After the Ballots

How the ‘year of elections’ reshaped treasury priorities

Published: January 01, 2014

Alstom works in four distinct business segments (thermal power, renewable power, grid and transport) each comprising a large number of subsidiaries operating globally, it was difficult to align cash and processes. To address these challenges, we made the decision to centralise and optimise our treasury structures, and enhance communication between treasury stakeholders. This article outlines some of the ways in which we have achieved this, and our plans for the future.

As a first step, we revised and restated our corporate treasury objectives. We determined that cash is a corporate asset and a common resource for all Alstom entities; therefore, it should be managed centrally. We aim to minimise the impact of financial risk on our balance sheet and the potentially negative effect of fluctuations in the foreign exchange and capital markets on our profits. We achieve this by identifying, hedging and actively managing risks, within well-defined objectives and limits, as well as actively evaluating and monitoring the cost of debt.

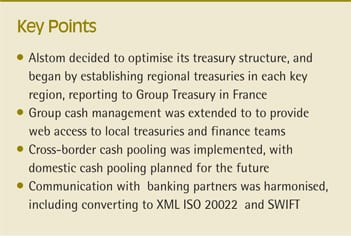

While many large multinationals have focused on establishing a single, global treasury centre, we recognised that this approach would not be feasible at Alstom. It is important that our treasury team maintain close proximity to the business to understand and respond to changing regulatory, operational and strategic requirements. At the same time, we wanted to achieve a simple, transparent treasury organisation that leveraged skills efficiently across the business. We therefore established regional treasury centres (RTCs) in each key region: Europe; North America; South America; Middle East & North Africa and Asia (including China). This allowed us to maintain a presence in each major time zone and develop expertise in regional treasury issues. These RTCs report into our group treasury in Levallois-Peret, France.

This structure offers the simplicity and transparency that we were seeking, and enables us to standardise policies and procedures at a group level. Country treasurers report into the relevant RTC, who act as treasury’s eyes and ears in each country, providing treasury expertise and input across the entire organisation and relationships with our key banking partners at a local level.

One of the primary objectives behind our treasury organisation was to enhance the way that we managed liquidity and risk. We recognised that we could not achieve this without a consistent, automated means of communicating both across and beyond our treasury organisation. For example, cash flow forecasts are completed by local finance teams. These were often produced differently, making it difficult to aggregate information in a consistent and reliable way. Implementing such a tool would also be essential to support a centralised treasury organisation. Funding would be provided through treasury, whenever possible through an automatic cash pool replacing intercompany borrowings.

We therefore extended the use of our Group cash management tool to provide web access to local treasurers and finance teams. Currently, the tool is used to input cash flow forecasts, retrieve reporting and request foreign currency (FX spot) and is being rolled out globally. Cash flow forecasts (announcements) are produced daily by all entities included in a cash pool, and every two weeks by those that are not. We are also integrating this tool with our hedging solution and other systems used in treasury to create an integrated, automated treasury technology infrastructure.

In the near future we will expand its use to FX (forwards and swaps), enabling us to use a single tool to support liquidity and risk management. Alstom’s hedging activities are very complex, particularly bearing in mind the large number of currencies that we manage and the volume of exposures across the business. By bringing together exposures in a consistent way and aggregating these more effectively, we will be able to implement a more integrated approach to hedging at a group level.[[[PAGE]]]

Having restructured our treasury organisation and established a more effective means of managing our liquidity needs, we were then in a position to review and rationalise our banking relationships. We wanted to optimise our core cash management and liquidity partners wherever possible and implement cash pooling to centralise liquidity more effectively. As a rule, we use zero balancing, and only use notional pooling where zero balancing is not available. The first step was to pool cash cross-border to create a single balance per currency. The second step will be to implement domestic cash pools in each country/ currency. This second step will be the more challenging and involve opening off-shore accounts for each entity in the most favourable location for each currency. This will require opening many new accounts and closing legacy accounts. We expect the process to take time to complete but it will be a significant step in enhancing cash and liquidity management at Alstom, e.g., by reducing the number and cost of cross-border flows and potential loss of value through different value-dating conventions as well as impacts on trading dates.

As well as rationalising our banking partners, it was important to harmonise the way that we communicated with them. We are therefore mid-way through a project to route all our bank communications to a single tool which first converts the formats received from our various internal systems into XML ISO 20022 and then channels these files to SWIFT. This solution brings a range of advantages. In particular, we do not need to amend the formats produced by our existing systems as these are automatically converted. However, we benefit from a consistent means of interacting with our banks, which reduces our integration cost and resource requirement, and allows us to automate processes such as reconciliation as we receive data in a more consistent way. The CGI version of ISO 20022 on which we have based our bank communication is now accepted by most of our banks both for SEPA and non-SEPA payments.

As a result of restructuring our treasury organisation, we have reduced the resources required to support the cash, treasury and risk management needs. Processes and reporting that were often replicated in different parts of the organisation have been rationalised. We have harmonised policies and processes across the Alstom group, including a consistent approach to reporting which improves the quality of decision-making, security and control. There are some exceptions where more specific processes are required, but there are very few countries where a group-wide approach cannot be implemented.

Our external cash management costs have already been reduced and we expect to make further savings as we roll out our cash pooling strategy further. In addition to direct cost savings, we are on the way to implementing a world-class treasury organisation with industry-leading levels of efficiency and control whilst supporting the evolving needs of our business, both now and in the future.