- Jarno Timmerman

- Head of Treasury South East Asia Pacific, AkzoNobel Treasury & Investor Relations

by Jarno Timmerman, Head of Treasury South East Asia Pacific, AkzoNobel Treasury & Investor Relations

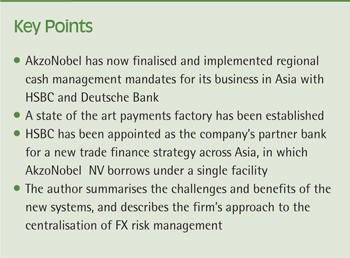

AkzoNobel has a centralised approach to treasury management, with a regional treasury centre (RTC) based in Singapore with responsibility for Asia Pacific, apart from China, Hong Kong and Taiwan which are supported through a dedicated treasury function in Shanghai. The RTC supports between 110 and 120 entities across 20 countries, covering cash management, foreign exchange, risk management, internal and external financing and investment.

[[[PAGE]]]

Gaining a market appreciation

When I joined the Singapore RTC 18 months ago, the difference in doing business in Asia compared with Europe was very striking. While Europe remains troubled by economic stagnation and uncertainty, the atmosphere in Asia is very positive and entrepreneurial. Even so, many of the countries in which we operate are still emerging economically, with varying degrees of regulatory restriction and currency controls. While this issue is well-known to treasury professionals worldwide, it is often difficult to appreciate the extent to which these restrictions differ by country and the varying levels of maturity in each country’s economic development and financial infrastructure without being ‘on the ground’.

Regulators in each country take a distinct approach to regulatory change, which is important to understand. In India, for example, it is common for rules to be established and then adapted. In Indonesia, there is more of a tendency to pilot changes, and then reverse or amend them depending on the outcome. These cultural, economic, regulatory and infrastructural differences, and the pace and nature of change, create completely different dynamics for managing treasury in Asia compared with Europe.

A pioneer in payments

Prior to my arrival, AkzoNobel had put in place regional cash management mandates for its business in Asia with two banks, HSBC and Deutsche Bank, which we have now finalised and implemented. This has included putting in place a payments factory, which covers both open and restricted economies, which is unusual amongst corporate treasuries. We have our own SWIFT address, so we have full access to the banking network and have set up robust interfaces between our internal SAP infrastructure and our partner banks, which has led to highly efficient and secure transaction processing.

In liberal countries (such as Singapore, Australia and New Zealand) we process payments on behalf of group entities (‘payments on behalf of’ or POBO). In more restricted countries, we still collate and process payment information centrally using a single platform, but payments are executed through the relevant entity account. Our payments factory is also distinctive in that we have configured our systems to process local payment instruments and formats as well as electronic fund transfers based on standard formats, enabling us to meet the needs of each entity as comprehensively as possible.

There are a few payment types that we are obliged to treat as exceptions, such as payroll and statutory payments in some jurisdictions which have specific data requirements, and in some cases we need to process these through local banks. However, only 5-10% of payments in Asia are treated as exceptions while the remaining payments are processed by HSBC or Deutsche Bank. As regulations in each country evolve, we are able to adapt the way that we support the relevant entities, and we can connect additional entities into the structure.

Our payments factory has been instrumental in reducing costs and improving efficiency and control, but also improving our business intelligence, such as cash flow forecasting. We focused on building a ‘state of the art’ payments factory from the start, and it has proved not only one of the most valuable, but also the most interesting element of our in-house bank structure. This is particularly the case in more complex economies which are now moving into scope as regulatory conditions evolve.

Extending centralisation to trade finance

Having successfully centralised bank relationships and standardised transaction processing for cash management, we have now set out to achieve similar benefits in trade finance. Previously, trade finance activities, such as letters of credit and guarantees, were managed locally by each entity, resulting in fragmented relationships and inconsistent, inefficient processes and controls. We worked with each entity to understand its trade finance needs and created a request for proposal for a regional trade finance mandate. Our objective was to standardise our trade finance activities and processes, reduce costs and enhance efficiency and control.

We appointed HSBC as our partner bank, and we are now implementing our new trade finance strategy across Asia. AkzoNobel NV borrows under a single facility, as opposed to each entity borrowing locally, and then allocates a credit limit to each entity. Local finance teams then connect to a single platform to access financing and execute transactions within the agreed credit limit agreed with treasury.

Overcoming challenges

One of the most significant challenges in implementing a centralised approach has been cultural rather than technical. The AkzoNobel Group has traditionally operated as a loose alliance of small and medium-sized enterprises, with a high degree of autonomy and an entrepreneurial culture. As the size of each entity, and the number of entities within the group has grown, however, this approach is not longer viable, and we needed to standardise and streamline our activities to maintain our competitive position. The challenge was how best to foster the entrepreneurial spirit that AkzoNobel’s employees value, whilst encouraging support for greater centralisation.

We debated how best to encourage financial controllers and local finance teams to use a central platform: for example, while we could have enforced compliance through treasury policy, these entities are remote from the group’s headquarters, so we decided it would be better to work closely with financial controllers to articulate the benefits rather than imposing compliance from afar. This approach also enabled us to access local expertise to understand and adapt our systems and processes to support specific needs in each country. HSBC has also been very helpful by engaging with local entities as well as group treasury: indeed, the bank’s coverage, local network and expertise in working at multiple levels within client organisations were amongst the factors in our selection.

Monitoring progress

Although we are at an early stage in standardising our systems and processes, and rationalising bank relationships, the implementation is proving highly successful. A number of entities already had connections with HSBC, which has been very helpful in building trust and confidence. In these cases, the first step has been to convert contracts to the standard group-wide template that we have in place, and then onboard each entity in turn, which will continue throughout 2015.

Looking ahead

Having made considerable progress towards centralising payments, cash management and trade finance in Asia, with a robust base from which to extend these activities in the future, the next major area of focus is FX risk management. In some cases, namely convertible currencies such as SGD, HKD, AUD and NZD, these are hedged through the in-house bank at our group treasury centre in the Netherlands. For restricted currencies, we currently hedge FX exposures locally, with financial controllers approaching their bank directly. As FX risk management is only part of their role, and the number of transactions may be relatively small, it is typically easier to approach their cash management bank, rather than obtaining competitive quotes.

We decided that it would be better to centralise FX risk management in order to ensure the necessary degree of specialist skills, reduce costs and increase processing efficiency and control. Under a new procedure, business units will advise treasury of their hedging requirements via SAP, and the RTC will then collate the relevant exposures, and route these automatically to authorised banks via Bloomberg FXGo for competitive bidding and transaction execution. This approach remains relatively unusual amongst corporations in Asia. Many companies choose to do auto-dealing of FX exposures with their cash management bank through the bank’s platform, or deal manually by telephone. However, by connecting FXGo with SAP, we achieve the benefits of straight-through processing with better price discovery.

Pursuit of excellence

In addition to the major centralisation projects in which we have been engaged, we have a constant focus on optimising our financial and operational efficiency. For example, we are working closely with our treasury centre in Shanghai to determine the best means of integrating RMB into our regional and global liquidity management structures. Similarly, now that our cash management mandates are fully operational, we are now looking to refine the solutions and services in each country to ensure that we are benefitting from optimal performance from our banks, and delivering the best possible service to group companies.