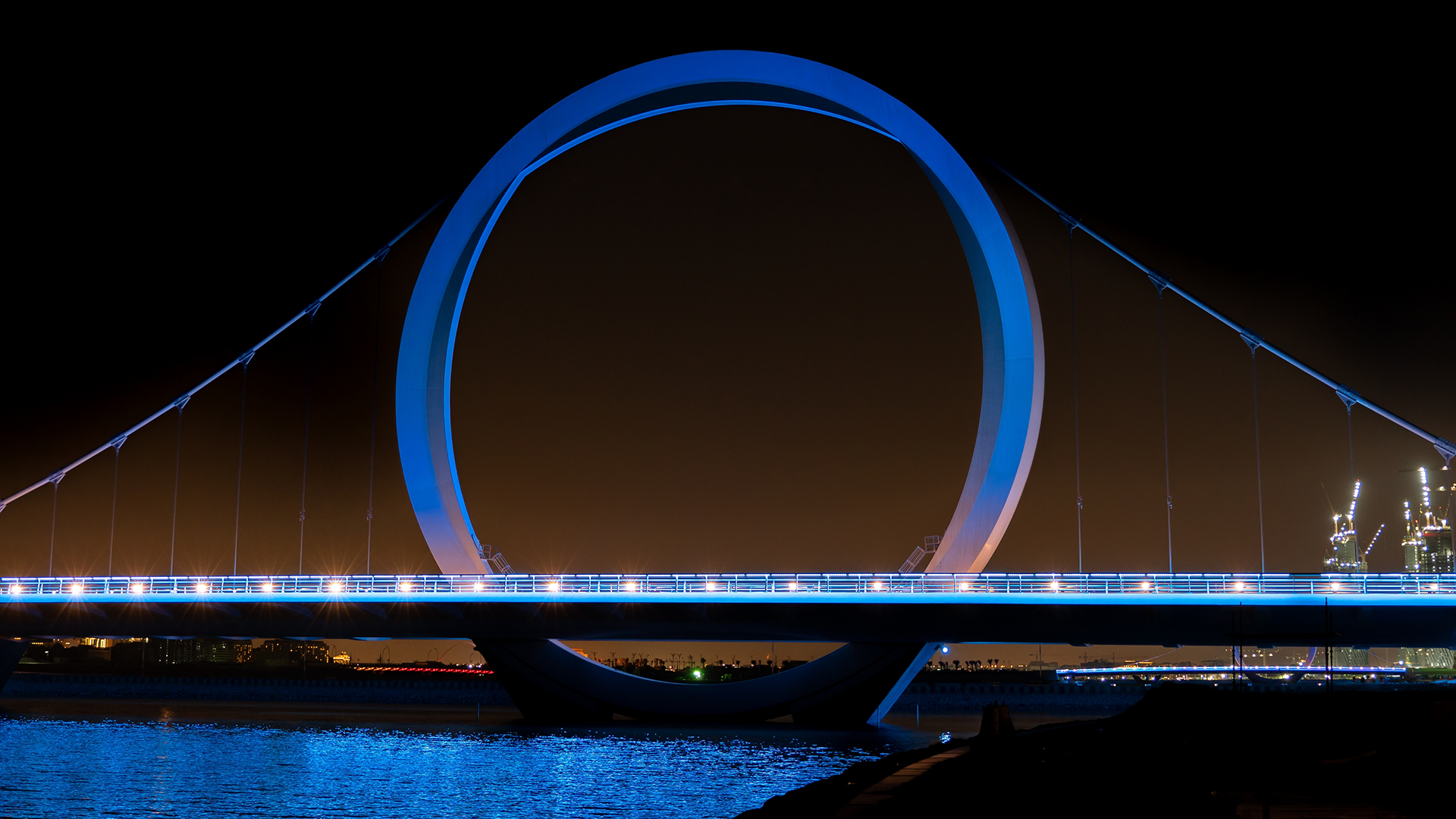

Operating together, building bridges

Beyond pure treasury activities, yet very much informing its functional efficiency, is the matter of technological development. Digital transformation, for Yadav, is about treasury “better positioning itself to respond to business and strategic change”. Indeed, over the past decade, his bank treasury leadership roles have seen him assume the mantle of “change agent”, driving transformations to align treasury with bank-wide programmes in response to developing market needs.

