After the Ballots

How the ‘year of elections’ reshaped treasury priorities

Published: October 01, 2013

ALTANA was operating as a pharmaceutical company with a small chemicals division until it was sold to Nycomed. Boosted by a series of acquisitions, ALTANA repositioned its business as a speciality chemicals company. The former treasury function remained with the pharmaceutical business, so the new ALTANA needed to set up a new Group Treasury function. In this article, Klaus Gerdes, Head of Treasury at ALTANA, describes Group Treasury’s experience of acquiring a treasury management system (TMS) to support the new business.

ALTANA was operating as a pharmaceutical company with a small chemicals division until it was sold to Nycomed. Boosted by a series of acquisitions, ALTANA repositioned its business as a speciality chemicals company. The former treasury function remained with the pharmaceutical business, so the new ALTANA needed to set up a new Group Treasury function. In this article, Klaus Gerdes, Head of Treasury at ALTANA, describes Group Treasury’s experience of acquiring a treasury management system (TMS) to support the new business.

When we first set up our Group Treasury function, our functional requirements were relatively straightforward so a specialist TMS was not required. Over time, however, our treasury requirements have expanded and become more complex, which prompted a TMS selection project.

We had a comprehensive catalogue of initial requirements which we used to evaluate the available TMS options. Although we already had SAP in place, we determined that a specialist system would allow more flexibility and enhanced functionality. Cash management was a key requirement, particularly to manage intercompany accounts. Other main requirements for a system included the ability to automate in-house bank postings, produce intercompany statements and manage intercompany loans effectively. In addition, a new system needed to support our requirements as they evolve in the future, such as risk management, and integration with ancillary systems such as 360T (for online transactions) and Misys (for confirmation matching) that have been implemented subsequently.

As a result of this evaluation process, we selected SunGard’s AvantGard Treasury (Integrity) solution based on its ability to meet our existing and evolving functional requirements, its ease of use and competitive pricing. The implementation has been a phased project approach. Cash management and integration with SAP, 360T and Misys were identified as the initial project priorities, which comprised the first project phase.

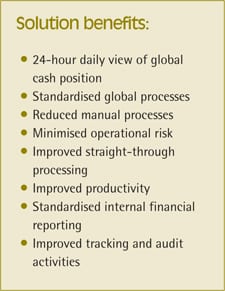

We have a small treasury team so we had limited resourcing available for the project. We therefore focused on implementing the functionality of SunGard’s AvantGard (Integrity) solution that brought the most immediate tangible benefits. These included both financial efficiency, by achieving better pricing for derivatives and enhanced decision making, and operational efficiency by automating processes and integrating the various elements of our treasury technology framework.[[[PAGE]]]

Following a successful implementation, we are using AvantGard’s Treasury (Integrity) solution for several key operations, including:

We have been able to satisfy internal and external audit requirements to enhance the transparency of processes and decision-making, and to minimise operational risk by eliminating manual processes. Integration is an essential element of a successful TMS implementation but is often overlooked. Integrating complex systems requires specialist skills and takes time, but the advantages of streamlined information flows and automated processing should not be underestimated. We have received valuable support from SunGard throughout this process to develop our SAP interface, which was a complex undertaking as multiple information flows are involved, but which has been instrumental to our project success. By integrating AvantGard Treasury (Integrity) solution within a wider technology framework, we have achieved a high degree of straight-through processing which is particularly important for a small team.

SunGard’s AvantGard Treasury (Integrity) solution has become the hub of our treasury technology framework by automating processes that were previously performed manually, and providing a central repository for treasury reporting. By integrating the solution with SAP and our ancillary systems, we have further streamlined our processes and information flows and created a technology environment that can be evolved in line with our changing treasury requirements.

Looking ahead, we are seeking to achieve further integration. Currently, MT940 files are imported daily for cash positioning and reconciliation purposes, but ultimately the AvantGard Treasury (Integrity) solution will be integrated with MultiCash. The interface with SAP will be extended to include derivative transactions for hedge accounting purposes which will bring considerable efficiencies. Currently, liquidity planning is still performed outside the system, but we are planning to migrate this process to the AvantGard Treasury (Integrity) solution in a later phase of the project.