- Bas Rebel

- Independent Treasury Consultant, BFRC

Independent treasury consultant Bas Rebel picks his way through the ‘minefield’ of fiscal and regulatory reforms surrounding cash pooling and examines the advantages and challenges to prove the overall benefit case of this method of liquidity management is still strong.

Cash pooling is in the crosshairs of regulators and tax authorities. This scrutiny increases the cost and complexity of compliance and maintenance – and may even make cash pooling unattainable for some organisations. But in the current economic climate, when many organisations are looking for liquidity and exploring areas where costs can be cut, let us not forget cash pooling’s raison d’être: efficient liquidity management. With that in mind, the business case remains worthwhile pursuing.

Physical versus notional pooling

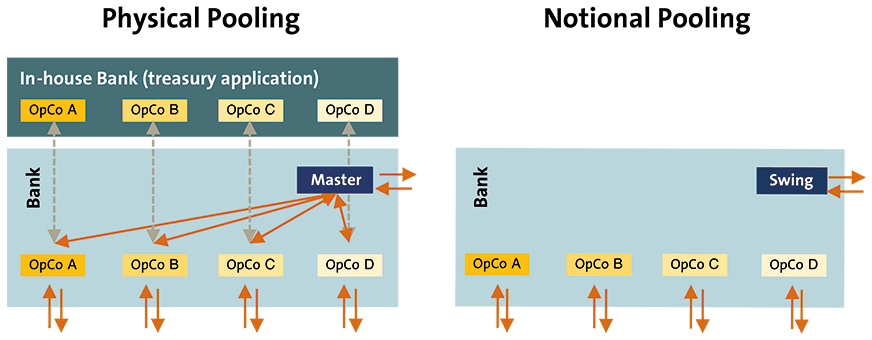

There are two types of cash pooling solutions physical and notional (see fig. 1). All pooling products offered by banks, including target balancing, Nordic, cross-border, cross-currency and cross-bank pooling, are variations of either or a combination of both. Virtual bank accounts – the latest pooling innovation – can be regarded as a hybrid of physical and notional pooling.

Fig 1: Two main types of cash pooling

Source: Bas Rebel

Physical pooling, also known as Zero Balancing or ZBA, refers to solutions whereby end-of-day cash balances are transferred to a master-account. Physical pooling creates a deposit (or a loan) between the owners of the sub-accounts and the master account. This may not be an issue when the pooled accounts are owned by the same entity, however it does create tax and transfer pricing issues when the two types of accounts are owned by different, affiliated companies, especially when these reside in different jurisdictions.

Physical pooling requires operational attention, because sub-account holders cannot easily track liquidity at their disposal based on their bank statement. They would need to either filter out the ZBA transactions from the bank statement or monitor the general ledger account to which these ZBA transactions are posted as representation of their (intercompany) liquidity. Furthermore, the master account holder will need to register on whose behalf it manages the liquidity in the master account. Participants can deplete pooled liquidity if not monitored.

Finally, the organisation must be able to calculate an arm’s-length interest on the pool participation in compliance with transfer pricing rules. All these issues can be solved by implementing an in-house bank (IHB) in the treasury management system (TMS) or a dedicated application on top of the cash pooling infrastructure. Typically, such systems provide a bank-like account statement report that can be reconciled with open items in the ledgers of the affiliated companies participating in the physical cash pool.

Notional pooling is a virtual aggregation of end-of-day balances across bank accounts for reporting and/or interest calculation purposes. Its popularity stems from the fact that, unlike physical pooling, it is easy to operate without a special system set-up. The participants can track their available cash by looking at their bank statement and banks can carry out the interest calculation and limit monitoring in their back-office systems.

However, from a legal regulatory perspective, notional pooling creates some complexity. And regulatory changes have made it even murkier. Banks require a cross guarantee or joint and several liability that puts each of the participants individually on the hook for debit balances by any of the other participants. These clauses are not always compatible with existing collateralised syndicate loans and often prove difficult to enforce under all circumstances.

The issue of legal enforceability triggered some debate around net representation of notional pooling on financial statements back in 2004 when IAS 32 was introduced. Banks slightly modified the way they operated notional pools as they were eager to continue notional pooling for commercial reasons. However, Basel III (published 2009, full implementation scheduled for 1 January 2023) is forcing banks to reconsider their eagerness. Basel III requires banks to calculate key capital and liquidity adequacy ratios based on the gross instead of net balances outstanding in a notional pool. This increases the internal cost of notional pooling structures where the gross balances are substantially higher than the net balances. The banks’ strategies to deal with this include capping the gross/net gap and managing client eligibility.

