- André Casterman

- Chief Marketing Officer, Intix

by Andre Casterman, Chief Marketing Officer, Intix

Regulation and digitisation are having a profound impact on the information processed by corporate treasurers. We are seeing a number of newly digitised processes emerging, such as electronic bank account management (eBAM), know your customer (KYC) etc. with new formats and ever-increasing amounts of data that need to be stored and organised.

Data in treasury is derived from a number of data sources, which are often very specialised, including the ERP, treasury management system, trade finance systems, ePresentation, eInvoicing, receivables financing, FX platforms, purchase-to-pay and collateral management, amongst others. The specialised nature of these platforms, and the specific nature of the data they produce, creates silos that make it difficult to achieve visibility and control over the financial supply chain. This contrasts with treasurers’ aim to achieve end-to-end visibility, and structured information to automate reconciliation processes etc.

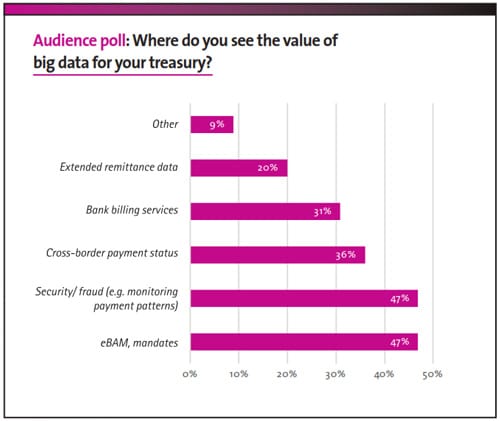

Data management technologies (‘big data’) are becoming instrumental in helping to manage and navigate data to establish full control/ visibility over the financial supply chain, and build a more complete view of transactions and exposures, irrespective of the systems, formats, semantics and character sets in which data was originally presented. Furthermore, by adding algorithms such as artificial intelligence and predictive analytics on top of the core data, treasurers can gain better insights into the future and significantly enhance decision-making.