After the Ballots

How the ‘year of elections’ reshaped treasury priorities

Published: May 01, 2014

FX losses amongst corporations in 2013 amounted to $17.8bn amongst fewer than 850 international companies. In an environment where sophisticated treasury and risk management systems are more readily available and cost effective than ever, online portals streamline the dealing process and a variety of hedging techniques are well-established, it seems hard to understand why. After all, with all these tools at their disposal, surely FX risk management should no longer prove an issue for treasurers of multinational corporations? FiREapps’ recently released 2013 Corporate Earnings Currency Impact Report provides a stark reminder, however, that managing FX risk remains a very real and tangible issue. With 846 multinational corporations included in the study (representing a subset of the Fortune 2000 companies that have at least 15% or more international revenues in at least two currencies) the impact of FX risk within this sample and the broader implications for the international corporate community are material and serious.

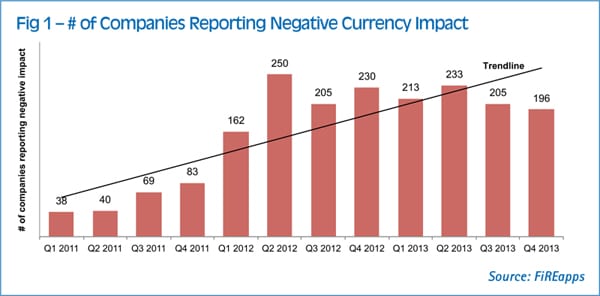

Twenty-five percent of the companies included in the FiREapps study reported negative impact resulting from FX volatility over the course of 2013 (figure 1).

This resulted in a net loss of $17.8bn in 2013 (figure 2) reflecting growing losses resulting from currency volatility from previous years, with the exception of the second and third quarters of 2012 when the euro crisis was at its height.

It is not only ‘difficult’ currencies that are resulting in FX losses. Despite the challenges of managing increasing exposures to more challenging currencies, such as in emerging markets, the major ‘culprits’ that are resulting in these exposures are mostly tradable, unregulated currencies, as figure 3 illustrates. Although this study is based on US companies, the same challenges exist for European and Asian companies, although they would report different currency exposures according to their geographic footprint and trading relationships.

Notably, since the first version of this study was completed in Q1, 2011, the euro was no longer included in the top five currencies and has proved stable against the USD, trading in the tightest range that has existed for over a decade. Consequently, companies for which Euro is not their base currency did not suffer the same negative currency impact as they had done in 2012.[[[PAGE]]]

Treasurers reading this may be surprised at these findings, particularly those who have well-established FX risk management strategies. Putting to one side the specific ‘currency culprits’, given that these will differ for companies headquartered outside the United States, the materiality of negative currency impact on earnings is still extremely significant. There would appear to be a variety of factors behind this which we will not have the time to cover comprehensively here, but include:

Although some companies have taken the decision to manage FX risk only to an extent, the scale of the impact of FX losses on corporate earnings is not lost on analysts or investors and indeed, they are scrutinising corporate results and risk management strategies in more detail. The FiREapps study highlights some interesting exchanges between analysts and CFOs during Q4, 2013. On being asked about the FX impact on quarterly earnings, one CFO of a $17.4bn company operating in over 200 countries with over 80% of revenues generated outside the US responded,

“My experience over the last five years with foreign exchange is that everybody knows after the fact”.

Another, the CFO of a $10bn company with businesses in over 100 countries replied,

“What we’re doing is trying to find ways to mitigate the impact where possible, looking at natural hedges. And we expect that we will have some impact along the way.”

Shoulder-shrugging and accepting that FX losses are simply a cost of doing business will become less and less acceptable to investors, credit rating agencies and analysts who are becoming increasingly sophisticated in their awareness of FX risks. Despite many of the world’s largest multinationals having considerable access to skills and infrastructure for FX risk management, they are sustaining significant losses; furthermore, the CFO’s office often seems to lack a detailed understanding of the issues involved.

It is not only analyst and investor perspectives that are changing. Globalisation is creating a different competitive landscape. Companies headquartered outside the US and Europe are expanding internationally, and are less inclined to do business in USD or EUR for cross-border trade, resulting in a wider currency mix for some companies. The growing emphasis on emerging markets for both sourcing and sales is not only increasing the number of currencies that companies need to manage, but the value of these flows is also becoming more material.