Net representation in corporate financial statements suffered a blow following a ruling by the International Financial Reporting Interpretations Committee (IFRIC) in November 2016 that seriously challenged the intent of netting within a notional pool.

Fiscal challenges

In addition to the legal and regulatory issues discussed above, the Organisation for Economic Co-operation and Development (OECD) guideline on fiscal reforms, known as base erosion and profit shifting (BEPS), allows for cash pooling but creates additional challenges to both types of cash pooling. The OECD guideline includes the following definition:

A written arrangement for the purpose of pooling cash and/or cash equivalent balances of related persons, in any currency, as part of short-term liquidity management, including the following elements and characteristics:

Despite its intention, the OECD guideline has not created a harmonised fiscal landscape. In some cases, like the US Section 385 reform in 2016, cash pooling almost became collateral damage of implementing the OECD guidelines in national legislation. Strong pushback from corporate treasurers and banks alike resulted in a revision of the draft legislation and a carve-out for cash pooling. However, the introduction of BEAT (base erosion and anti-abuse tax) introduced in the revised legislation, set limits for foreign companies to include US-based affiliates and their subsidiaries in cash pooling structures.

The OECD definition for cash pooling proves to be too high-level and might require non-standardised processing across multinationals that operate an IHB as a like-for-like substitute for external banks. Bullet points d) and e) allow for interpretation regarding the tax-exempted cash balances. For instance, is a liquidity buffer deposited in the IHB a structural amount or basic common business sense? Also, how can one prove that a cash balance of, say, $100 outstanding on the internal account at the start of a fiscal year is not the same $100 outstanding at the end of the year? Or, phrasing it differently, does the first-in-first-out (FIFO) measurement apply to the net or gross daily account turnover? Tax authorities in the countries where IHB clients are residing might impose a narrow interpretation in order to protect their tax base. It will be prudent for treasury to closely monitor the outstanding balances on the intercompany current accounts with the IHB and review the capitalisation of group entities regularly.

A second cluster of fiscal challenges relates to transfer pricing. BEPS encapsulates the two key objectives of the guideline: avoiding base erosion locally and shift of profits between jurisdictions. The implementation of arm’s-length pricing principles is key. Phrasing the issue more clearly: is a positive balance pooled daily a fluctuating deposit placed by the affiliate or a credit facility taken by the master? And: how to define fair arm’s-length conditions on the internal current account? Revenue agencies have become more sophisticated and require better justification and regular evaluation of the interest margins applied. In response to this, leading-edge organisations and their transfer pricing specialists are increasingly using more advanced credit-rating models in their transfer pricing policies that tend to raise the expectation with tax inspectors.

Some transfer pricing specialists don’t see a material difference between physical and notional pooling. They make a compelling case that the requirement of a corporate guarantee or act of joint and several liability implies that notional pooling has never been an arm’s-length product and that the margin set on the individual accounts, as well as the corporate guarantee, are to be governed by intercompany transfer pricing rules. The implications being that balances and (interest) conditions on bank accounts participating in a notional pool may have to be set, reviewed and calibrated regularly by the organisation itself and cannot be accepted as proposed and managed by the bank. At the same time the corporate guarantee must also be included in these calculations.

A third cluster of fiscal challenges to cash pooling relates to substance. More than ever before, tax authorities are looking beyond the contractual relationships for base erosion and profit shifts. Organisations that manage treasury in one location and use an offshore treasury entity are pressed harder as best practices are evolving. Income revenue agents like to assess where the decisions are made that justify the allocation of cash pooling benefit and interest earned on intercompany loans.

Making cash a corporate resource

While the regulatory issues and fiscal reforms discussed above may appear to be a minefield, one should not lose sight of the overall benefit case of cash pooling. Physical and notional cash pooling have been the bedrock of corporate cash management for decades for a reason. Traditionally, cash pooling has been justified first and foremost based on treasury process efficiency and centralised liquidity management. Pooling provides centralised access to liquidity and enables organisations to cut out deposit/borrowing spread on account balances. In the late 1990s and early 2000s cash pooling became the foundation of sophisticated in-house banking and payment factory solutions. In-house banking creates an even tighter control over liquidity and standardises bank connectivity and payment processes across the entire organisation. Today, IHBs and payment factories prove to be key in combating payment fraud and cyber-criminality.

