After the Ballots

How the ‘year of elections’ reshaped treasury priorities

Published: October 01, 2011

As the company grew, we had a number of cash management banks in place, which led to a lack of visibility and control over cash, which became fragmented across different banks and accounts. While treasury acted as an in-house bank using intercompany loans, this was inefficient from a cash management perspective, with capital invested at a local level. Furthermore, this approach was administratively intensive with a great deal of legal documentation and board resolutions required for each loan. As the business matured, a growing number of subsidiaries had moved from a cash negative to a cash positive position, so the total amount of surplus cash across the business was growing. However, with an aggressive growth strategy in place, we wanted to use this cash to fund new subsidiaries in an efficient way, which in turn prompted our decision to seek a new, efficient international cash management solution.

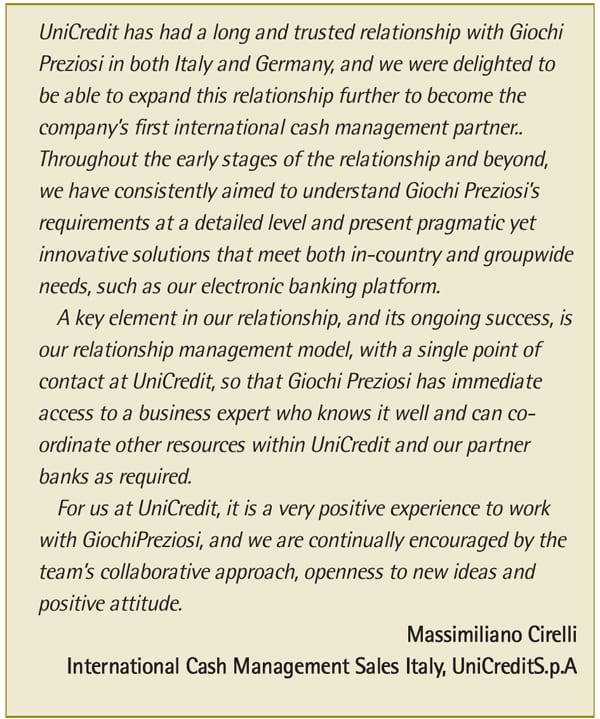

We already had a domestic cash pool in place with UniCredit in Italy, which had proved successful in allowing us to take greater control over our cash, so our aim was to extend the same model on an international basis. We also had an overlay relationship with the bank in Germany. We approached each of our major banks to tender for an efficient cash management solution that would meet our initial needs and our future requirements. Ultimately, we made the decision to pursue our relationship with UniCredit further, based on our confidence in the relationship and the quality of the solution that the bank proposed. We therefore launched a pilot project in Germany. This involved setting up a new credit facility and header account in Germany, into which all flows in Germany were zero balanced each day. This was supported by an electronic banking system that was accessed from both Germany and Italy, with appropriate user profiles. Given the complex partnerships’ scenario the group has, and the heavily seasonal business which involves a few months of peak financial needs, we still work with different banks depending on the country; however, we certainly appreciate the benefits and efficiency of working with one primary banking partner. The success of the pilot quickly suggested to us to expand this solution across other subsidiaries. [[[PAGE]]]

We certainly appreciate the benefits and efficiency of working with one primary banking partner.

Following the successful implementation in Germany, we then extended the project to France. Here the bank co-ordinated its activities with its IBOS partner, so that we could connect our accounts in France with our international cash pool. Looking ahead, we will also extend the project to countries such as the UK and Hong Kong using the same model as in Germany.

Our international cash pooling project has progressed very smoothly within tight timescales, and without the need to make a major IT investment. This has largely been due to the commitment and expertise of our colleagues at UniCredit, to whom we delegated much of the implementation. We have got to know the team well, and they in turn have a sound understanding of our business. Consequently, we did not experience any major challenges during the course of the implementation. Involving third-party banks inevitably took a little more time in order to deal with legal and integration requirements, but UniCredit remained very supportive throughout.

Centralising our cash from Italy, Germany and France, with more countries to follow, has already proved very successful. Intercompany lending is far more efficient and easier to manage, and allows us to manage our counterparty and financial risk far more effectively. We also have far greater visibility and control over our cash which in turn means that we can make better use of it across the group, increase investment returns and minimise borrowings.

The cash pooling project is one element in a wider cash management transformation, but a very important one. In addition to centralising our cash, we are also looking to standardise our financial software across the group: currently, each subsidiary uses its own treasury and accounting tool, but we are intending to roll out SAP globally. We will then consider whether to use SAP for cash and treasury management or whether to use a specialist tool located in our Italian headquarters for both our domestic and international business. We have also centralised many of our core processes, such as procurement, which is based on Hong Kong. Consequently, as this group is responsible for most of our larger purchases, local payments are typically small, reducing the amount of cash required at a local level.

Our experiences of enhancing our cash management with UniCredit have been very positive and we would recommend the approach that we have taken to other companies experiencing similar business challenges to our own. It is very important to make a realistic and comprehensive analysis of the cash management needs of the business, to ensure that a partner bank can quickly develop a detailed understanding of the company, and recommend the right solution. This includes looking ahead to anticipate the likely business requirements in the future as well as current needs. It is also vital to select the right banking partner, who can remain close to the business, and has the local expertise and international reach to support both domestic and international cash management objectives.