After the Ballots

How the ‘year of elections’ reshaped treasury priorities

Published: April 10, 2013

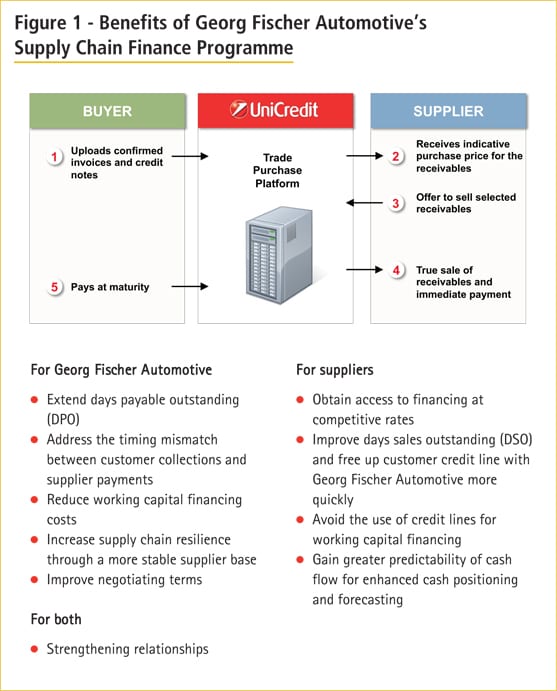

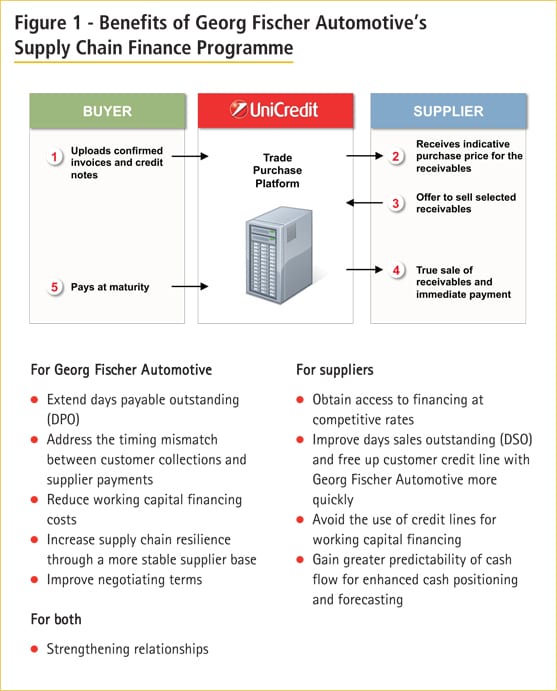

Like many organisations, Georg Fischer Automotive, one of the three core businesses in the Georg Fischer group, was experiencing working capital challenges caused by the timing mismatch between customer collections and supplier payments. To address this, Georg Fischer Automotive made the decision to implement a supply chain finance programme with UniCredit. This article outlines some of their experiences and the outcomes of implementing the programme so far.

Although the Georg Fischer is made up of three core business divisions, treasury is managed at a corporate level and manages the cash, treasury and risk management requirements of the group as a whole. Specific divisional needs are managed by the divisional CFO, supported by treasury.

One of Georg Fischer’s most significant treasury challenges is to manage working capital effectively. Before implementing the supply chain finance programme, there was significant divergence between inflows and outflows with a timing gap of 20-25%, which was expensive to finance. Consequently, our aim was to narrow this gap as far as possible. In addition, the 2008-9 crisis encouraged the group to optimise its net working capital, including suppliers, inventory and customers. One of the outcomes of this was to renegotiate payment terms wherever possible, but this was not sufficient in itself to resolve the funding gap, not least as many of our suppliers were experiencing similar liquidity challenges.

We therefore made the decision to establish a supply chain finance (SCF) programme, recognising that it would offer working capital benefits to Georg Fischer Automotive, but also support our suppliers’ liquidity position, and therefore increase the resilience of our supply chain (figure 1). A number of banks had approached us to offer a SCF programme, but ultimately we made the decision to appoint UniCredit, one of our primary relationship banks at a corporate level, based on the quality of our existing relationship. As an early adopter of SCF programmes, we recognised the potential to shape the way in which our programme operated.[[[PAGE]]]

We worked with UniCredit to identify initial target suppliers. These were our key suppliers with which we do business regularly, with whom we had a long-standing relationship, and which amounted to around 35% of our total creditor volumes. We embarked on the project in February 2012, and commenced an onboarding process for these key suppliers. As many of these companies were not familiar with SCF, we spent considerable time explaining the way in which the programme would operate, the benefits, and the terms and conditions, which then enabled them to decide whether or not to participate. In some cases, companies already participated in similar programmes, while others, particularly larger suppliers, decided not to participate as they were able to source finance more competitively, or for balance sheet reasons; however, overall there was widespread acceptance of the programme.

The project also involved implementing UniCredit’s SCF platform, which is used by suppliers to discount their receivables. We put in place a process where suppliers send invoices to Georg Fischer Automotive, which are then approved and passed to the SCF platform, at which point suppliers can choose to discount invoices as required. The processes and technology were easy to implement, particularly as we had already centralised our accounting and payments processing in a shared service centre (SSC).

We have now onboarded 20% of our main suppliers, resulting in a 10-15% impact on our days payable outstanding (DPO) and a positive balance sheet impact. The programme is now being extended to a wider group of suppliers, which we anticipate will cover about 50% of our total creditors volume. While we had hoped to onboard suppliers more quickly, the time taken to educate suppliers cannot be underestimated. The competitiveness of the SCF programme is essential to its success, which requires dialogue between the purchaser, suppliers and the SCF bank.

The successful introduction of the SCF programme at Georg Fischer Automotive is an important means for us to continue closing our funding gap and optimising liquidity. We have been very fortunate in the successful collaboration with UniCredit throughout this project, with excellent support, proactive ideas and very strong personal relationships. Looking ahead, not only will we seek to onboard more suppliers, but we will also seek additional means to manage working capital and liquidity successfully. We are also aware that as the SCF programme is a long-term initiative, it is likely to become more or less competitive as funding conditions evolve; consequently, we will need to review it regularly to ensure that it continues meeting our liquidity needs, and those of our suppliers.