However, the most important benefit of all is rarely discussed in detail: making cash a corporate resource. Cash pooling allows for releasing liquidity from working capital without increasing liquidity risk. Cash pooling reduces ‘cash friction’ within an internal supply chain to zero days.

For organisations, sales and distribution are often mostly outside of the jurisdiction where they produce and procure. Therefore, they maintain an internal supply chain and cash collected from customers in one location must be transferred to the production and procurement entities along it before it can be used for supplier payments. The velocity of the internal financial supply chain is defined by arm’s-length transfer pricing rules. Without cash pooling and IHB solutions, each affiliate would hold on to the cash collected or would need credit to bridge the time between collecting and disbursing internally.

By comparison, cash pooling automatically centralises customer proceeds and can make it available to the procurement company in another location for vendor payments that same day. If affiliates use an internal current account at the IHB for ‘cashless settlement’ of intercompany invoices when due, the group no longer requires liquidity externally or credit lines for intercompany liabilities. The IHB effectively takes over the role of external banks and surplus liquidity can be released from working capital (see fig. 2). Liquidity unlocked permanently this way will disappear from the consolidated balance sheet when used to repay debt, fund projects or distributed to shareholders and subsequently marginally increases the return on assets employed.

Fig 2: Internal supply chains and liquidity

Source: Bas Rebel

Cash pooling makes liquidity available from the moment a group company is paid by a customer for payment to a supplier elsewhere without violating arm’s-length trade terms.

Cash pooling can also be regarded as creating a portfolio of bank account balances. Without cash pooling, each bank account ought to be funded according to its cash flow forecast. Given the non- or negative correlation of daily account balances across bank accounts, the minimum of the cash pool balance will be higher than the sum of minimum balances for the participating accounts. The difference between these two minimums can be released permanently without increasing the liquidity risk for the group.

Fig. 3 illustrates the cash pooling portfolio effect using the example of three bank accounts. The yellow dotted line represents the sum of the minimum balances for the individual accounts and probably is the result of a variety of causes and decisions, including compensation for forecasting errors and timing differences between cash inflow and outflow. The orange dotted line represents the minimum of the pooled balances. The difference between these two lines is cash that is unlocked without increasing liquidity risk of the group and individual affiliates.

Fig 3: The benefit of cash pooling – unlocking liquidity

Source: Bas Rebel

The benefit case of using cash pooling for making cash a corporate resource goes beyond unlocking cash permanently. Also, in situations of a prolonged period of positive or negative cash flow, cash pooling creates additional cash efficiency. From time to time, forward-looking 30 and 90 days moving average pool balances will be considerably above the absolute minimum pool balance. The difference between these two minimum balance lines can be used for reducing the use of revolving credit facilities (RCFs) or credit lines. Furthermore, as fig.4 illustrates, during periods of persistent positive cash flow, cash pooling allows for unlocking liquidity sooner than without pooling. The trendline is an indication of how soon, on average. By the same token, in the case of a persistently negative cash flow, cash pooling postpones the funding requirement.

Fig 4: The benefit of cash pooling – unlocking liquidity in the case of a positive cash flow

Source: Bas Rebel

A tangible and powerful solution

Cash pooling not only creates process efficiency, it also enables organisations to operate in a more ‘cash efficient’ manner and reduces their dependency on external credit without increasing liquidity risk. In many cases, the total benefit of cash pooling is material and far outweighs the increased cost of compliance and maintenance. Once liquidity is released from the cash pool, it is easy to forget about the benefits created this way, especially when the unlocked liquidity is used for repaying loans and distributing dividends. Liquidity released or cash efficiency resulting from treasury operations is a tangible and powerful treasury key performance indicator (KPI) to track. It is relatively easy to explain, and it can be expressed in visible numbers, such as interest saved/increased or impact on return on assets employed.

Bas Rebel

Bas Rebel is an independent treasury consultant with 30 years’ experience in treasury strategy, operations and transformation. During the he first half of his career he held leading roles in banking, corporate treasury and treasury technology. In 2004 Rebel became a treasury consultant. He worked for Zanders and more recently for PwC.