It has also been an opportunity to provide key clients and counterparties with training about products, processes, regulatory developments, and risk frameworks. For instance, recent well-received week-long sessions held for clients focusing on treasury and trade finance, were aimed at building a deeper understanding of these aspects and exploring how technology is being leveraged to deliver better outcomes.

The drive for enhancement is well paced. “Africa as a continent is definitely moving ahead with plans for marketplace integration and monetary unions,” says Yadav. “There is a huge amount of work underway, and technology has a key role to play, which is why we’re introducing these conversations now, as part of our training sessions.”

Treasury’s push for progress has an internal component too. To ensure his department’s work is aligned with that of non-treasury colleagues within the bank, Yadav stresses the importance of collaborating with colleagues, in both corporate and FI coverage teams.

“Treasury cannot operate in a silo. It has to be a joined-up effort to understand client requirements so as to deliver suitable products or tailored solutions in some cases. And that’s part of the transformation we’re going through, operating together, building bridges, and having conversations across the business areas to identify where value could be added.”

With a number of BACB’s clients and counterparties increasing in sophistication, their thoughts are turning to accessing more developed markets and products, Yadav explains. “We will have an increasing role to play here. For instance, if a client is looking to grow its portfolio management function, treasury supports it in building and developing this capability. That support covers market access, product knowledge, technology, and skills development. Once the client builds that, then we can start talking about more sophisticated products.”

Strategic conversations pay off

Treasury has become more integrated within banks over the years, and notably since the 2008 global financial crisis, notes Yadav. “We’ve gone from being an operational and trading function, to being a strategic business partner. At BACB, treasury plays a key role in decision-making, helping inform the setting of bank strategy and risk appetite.”

A more prosaic yet nonetheless significant area of development that Yadav highlights concerns the bank’s requirement for treasury to operate as a profit centre. “In the past it has operated that way, but it’s been one of my mandates for change that we stop thinking about short-term profits and instead focus on balance-sheet optimisation and long-term stable, sustainable earnings,” he explains. “That is more important regarding what treasury delivers in terms of value, not just in terms of its own performance, but also in supporting the business areas and driving the right outcomes from a balance-sheet perspective.”

The mechanics of this can be seen in how appropriate funds transfer pricing (FTP) is established. FTP is the mechanism by which treasury allocates funding and liquidity costs to the business lines.

“FTP is complex and contentious, and it’s easy to get stuck in the weeds with the finer details,” comments Yadav. But ultimately, he says it has to be viewed as resource allocation. And as long as treasury is transparent, aligns with what the bank as a whole is looking to achieve, and its strategy is clear, it becomes easier to implement. “If you’re having the right strategic conversations, which are made possible through suitable governance structures, it can be applied as an effective tool.”

Treasury, Yadav believes, needs to keep pace as the bank continues to grow. “The board is looking to us to build upon the bank’s capabilities in terms of product offerings, and to explore market access and coverage opportunities, both in terms of new geographies and clients,” he reveals.

Solid foundations

To achieve its goals, treasury resourcing will need to be reviewed. “Allocation of resources is driven by client needs. Given the volumes treasury has at the moment, it makes no sense for us to onboard a white-label solution or build a TMS without thinking about where we’re going to be over the next few years and what the clients seek.”

But encouragement and support for treasury from the board and executive committee are readily apparent, he adds. “They’re obviously very aware in terms of understanding our client needs because we are constantly talking to all of our key relationships. And because clients also talk directly to us about what their needs are, if they need a technology solution for booking FX trades, for example, it makes it easier to present a business case for executive and board approval.”

With that strong internal support and clear strategy, its positive relationships with regulators, counterparties and clients, Yadav states that BACB is able to remain fully committed to the regions in which it operates. “And we’re in a very strong place to continue our journey, with treasury now playing a key role.”