The FiREapps research highlights that the average hit to earnings per share (EPS) from negative currency volatility is $.03 (compared with the fact that many FX managers have KPIs of less than $.01 EPS impact from balance sheet exposures alone). Furthermore, there is also an impact on stock prices, whether positive or negative. However, the positive currency impact on stock prices in terms of stock price increase is less than the drop in price as a result of a negative currency impact (IntelliBusiness/eventVestor and Sharon Merrill Associates, The Guidance Effect: Improving Valuation, August 2012). Among companies in the S&P 500, this means an average negative stock return of between 125-430 basis points in the 20 days after announcing, compared with an average positive impact of 30-100 basis points over the same period. In both cases, most of the stock return change occurred immediately.

As a result of changing competitive dynamics, and an evolving currency mix companies that manage their FX risk proactively (which is not the same as adding complexity to hedging strategies) have the opportunity to create significant competitive advantage, minimise negative EPS impact and stock price.

Firstly, this requires a complete view of exposure across the business, which can be challenging where cash and treasury management is performed locally and/ or where exposure information is not centralised in a single system. The technical implications of achieving this are becoming less challenging; however, organisational obstacles can be more difficult to overcome without sufficient management attention. Without a clear view of exposures, it is impossible to recognise or manage risk effectively.

Secondly, the FX policy needs to be clear, appropriate to the business and achievable. This means that it needs to reflect the corporation’s currency mix, materiality of foreign currency flows, shareholder appetite and resources (both in terms of expertise, headcount and technology) available. In some cases, treasurers will have a strong business case to increase resourcing or invest in technology if it means they are in a better position to manage FX risk effectively. The FiREapps study notes,

“Historically, companies may have focused on the five or ten largest exposures, but today the companies that manage risk well are taking the portfolio approach: manage currency risk across all exposures such that the impact of fluctuations falls below a pre-set threshold – no matter which way any currency pair moves.”

During the years immediately after FAS 133 and IAS 39 were introduced to determine the accounting treatment of hedging transactions against business exposures, the use of derivatives for managing risk fell out of favour, as often they were considered too complicated, particularly where it was difficult to demonstrate hedge effectiveness. Indeed, we have featured case studies in TMI in the past where companies have stopped hedging FX risk altogether, primarily as a result of hedge accounting requirements. However, bearing in mind the potential impact that FX losses can have on the business, greater understanding and consistency amongst auditors and better functionality offered by ERP and TMS, treasurers are generally more able to take hedge accounting requirements in their stride. In addition, many treasurers have convinced the board and CFO that a hedging strategy that does not fulfil hedge accounting requirements may still be advantageous.[[[PAGE]]]

Thirdly, banks are increasingly able to offer bespoke risk management strategies (particularly for companies where resources to manage FX risk are an issue or the range of exposures is considerable). Treasurers are often reluctant to discuss their FX risk management issues with their banks, in some cases due to concerns that they will be sold complex products that are not easily understood by the board or cannot be managed through existing systems. These concerns are generally unfounded, and increasing transparency and simplicity is often a key objective. Furthermore, it is not only FX hedging strategies that can help to reduce foreign currency exposure, and therefore the impact of currency volatility.

In addition to specific FX hedging strategies, cash management solutions also have an important role in simplifying FX risk management, particularly for small currencies. For example:

Increased analyst and investor scrutiny of FX management and changing market dynamics mean that company boards, and therefore CFOs and treasurers, cannot be complacent. While in the past it was common for finance professionals with a background primarily in accounting to become CFO, it is becoming increasingly clear that the CFO needs to have significant treasury and risk management experience to ensure that sufficient focus is given to FX, and to address with analyst and investor queries. Treasurers also need to have an open door to the board so that treasury issues remain high on the strategic agenda. Thirdly, every company operating internationally that is exposed to FX risk has a strong business case to invest in the skills and infrastructure required to manage FX risk given the materiality of currency volatility on earnings. With globalisation continuing to dominate the strategic agenda for companies of all sizes, and ongoing changes in the currency market, not least the gradual liberalisation of RMB, FX risk management will continue to pose challenges for treasurers but also the opportunity to deliver material value.

With many thanks to FiREapps for access to their Q4 Currency Impact Report. This report and other research findings, together with information on FiREapps’ FX risk management solutions, can be found at www.fireapps.com